2024 8822 Form and Instructions

Change of Address

Form 8822 Is Used For What Purpose?

Form 8822 is used for the purpose of notifying the IRS that you have changed your home mailing address. For example, you mailed in your 2024 Form 1040 and moved to another state soon after. Your refund check, balance due notice, and auto mailed forms and vouchers will be mailed to your old address until you either notify the IRS using Form 8822, or, submit next years' income tax return using your new home address.

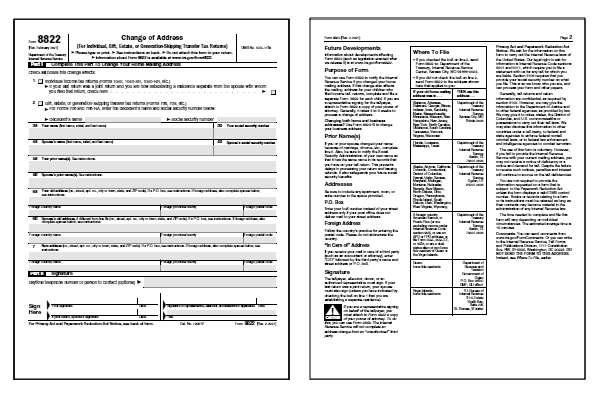

Form 8822 and Instructions

Below is the PDF file link which you can download, print, and save. This printable PDF file contains the IRS 8822 tax form along with the instructions.

I Can Change The Address Of Which Forms?

You can use Form 8822 to request an address change for the following income tax forms: 1040, 1040A, 1040EZ, 1040-ES, 1040-NR, 1040-SR, etc.

How Long Does It Take To Change My Address?

Form 8822 generally takes 4 to 6 weeks to process.

Are You Required To File Form 8822?

No. However, if you have ever received a notice or forms by mail from the IRS throughout the calendar year, it might be a good idea to print, fill out, and mail in Form 8822 to the required address in the table. There are five ways to notify the IRS of an address change. Below we have listed the three most popular methods:

- Mail in Form 8822.

- Use the new address on your income tax return.

- Call and tell the IRS by telephone.

If you move later in the year after filing your income tax forms, you can avoid missing important correspondences from the IRS by submitting Form 8822 by mail. Given that it takes 4 to 6 weeks to process Form 8822, anyone waiting for a refund check, for example, should call and notify the IRS of their new address to ensure delivery.

Last updated: October 24, 2024

References:

- Form 8822, Change Of Address, by the Department of the Treasury Internal Revenue Service. U.S. Department of the Treasury, Internal Revenue Service. Retrieved October 24, 2024.