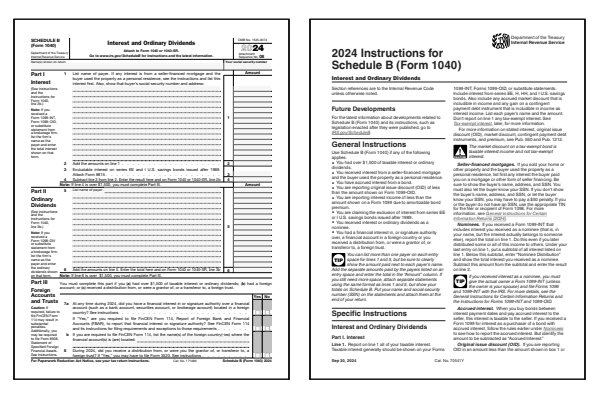

2024 Schedule B Form and Instructions

Interest and Ordinary Dividends

What Is Form 1040 Schedule B?

Schedule B, Interest and Ordinary Dividends, is required when reporting taxable interest or dividend income on Form 1040 or Form 1040SR. This IRS tax form asks you to list each payer's name, the amount received, and to disclose any foreign financial accounts. While Schedule B instructions were once included directly on the form, they are now published as a separate three-page booklet for improved guidance.

Who Must File Schedule B?

- Over $1,500 of taxable interest income.

- Over $1,500 of ordinary dividend income.

- Accrued interest from a bond.

- Exclusion of interest from series EE or I US savings bonds.

- Financial account or trust in a foreign country (FBAR).

- Interest income from a seller financed mortgage.

Click any of the IRS Schedule B Form and Instructions links below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable Schedule B Forms

Printable Schedule B Instructions

When to File Schedule B

Schedule B is filed annually with your Form 1040 or 1040-SR tax return. When you have taxable interest or ordinary dividends that exceed $1,500 in total, or if you received interest from a foreign account, attach Schedule B. This form helps report the total amount of interest and dividends received during the year and provides important information to the IRS about your investment income.

Where to Mail Schedule B

If you're filing electronically, form Schedule B will be submitted along with your federal income tax return. For paper filing, attach Schedule B to your Form 1040 or Form 1040-SR and mail it to the IRS address listed in the instructions for Form 1040. Notice the Attachment Sequence No. 08 text in the upper right-hand corner of the Schedule B form. Always verify the correct mailing address and use certified mail to ensure your return is tracked and delivered on time.

Common IRS Schedule B Mistakes to Avoid

If you make an error on Schedule B, you may need to file Form 1040X (Amended US Individual Income Tax Return) to correct it. Errors on Schedule B can result in underreporting or overreporting interest and dividend income, which could lead to penalties or additional taxes.

Common Mistakes to Avoid:

- Failing to report all sources of interest and dividends, especially from smaller or lesser-known accounts.

- Not including interest from tax-exempt bonds when required for informational purposes.

- Misreporting dividends as capital gains instead of ordinary dividends.

- Not accurately calculating interest on accounts held jointly, which can lead to misreporting income amounts.

- Forgetting to complete Part III of Schedule B if you have foreign financial accounts or received interest from foreign sources.

- Failing to file FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR), if required to do so.

Review the Schedule B instructions carefully to ensure all interest and dividend income is reported accurately, including any foreign accounts or investments.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about Schedule B. These FAQs help clarify when to file and how to report interest and dividend income accurately.

What types of income are reported on Schedule B?

Schedule B is used to report taxable interest and ordinary dividends. This includes income from bank accounts, savings accounts, dividends from stocks or mutual funds, and any interest earned on tax-exempt bonds if required for reporting purposes. Review the instructions for Schedule B to determine which income sources need to be reported.

Can I file Schedule B electronically?

Yes, Schedule B can be filed electronically as part of your federal tax return. For paper filers, attach Schedule B in sequence with your Form 1040 or Form 1040-SR and mail it to the correct IRS address.

Do I need to file Schedule B if my interest and dividends are under $1,500?

No, if your taxable interest and dividends total less than $1,500, you do not need to file Schedule B unless you have foreign accounts or other special reporting requirements. However, you must still report the income directly on Form 1040.

What is considered a foreign financial account?

A foreign financial account includes any financial accounts located outside the United States, such as savings or checking accounts, investment accounts, or pensions held in foreign banks or financial institutions. If you own or control these accounts, you may need to complete Part III of Schedule B to report them.

What is FinCEN Form 114 (FBAR) and when do I need to file it?

FinCEN Form 114, also known as the Report of Foreign Bank and Financial Accounts (FBAR), is required if you have foreign financial accounts with a combined value exceeding $10,000 at any point during the tax year. If you meet this threshold, you must file the FBAR separately from your tax return with the Financial Crimes Enforcement Network (FinCEN). Even if you're not required to file Schedule B for your tax return, you may still need to file the FBAR if you have foreign accounts.

What is FinCEN Form 114 (FBAR) and when do I need to file it?

FinCEN Form 114, also known as the Report of Foreign Bank and Financial Accounts (FBAR), is required if you have foreign financial accounts with a combined value exceeding $10,000 at any point during the tax year. If you meet this threshold, you must file the FBAR separately from your tax return with the Financial Crimes Enforcement Network (FinCEN). Additionally, you are required to complete Part III of Schedule B to report your foreign accounts, even if your total interest is below the $1,500 threshold.

Last updated: November 27, 2024

References:

- About Schedule B (Form 1040), Interest and Ordinary Dividends. U.S. Department of the Treasury, Internal Revenue Service. Retrieved November 27, 2024.

- Instructions for Schedule B (Form 1040), Interest and Ordinary Dividends. U.S. Department of the Treasury, Internal Revenue Service. Retrieved November 27, 2024.

- What Is a Schedule B IRS Form?. Intuit TurboTax, Income Tax Preparation Service. Retrieved November 27, 2024.

- Understanding 2024 IRS Form 1040 Schedule B: A Comprehensive Guide to Reporting Interest and Ordinary Dividends. Taxfyle, Tax and Bookkeeping Services. Retrieved November 27, 2024.

- Reporting interest and dividend income on Schedule B. Jackson Hewitt, Income Tax Preparation Service. Retrieved November 27, 2024.

- The FBAR: When (and How) to Report Money in Foreign Bank Accounts. H&R Block, Income Tax Preparation Service. Retrieved November 27, 2024.

- IRS Schedule B, Foreign Accounts, and FBAR Filing Requirements. NOLO, Legal Issues. Retrieved November 27, 2024.

- IRS Schedule B Instructions. Teach Me Personal Finance, Tax Planning. Retrieved November 27, 2024.

- What Is FBAR Reporting?. Silver Tax Group, Tax Attorneys. Retrieved November 27, 2024.