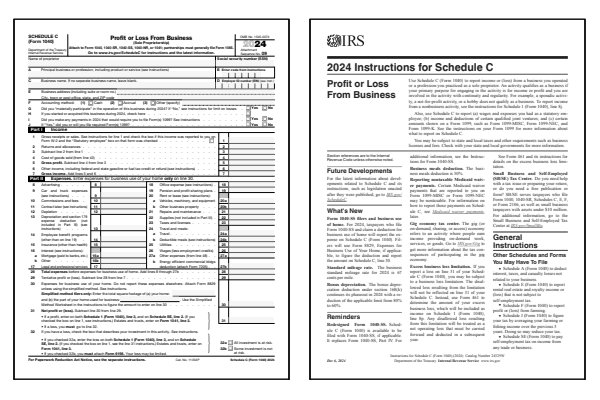

2024 Schedule C Form and Instructions

Profit or Loss from Business

What Is Form 1040 Schedule C?

Schedule C, Profit or Loss From Business, is used to report income and expenses for self-employed individuals, independent contractors, or sole proprietors. This form helps you calculate your business's net profit or loss, which is then transferred to Form 1040, 1040-SR, 1040-SS, or 1040-NR, as well as Schedule SE.

Schedule C requires you to detail business income, operating expenses, and deductible costs such as home office use, vehicle expenses, and supplies. It plays an important role in reporting self-employment earnings and calculating your self-employment tax.

Who Must File Form 1040 Schedule C?

- Practice a profession (freelance, instructor, agent, etc).

- Operate a business as a sole proprietor or one owner LLC.

- Have earnings from self-employment of $400 or more.

- Business expenses over $5,000.

- Have inventory to report.

- Business use of your home deductions.

- Will report a loss or carry forward.

Click any of the IRS Schedule C Form and Instructions links below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable Schedule C Forms

Printable Schedule C Instructions

When to File Schedule C

Schedule C is filed with your annual Form 1040, 1040-SR, 1040-SS, or 1040-NR tax return. If you operate a sole proprietorship or are a single-member LLC, you will need to report a profit or loss from your business. Form Schedule C is used to report all business income, expenses, and profits or losses for the year. If you earn income from self-employment, freelancing, or independent contracting, you must file form Schedule C to report that income, regardless of whether your business shows a profit or loss.

For more details, refer to the IRS instructions for Schedule C. The Schedule C instructions will guide you through reporting your business income and allowable expenses.

Where to Mail Schedule C

If you're filing electronically, form Schedule C will be submitted along with your federal income tax return. For paper filing, attach Schedule C to your Form 1040 or Form 1040-SR and mail it to the IRS address listed. Notice the Attachment Sequence No. 09 text in the upper right-hand corner of the Schedule C form. Always verify the correct mailing address and use certified mail to ensure your return is tracked and delivered securely.

Common IRS Schedule C Mistakes to Avoid

If you make a calculation error on Schedule C, you may need to file Form 1040X (Amended U.S. Individual Income Tax Return) to correct it. Mistakes on Schedule C can lead to misreporting business income or expenses, resulting in additional taxes, penalties, audits, or missed deductions.

Common Mistakes to Avoid:

- Failing to report all business income, especially cash payments or income from side work.

- Misreporting expenses by claiming personal expenses as business expenses or missing deductions for legitimate business expenses.

- Incorrectly calculating business mileage or travel expenses, which require accurate logs and receipts.

- Forgetting to track and report expenses related to a home office if you qualify for the home office deduction.

- Failing to complete Part II of Schedule C correctly, which is used to calculate total expenses and net profit or loss.

Review the Schedule C instructions carefully to ensure all business income and expenses are reported accurately. Keep detailed records of your income and expenses in case of an audit.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about Schedule C. These FAQs help clarify how to report business income and expenses accurately for sole proprietors and single-member LLCs.

What types of income are reported on Schedule C?

Schedule C is used to report income earned from a sole proprietorship, self-employment, freelancing, or independent contracting. This includes payments for services, sales of goods, and any additional income related to your business. Be sure to review the Schedule C instructions to report all forms of business income accurately.

Can I file Schedule C electronically?

Yes, Schedule C can be filed electronically along with your federal tax return. For paper filers, attach Schedule C in sequence with your Form 1040 or Form 1040-SR and mail it to the correct IRS address.

What expenses can I deduct on Schedule C?

Allowable expenses on Schedule C include costs that are ordinary and necessary for running your business, such as office supplies, advertising, rent, utilities, travel, and certain vehicle expenses. If you work from home, you may also be able to claim the home office deduction for a portion of your housing expenses. Review the Schedule C instructions for a full list of allowable business deductions.

Do I need to file Schedule C if my business didn't make a profit?

Yes, you still need to file Schedule C even if your business did not make a profit during the year. The form will be used to report your business's income, expenses, and losses, which may reduce your overall tax liability.

What is a single-member LLC, and how is it taxed?

A single-member LLC is a business entity that is owned by one person. For tax purposes, the IRS disregards the LLC as a separate entity, meaning you report your business income and expenses on Schedule C as if you were a sole proprietor. The LLC itself does not file a separate tax return unless you've chosen to have it taxed as a corporation. For more information, see IRS Publication 3402 or Form 8832.

Which accounting method do I choose: Cash, Accrual, or Other?

Your accounting method determines when you report income and expenses on your tax return. If you use the cash method, you report income when you receive it and deduct expenses when you pay them. With the accrual method, you report income when it's earned and deduct expenses when they are incurred, even if the money hasn't changed hands yet. For more information on this topic, see the Schedule C instructions and IRS Publication 538, Accounting Periods and Methods.

Did you materially participate in the operation of this business?

To materially participate in a business means that you were actively involved in its operations on a regular, continuous, and substantial basis. In simple terms, if you managed the business, made day-to-day decisions, and worked regularly in the business, you materially participated. If you were mostly hands-off and only collected profits, you may not meet the criteria. For more detailed rules on determining material participation, see the Schedule C instructions or IRS Publication 925, Passive Activity and At-Risk Rules.

Last updated: December 11, 2024

References:

- About Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). U.S. Department of the Treasury, Internal Revenue Service. Retrieved December 11, 2024.

- Instructions for Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). U.S. Department of the Treasury, Internal Revenue Service. Retrieved December 11, 2024.

- Schedule C: Reporting Self-Employment Income from Multiple Sources. TaxAct, Online Tax Preparation. Retrieved December 11, 2024.

- What do the Expense entries on the Schedule C mean?. TaxSlayer, Income Tax Preparation Service. Retrieved December 11, 2024.

- IRS Schedule C: What Is It and Who Has to File One?. H&R Block, Income Tax Preparation Service. Retrieved December 11, 2024.

- What Is a Schedule C IRS form?. Intuit TurboTax, Income Tax Preparation Service. Retrieved December 11, 2024.

- The Last Schedule C Guide You'll Ever Need. Keeper, Tax Filing Services. Retrieved December 11, 2024.

- A Friendly Guide to Schedule C Tax Forms (U.S.). Freshbooks, Accounting and Tax Services. Retrieved December 11, 2024.

- Schedule C, Profit or Loss from Business: What it is and who has to file one. H&R Block, Income Tax Preparation Service. Retrieved December 11, 2024.