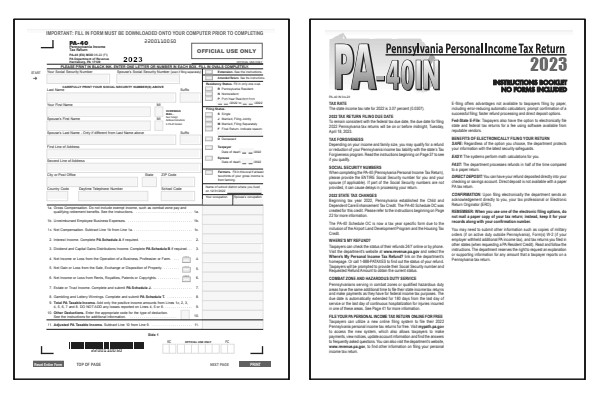

2024 Pennsylvania Form 40

Printable PA-40 Tax Forms and Instructions

What Is Pennsylvania Form 40?

Pennsylvania Form 40 is used by full-year residents, part-year residents, and nonresidents to file their state income tax return. The purpose of Form PA-40 is to determine your tax liability for the state of Pennsylvania. Nonresident and part-year resident filers will enter their residency status on the first page of the form.

The State of Pennsylvania does not have an Easy Form (EZ) or Short Form.

Read the General Instructions

section of the PA-40 instructions book to help determine if you should file as a full-year resident, part-year resident, or nonresident for tax year 2024.

Who Must File Pennsylvania Form 40?

You must file a Pennsylvania tax return if your gross taxable income exceeds $33, even if no tax is due. You may be required to file a Pennsylvania income tax return even though you are not required to file a federal income tax return. You must also file if you incurred a loss from any transaction as an individual, sole proprietor, partner in a partnership, or S corporation, for example.

Read the Who Must File

section of the Pennsylvania form PA-40 instructions book to help determine if you should file a state income tax return for tax year 2024.

Printable Pennsylvania State Tax Forms

Printable Pennsylvania Form PA-40 Instructions

How To Check The Status Of My Pennsylvania Tax Return?

To check the status of your Pennsylvania income tax refund online, visit the Pennsylvania Department of Revenue website and use their Where's My Refund service. Pennsylvania Department of Revenue asks that you wait at least eight weeks before using this tool.

To check the status of your Pennsylvania income tax refund for 2024 you will need the following information:

- Social Security Number

- Amount of your refund

The requested information must match what was submitted on your 2024 Pennsylvania Form PA-40. To look up a refund for a prior tax year you will need to contact the Pennsylvania Department of Revenue customer service center through the online form provided.

To contact the Pennsylvania Department of Revenue service center by phone or email, use the check your refund status link above. Alternatively, read or print the 2024 Pennsylvania Form PA-40 instructions to obtain the proper phone number and mailing address.

Last updated: January 27, 2025

References:

- Pennsylvania Department of Revenue. State of Pennsylvania, Pennsylvania Department of Revenue. Retrieved January 27, 2025.

- Individual Income Tax Forms. State of Pennsylvania, Pennsylvania Department of Revenue. Retrieved January 27, 2025.