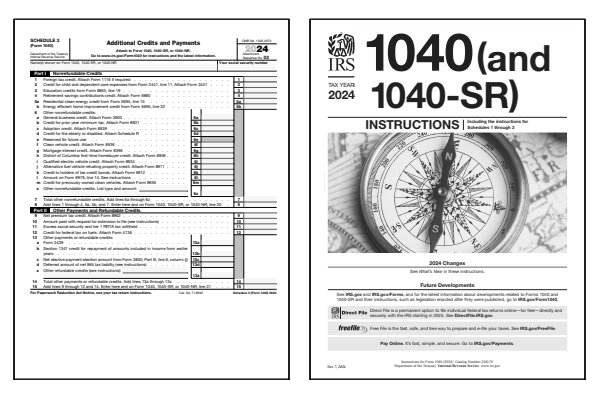

2024 Schedule 3 Form and Instructions

Additional Credits and Payments

What Is Form 1040 Schedule 3?

Form 1040 Schedule 3, Additional Credits and Payments, asks that you report any nonrefundable credits that can't be entered directly onto Form 1040. The 2024 Schedule 3 Instructions are not published as a separate booklet. Instead, you will need to read the Schedule 3 line item instructions found within the general Form 1040 instructions booklet.

On page two of IRS Form 1040, line 20, the taxpayer is asked to add the amount from Schedule 3, line 8, Nonrefundable Credits. Then on line 31, the taxpayer is asked to add the amount from Schedule 3, line 15, Other Payments and Refundable Credits. Part 1 and Part 2 of the Additional Credits and Payments schedule combines the less frequently used tax payments and tax credit amounts onto one form.

Form 1040 Schedule 3, Additional Credits and Payments, was created as part of the Form 1040 redesign implemented for the 2018 tax year. You do not file IRS Schedule 3 with the older 1040 series forms such as Form 1040A or Form 1040EZ. Schedule 3 can only be attached to Form 1040, Form 1040-SR, and Form 1040-NR.

Who Must File Form 1040 Schedule 3?

- Adoption credit.

- Amount paid with request for extension to time file.

- Credit for child and dependent care expenses.

- Education credits.

- Foreign tax credit.

- Mortgage interest credit.

- Residential energy credit.

- Retirement savings contributions credit.

- Credit for the elderly or disabled.

- Other nonrefundable credits.

Click any of the IRS Schedule 3 Form and Instructions links below to download, save, view and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable Schedule 3 Forms

Printable Schedule 3 Instructions

When to File Schedule 3

Schedule 3 is filed with your Form 1040, Form 1040-SR, or Form 1040-NR when you have additional credits or payments that are not included directly on the main form. This includes credits such as the credit for child and dependent care expenses, education credits, retirement savings contributions credit, and other important tax credits. Form Schedule 3 is typically filed by April 15th, unless you file for an extension, which may extend the deadline to October 15th.

For more details, refer to the IRS instructions for Schedule 3. The Schedule 3 instructions outline which credits and payments must be reported and how to calculate them correctly.

Where to Mail Schedule 3

If you're filing electronically, form Schedule 3 will be submitted along with your federal tax return. For paper filing, attach Schedule 3 to your Form 1040, Form 1040-SR, or Form 1040-NR and mail it to the IRS address listed in the instructions for Form 1040. Notice the Attachment Sequence No. 03 text which appears in the upper right-hand corner of the Schedule 3 form. Always double-check the mailing address and use certified mail to ensure your return is tracked and delivered on time.

Common IRS Schedule 3 Mistakes to Avoid

If you make a mistake on Schedule 3, you may need to file Form 1040X (Amended U.S. Individual Income Tax Return) to correct the error. Individual credits might be removed by the IRS if you forget to attach the required supporting forms, such as Form 2441 for the child and dependent care credit or Form 8863 for education credits. Be sure to update all impacted forms and schedules when making corrections or amending your income tax return.

Common Mistakes to Avoid:

- Missing beneficial credits, such as the credit for child and dependent care expenses or the education credits.

- Misreporting contributions for retirement savings and missing the opportunity to claim the saver's credit.

- Omitting the adoption credit when you have qualifying adoption-related expenses.

- Incorrectly calculating credits like the residential clean energy credit or the electric vehicle credit.

- Forgetting to attach Schedule R when claiming the credit for the elderly or disabled.

Review the Schedule 3 instructions carefully to ensure all eligible credits and payments are included on your return, and be sure to attach any required supporting forms.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about Schedule 3. These FAQs cover frequently claimed additional credits and payments, helping guide you through the filing process.

What types of credits are reported on Schedule 3?

Schedule 3 is used to report additional credits that are not included directly on Form 1040. These credits include the child and dependent care credit, education credits, the saver's credit for retirement contributions, adoption credit, mortgage interest credit, and clean energy or electric vehicle credits. The list of additional credits and their calculations can change from year to year. Be sure to stay updated on any changes to the credits you regularly claim.

Do I need to file Schedule 3 if I have no additional credits or payments?

No, if you do not have any additional credits or payments to report, you do not need to file Schedule 3. However, it's important to review the Schedule 3 instructions to ensure you are not missing any credits or payments that apply to your situation.

Can I file Schedule 3 electronically?

Yes, Schedule 3 can be filed electronically along with your federal tax return. If you're using software to prepare your own taxes, the program will prompt you to complete Schedule 3 if it applies to your situation. For paper filers, attach Schedule 3 in sequence to your Form 1040 and mail it to the IRS address listed in the instructions.

What is the child and dependent care credit?

The credit for child and dependent care expenses is a tax credit that helps offset the costs of care for qualifying children or dependents while you work or look for work. The credit is claimed on Form 2441, and the amount is then transferred to Schedule 3. Eligibility is generally based on your income and the amount of care expenses you paid.

Last updated: December 27, 2024

References:

- About Form 1040, U.S. Individual Income Tax Return. U.S. Department of the Treasury, Internal Revenue Service. Retrieved December 27, 2024.

- Line Instructions for Form 1040. U.S. Department of the Treasury, Internal Revenue Service. Retrieved December 27, 2024.

- What is IRS Form 1040 Schedule 3?. Intuit TurboTax, Income Tax Preparation Service. Retrieved December 27, 2024.

- Understanding IRS Form 1040 Schedule 3: Additional Credits and Payments. Taxfyle, Tax and Bookkeeping Services. Retrieved December 27, 2024.