2024 1040TT Booklet

Tax And Earned Income Credit Tables

What Is Instructions Booklet 1040TT?

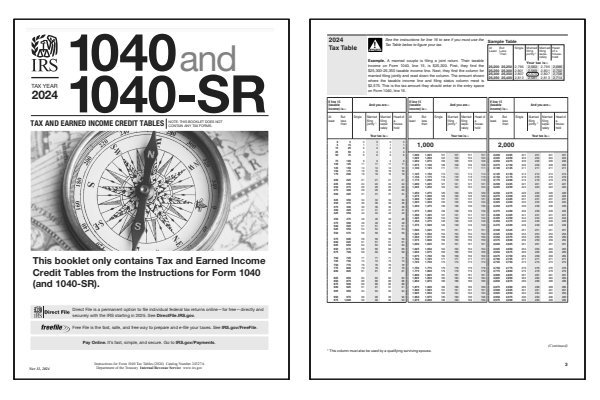

Booklet 1040TT contains the 2024 Tax And Earned Income Credit Tables used to calculate income tax due on federal Form 1040 and Form 1040-SR. Instructions booklet 1040TT does not contain any income tax forms.

Keep in mind that these same federal income tax tables can be found inside the Form 1040 Instructions and Form 1040-SR Instructions booklets. The difference is the ability to quickly navigate the 26 page 1040TT PDF file versus the larger Form 1040 Instructions which are generally over 100 pages long. The 1040 tax tables inside the Form 1040 instructions are found near the end of the booklet.

The disadvantage of using the 1040TT instructions is that it often omits topics of interest such as the federal income tax rates and brackets for the current year. Such tax rate schedules printed inside the Form 1040 Instructions show which rate applies at each level of taxable income. You do not use the tax rate schedules or tax brackets to calculate your tax due amount.

Who Must Use The 1040TT Booklet?

- See the instructions for 1040 line 16 to determine if you must use the tax table to calculate the amount of income tax due.

Click any of the IRS 1040TT tax table links below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable Form 1040 Tax Tables

When to Use the Form 1040 Tax Tables

The Form 1040 Tax Tables, officially titled the Tax and Earned Income Credit Tables, provide tax rate and earned income credit calculations for various income levels. These tables are essential for calculating the correct tax owed based on adjusted gross income and filing status. While the Tax Tables are typically included within the Form 1040 instructions booklet, they can also be accessed as a standalone file for quick reference. This tool is especially helpful for tax professionals and individual filers who want to double-check tax liability for accuracy.

Where to Find the Form 1040 Tax Tables

The tax tables are generally included inside the IRS Form 1040 instructions. You can access these tables as part of the Form 1040 instruction booklet or as a separate tables only booklet. Be sure to match the 1040 form year with the corresponding 1040 tax table year, as the calculations are updated annually to reflect tax rate, credit limits, and other tax policy changes.

Common Form 1040 Tax Table Mistakes to Avoid

When referencing the Form 1040 Tax Tables, accuracy is essential, as small errors can lead to incorrect tax calculations or refund amounts. Common mistakes include selecting the wrong income range or misapplying credits, which can affect your overall tax liability.

Common Mistakes to Avoid:

- Selecting the wrong income range for your adjusted gross income (AGI) and filing status.

- Misapplying the earned income credit (EIC) by choosing an incorrect income or credit range.

- Using outdated tax tables that do not match the current tax rates or credit limits.

The IRS instructions for the Tax and Earned Income Credit Tables provide guidance for accurate use. Be sure to cross-check results with the Form 1040 instructions if you suspect you are using the wrong tables.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about the Form 1040 Tax Tables.

Where can I find the Tax and Earned Income Credit Tables?

The Tax and Earned Income Credit Tables are included in the Form 1040 instructions booklet. For ease of access, a standalone PDF file is also published for quick reference.

Do the Tax Tables change each year?

Yes, the IRS updates the Form 1040 Tax Tables annually to reflect any changes in tax brackets, rates, or earned income credit limits. Make sure to use the tax tables for the specific tax year you are filing to ensure accurate calculations.

Last updated: December 11, 2024

References:

- 1040 Tax And Earned Income Credit Tables. U.S. Department of the Treasury, Internal Revenue Service. Retrieved December 11, 2024.

- Line Instructions for Form 1040. U.S. Department of the Treasury, Internal Revenue Service. Retrieved December 11, 2024.

- How to Read Federal Tax Tables. Intuit TurboTax, Income Tax Preparation Service. Retrieved December 11, 2024.

- Where To Find and How To Read 1040 Tax Tables. The Balance, File Your Own Taxes. Retrieved December 11, 2024.