2024 Schedule R Form and Instructions

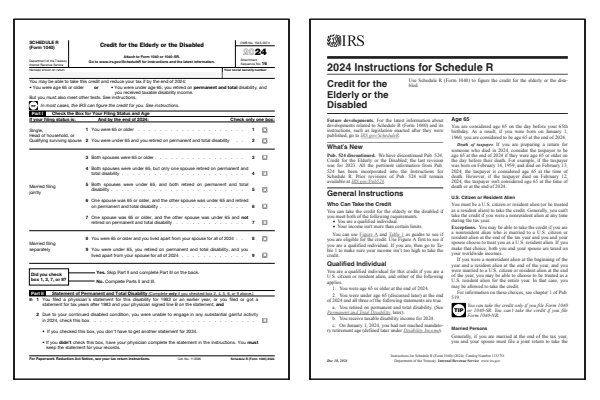

Credit for the Elderly or the Disabled

What Is Form 1040 Schedule R?

Page two of IRS Form 1040A and Form 1040 both request that you attach Schedule R to claim a credit for the elderly or the disabled. You can not file Schedule R with the shortest IRS Form 1040EZ. The credit is primarily based upon your age, disability, and filing status.

Who Must File Form 1040 Schedule R?

- You or spouse is 65 or older.

- You or spouse receive taxable disability income.

- You or spouse are unable to work due to a physical disability.

- You or spouse are unable to work due to a mental disability.

Click any of the IRS Schedule R Form and Instructions links below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable Schedule R Forms

Printable Schedule R Instructions

When to File Schedule R

Schedule R is filed with your Form 1040 or Form 1040-SR if you are claiming the Credit for the Elderly or the Disabled. This credit is available to individuals who are 65 or older, or who are under 65 but permanently and totally disabled. You must file form Schedule R to claim this credit, as it helps reduce your tax liability based on your age or disability status. Eligibility depends on your filing status and income.

For more details, refer to the IRS instructions for Schedule R. The Schedule R instructions guide you through determining if you qualify and how to calculate the amount of your credit.

Where to Mail Schedule R

If you're filing electronically, form Schedule R will be submitted along with your federal tax return. For paper filing, attach Schedule R to your Form 1040 or Form 1040-SR and mail it to the IRS address listed in the instructions for Form 1040. Notice the Attachment Sequence No. 16 text in the upper right-hand corner of the Schedule R form. Always verify the correct mailing address and use certified mail to ensure your return is tracked and delivered securely.

Common IRS Schedule R Mistakes to Avoid

If you make an error on Schedule R, you may need to file Form 1040X (Amended U.S. Individual Income Tax Return) to correct it. Mistakes on Schedule R can result in claiming an incorrect credit amount or missing out on the credit altogether.

Common Mistakes to Avoid:

- Failing to meet the age or disability requirements for the credit.

- Incorrectly calculating the credit amount due to misreporting your income or disability status.

- Overlooking the eligibility limits based on your filing status and adjusted gross income (AGI).

- Forgetting to attach Schedule R when claiming the credit for the elderly or disabled.

Review the Schedule R instructions carefully to ensure you meet the qualifications and report your income correctly to claim the full credit amount.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about Schedule R. These FAQs help clarify how to claim the Credit for the Elderly or Disabled and determine if you qualify.

What is the Credit for the Elderly or Disabled?

The Credit for the Elderly or Disabled is a tax credit available to individuals who are 65 or older, or who are under 65 and permanently and totally disabled. The credit helps reduce your tax liability and is based on your income, filing status, and eligibility for the credit.

Can I file Schedule R electronically?

Yes, Schedule R can be filed electronically along with your federal tax return. For paper filers, attach Schedule R in sequence with your Form 1040 or Form 1040-SR and mail it to the correct IRS address.

Who qualifies for the Credit for the Elderly or Disabled?

You may qualify for the Credit for the Elderly or Disabled if you are 65 or older, or if you are under 65 and permanently and totally disabled. Your filing status and adjusted gross income (AGI) must also fall within the limits set by the IRS. Check the Schedule R instructions for detailed eligibility criteria.

How do I calculate the Credit for the Elderly or Disabled?

The amount of the credit is calculated based on your age, disability status, and income. You must fill out Schedule R to determine your eligibility and credit amount. The IRS provides worksheets in the Schedule R instructions to help with the calculation. Be sure to use the correct figures for your income and filing status to avoid errors.

What is the maximum Credit for the Elderly or Disabled?

The maximum amount you can claim for the Credit for the Elderly or Disabled depends on your filing status and the number of qualifying individuals:

- $7,500 for married couples filing jointly if both spouses qualify for the credit.

- $5,000 for single filers or married filing jointly if only one spouse qualifies.

- $3,750 for married individuals filing separately, provided you lived apart from your spouse for the entire year.

These amounts are reduced by any nontaxable Social Security or other benefits you receive. For more details, refer to the IRS instructions for Schedule R.

Last updated: December 27, 2024

References:

- About Schedule R (Form 1040), Credit for the Elderly or the Disabled. U.S. Department of the Treasury, Internal Revenue Service. Retrieved December 27, 2024.

- Instructions for Schedule R (Form 1040), Credit for the Elderly or the Disabled. U.S. Department of the Treasury, Internal Revenue Service. Retrieved December 27, 2024.

- IRS Schedule R Instructions. Teach Me Personal Finance, Tax Planning. Retrieved December 27, 2024.

- Schedule R (Form 1040): Credit for the Elderly or Disabled. Fincent, IRS Tax Forms. Retrieved December 27, 2024.

- Schedule R: The Tax Credit for the Elderly or the Disabled. The Balance, Tax Credits & Deductions. Retrieved December 27, 2024.

- Guide to Schedule R: Tax Credit for Elderly or Disabled. Intuit TurboTax, Income Tax Preparation Service. Retrieved December 27, 2024.