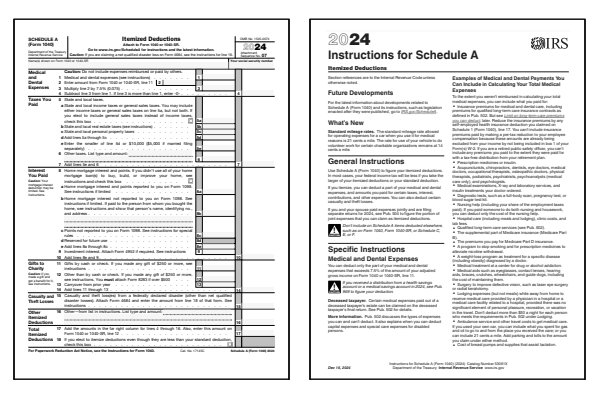

2024 Schedule A Form and Instructions

Itemized Deductions

What Is Form 1040 Schedule A?

On page one of IRS Form 1040, line 12, there is an option to take either the standard deduction or file Schedule A and itemize your deductions. You can only attach this US resident version of Schedule A to Form 1040 or Form 1040-SR. Nonresident Form 1040-NR filers have their own Schedule A NR form to attach.

Itemizing simply means that you are going to add up the major expenses that the IRS will allow you to deduct on Schedule A. Then you will compare that total to the standard deduction amount presented in the left margin on page one of IRS Form 1040. Most individual income tax payers will take the higher of the two, but, exceptions do exist.

Who Must File Schedule A?

You may benefit from filing Schedule A if you have any of the following:

- Medical and dental expenses.

- Real estate, personal property, and other deductible taxes.

- Home mortgage interest and points.

- Business use of car and home.

- Stock market investment interest.

- Gifts by cash, check, or trade to charity.

- Business travel and entertainment expense.

- Work-related expenses including education.

- Disaster and theft losses of property.

- Miscellaneous expenses not captured elsewhere.

Click any of the IRS Schedule A Form and Instructions links below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable Schedule A Forms

Printable Schedule A Instructions

Schedule A Instructions 2024

Instructions for Schedule A, Itemized Deductions

PDF file, about 552 KB

Schedule A Instructions 2023

Instructions for Schedule A, Itemized Deductions

PDF file, about 674 KB

Schedule A Instructions 2022

Instructions for Schedule A, Itemized Deductions

PDF file, about 673 KB

When to File Schedule A

Schedule A is filed with your Form 1040 or Form 1040-SR when you choose to itemize your deductions instead of taking the standard deduction. Itemizing deductions can allow you to reduce your taxable income by claiming specific expenses, such as medical expenses, state and local taxes, mortgage interest, and charitable contributions. You should file form Schedule A if your itemized deductions exceed the standard deduction for your filing status. Form Schedule A is typically filed by April 15th, unless you have filed for an extension, which may extend the deadline to October 15th.

For more details, refer to the IRS instructions for Schedule A. The Schedule A instructions provide information on which expenses can be deducted and how to calculate your total itemized deductions.

Where to Mail Schedule A

If you're filing electronically, form Schedule A will be submitted along with your federal tax return. For paper filing, attach Schedule A to your Form 1040 or Form 1040-SR and mail it to the IRS address listed in the instructions for Form 1040. Notice the Attachment Sequence No. 07 text in the upper right-hand corner of the Schedule A form. Always verify the correct mailing address and use certified mail if possible to ensure your return is tracked and delivered on time.

Common IRS Schedule A Mistakes to Avoid

If you make an error on Schedule A, you may need to file Form 1040X (Amended U.S. Individual Income Tax Return) to correct it. Errors on Schedule A can result in missed deductions or claiming deductions that you're not eligible for, which could lead to penalties or a lower than expected refund.

Common Mistakes to Avoid:

- Failing to properly calculate medical expenses that exceed 7.5% of your adjusted gross income (AGI).

- Incorrectly claiming state and local tax (SALT) deductions, which are capped at $10,000 for tax years 2023 and beyond.

- Misreporting mortgage interest deductions, especially if you've refinanced or have multiple mortgages.

- Failing to document charitable contributions properly, especially for donations over $250.

- Not including unreimbursed business expenses if they qualify under certain professions.

Review the Schedule A instructions carefully to ensure all itemized deductions are eligible and properly calculated.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about Schedule A. These FAQs help clarify when it's better to itemize deductions and how to file correctly.

What types of deductions can be itemized on Schedule A?

Schedule A allows you to itemize deductions such as medical and dental expenses, state and local taxes, mortgage interest, charitable contributions, casualty and theft losses, and certain unreimbursed business expenses. Each type of deduction has specific limits and requirements outlined in the Schedule A instructions.

Can I file Schedule A electronically?

Yes, Schedule A can be filed electronically along with your federal tax return. For paper filers, attach Schedule A in sequence with your Form 1040 or Form 1040-SR and mail it to the correct IRS address.

How do I know if I should itemize deductions?

You should itemize deductions on Schedule A if the total of your allowable itemized deductions exceeds the standard deduction for your filing status. For example, if you had significant medical expenses, mortgage interest, or charitable contributions, it might be beneficial to itemize rather than take the standard deduction.

What is the SALT deduction cap?

The state and local tax (SALT) deduction is capped at $10,000 ($5,000 if married filing separately). This cap applies to the combined total of state and local income taxes, real estate taxes, and personal property taxes. Be sure to apply this limit correctly when completing Schedule A.

Last updated: January 1, 2025

References:

- About Schedule A (Form 1040), Itemized Deductions. U.S. Department of the Treasury, Internal Revenue Service. Retrieved January 1, 2025.

- Instructions for Schedule A (Form 1040), Itemized Deductions. U.S. Department of the Treasury, Internal Revenue Service. Retrieved January 1, 2025.

- All About Schedule A (Form 1040 or 1040-SR): Itemized Deductions. Investopedia, Income Tax Forms. Retrieved January 1, 2025.

- What Is a Schedule A IRS form?. Intuit TurboTax, Income Tax Preparation Service. Retrieved January 1, 2025.

- What is Schedule A tax form? And how does it relate to itemized deductions?. H&R Block, Income Tax Preparation Service. Retrieved January 1, 2025.

- What Is Schedule A of IRS Form 1040? Itemized Deductions in 2023-2024. Nerdwallet, Taxes. Retrieved January 1, 2025.