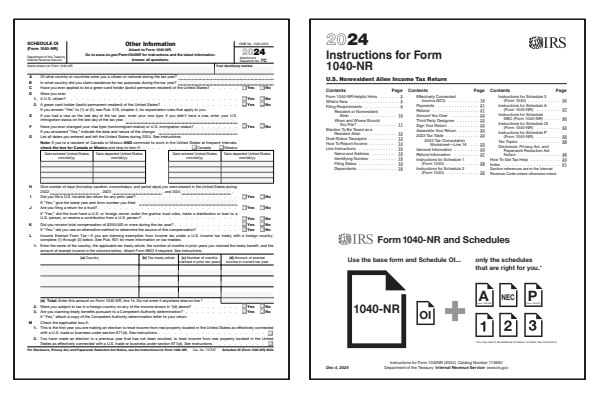

2024 Schedule OI Form and Instructions

Other Information for Nonresidents

What Is Schedule OI?

Schedule OI, titled Other Information, is an essential component of the US Nonresident Tax Return. It gathers additional details about the taxpayer's residency, visa status, and other pertinent information that may influence tax obligations.

Who Must File Schedule OI?

All nonresident individuals who file Form 1040-NR also need to complete Schedule OI. Schedule OI is required, however, you may not need to file the other schedules such as: Schedules 1, Schedule 2, Schedule 3, Schedule A NR, Schedule NEC, and Schedule P. If your US tax return is more complex and wish to claim certain deductions or credits or owe additional taxes, you may need to complete one or more of those schedules. See the form and instructions for Schedule OI below for more information.

Click any of the IRS Schedule OI form and instructions below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable Schedule OI Forms

Printable Schedule OI Instructions

When to File Schedule OI

Nonresident aliens filing Form 1040-NR must complete and attach Schedule OI. Form 1040-NR is typically filed by April 15th, unless you have filed for an extension, which may extend the deadline to October 15th. This schedule collects information crucial for determining tax liability, including:

- Country of Citizenship: Identifies the taxpayer's nationality.

- Tax Residency: Specifies the country where the taxpayer claims tax residence during the tax year.

- Visa Information: Details the type of visa held and any changes in visa status.

- Days Present in the US: Records the number of days spent in the United States during the tax year.

- Tax Treaty Benefits: Indicates if the taxpayer is claiming benefits under an income tax treaty.

For more details, refer to the IRS instructions for Schedule OI. The Schedule OI instructions provide examples of the information requested including visas types, entering dates on the form, income exemptions, and tax treaty benefits.

Where to Mail Schedule OI

Mail your completed Form 1040-NR, along with Schedule OI and any other required attachments, to the appropriate IRS address as specified in the Form 1040-NR instructions. Notice the Attachment Sequence No. 7C text in the upper right-hand corner of the Schedule OI form. The mailing address depends on whether you are enclosing a payment and your filer type (individual, estate, or trust). Refer to the Where To File section in the Form 1040-NR instructions for the correct address.

Common IRS Schedule OI Mistakes to Avoid

- Incomplete Information: Ensure all questions on Schedule OI are fully answered to avoid processing delays.

- Inaccurate Visa Details: Provide correct visa type and any changes in status during the tax year.

- Incorrect Days of Presence: Accurately count and report the number of days present in the US to determine residency status.

- Overlooking Tax Treaty Claims: If claiming tax treaty benefits, ensure you meet the eligibility criteria and provide necessary documentation.

Frequently Asked Questions (FAQ)

Below are answers to some of the most common questions asked about Schedule OI Other Information.

Who needs to file Schedule OI?

Nonresident aliens filing Form 1040-NR are required to complete and attach Schedule OI to provide additional information relevant to their tax situation.

What information is required on Schedule OI?

Schedule OI requires details about your country of citizenship, tax residency, visa type, days present in the US, and any tax treaty benefits you are claiming.

Where can I find the instructions for Schedule OI?

Instructions for Schedule OI are included in the instructions for Form 1040-NR, which can be found above on this page.

Can I e-file Schedule OI with my Form 1040-NR?

Yes, if you are eligible to e-file Form 1040-NR, you can include Schedule OI Other Information in your electronic submission.

Last updated: January 26, 2025

References:

- About Form 1040-NR, US Nonresident Alien Income Tax Return. US Department of the Treasury, Internal Revenue Service. Retrieved January 26, 2025.

- Instructions for Form 1040NR. US Department of the Treasury, Internal Revenue Service. Retrieved January 26, 2025.

- About Publication 519, US Tax Guide for Aliens. US Department of the Treasury, Internal Revenue Service. Retrieved January 26, 2025.