2024 Schedule H Form and Instructions

Household Employment Taxes

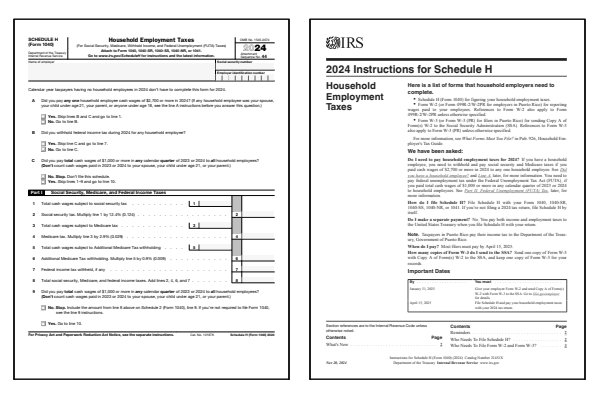

What Is Form 1040 Schedule H?

Schedule 1 of IRS Form 1040 requires that you attach Schedule H to report any household employment taxes. Schedule H is a two page tax form which asks if you paid anyone to work inside or outside of your house. Such wages may be subject to social security, Medicare, or Federal Unemployment Tax (FUTA).

Schedule H can be attached to Form 1040, Form 1040-SR, Form 1040-SS, and Form 1040-NR. It can also be filed by itself if you are not required to file a federal income tax return. The Schedule H instructions booklet explains when to file and which tax and immigration forms are required to legally hire and pay a household employee (I-9, W-2, W-3, etc).

Who Must File Schedule H?

- Paid cash to a child or parent for household work.

- Paid cash to non-agency babysitter, caretaker, cleaner, cook, driver, health aide, housekeeper, nanny, nurse, yard worker, etc.

- Paid cash hourly, daily, weekly or by the job.

- Withheld federal income tax for a household employee.

Click any of the IRS Schedule H Form and Instructions links below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable Schedule H Forms

Printable Schedule H Instructions

When to File Schedule H

Schedule H is filed with your Form 1040, 1040-SR, 1040-NR, or 1040-SS if you employ household workers and need to report household employment taxes. This includes taxes for Social Security, Medicare, and federal unemployment (FUTA) for household employees like nannies, housekeepers, or gardeners. You must file form Schedule H if you paid a household employee $2,700 or more in wages during the tax year (2024 threshold) or if you withheld federal income tax from their wages.

For more details on filing, refer to the IRS instructions for Schedule H. The Schedule H instructions guide you through calculating and reporting household employment taxes.

Where to Mail Schedule H

If you're filing electronically, form Schedule H will be submitted along with your federal tax return. For paper filing, attach Schedule H to your Form 1040 or Form 1040-SR and mail it to the IRS address listed in the instructions for Form 1040. Notice the Attachment Sequence No. 44 text in the upper right-hand corner of the Schedule H form. Always verify the correct mailing address and use certified mail to ensure your return is tracked and delivered on time.

Common IRS Schedule H Mistakes to Avoid

If you make an error on Schedule H, you may need to file Form 1040X (Amended U.S. Individual Income Tax Return) to correct it. Mistakes on Schedule H can lead to misreporting household employment taxes, which could result in additional taxes, penalties, or issues with Social Security and Medicare contributions.

Common Mistakes to Avoid:

- Failing to report all wages paid to household employees, especially if paid in cash.

- Incorrectly calculating Social Security or Medicare taxes for household employees.

- Failing to file if you withheld federal income taxes for your household employee.

- Not paying federal unemployment taxes (FUTA) for household employees when required.

- Overlooking the need to provide household employees with a Form W-2 at year-end.

- Failing to send copies of Form W-2 and Form W-3 to the Social Security Administration.

Review the Schedule H instructions carefully to ensure you report household employment taxes accurately and retain all necessary records for your household employees.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about Schedule H. These FAQs help clarify how to report household employment taxes for nannies, housekeepers, and other household employees.

What is Schedule H used for?

Schedule H is used to report household employment taxes if you employ household workers, such as nannies, housekeepers, or caregivers. It covers taxes for Social Security, Medicare, and federal unemployment (FUTA), and it allows you to report any federal income tax you may have withheld from your employees' wages.

Can I file Schedule H electronically?

Yes, Schedule H can be filed electronically along with your federal tax return. For paper filers, attach Schedule H in sequence with your Form 1040 or Form 1040-SR and mail it to the correct IRS address.

Do I need to file Schedule H if I paid my household employee in cash?

Yes, you must file Schedule H if you paid a household employee $2,700 or more in wages during the year (2024 threshold), even if you paid them in cash. You are still responsible for reporting and paying Social Security, Medicare, and federal unemployment taxes on these wages.

Do I need to provide a Form W-2 to my household employee?

Yes, if you paid your household employee $2,700 or more in wages during the year, you are required to provide them with a Form W-2 by January 31 of the following year. The W-2 reports the employee's wages and the taxes you withheld for Social Security, Medicare, and federal income tax.

What's the difference between Form W-2 and Form W-3 for household employees?

Form W-2 is provided to your household employee by January 31 of the following year and reports their wages as well as the taxes you withheld for Social Security, Medicare, and federal income tax. Form W-3, on the other hand, is sent to the Social Security Administration (SSA) along with a copy of the W-2. Form W-3 summarizes the total wages and tax information from all W-2 forms you issued for the year. You are responsible for filing both forms: W-2 for your employee and W-3 for the SSA.

Do I need an Employer Identification Number (EIN) for Schedule H, or can I use my Social Security Number (SSN)?

If you are filing Schedule H to report household employment taxes, you can generally use your Social Security Number (SSN). However, if you have other employees or file certain other tax forms, such as Form 941 or Form W-3, you may need to apply for an Employer Identification Number (EIN). To apply for an EIN, you can file Form SS-4, Application for Employer Identification Number, or see IRS Publication 1635, Understanding Your EIN, for more information.

Last updated: December 11, 2024

References:

- About Schedule H (Form 1040), Household Employment Taxes. U.S. Department of the Treasury, Internal Revenue Service. Retrieved December 11, 2024.

- Instructions for Schedule H (Form 1040), Household Employment Taxes. U.S. Department of the Treasury, Internal Revenue Service. Retrieved December 11, 2024.

- What is Household Employment Tax (Schedule H)?. TaxSlayer, Income Tax Preparation Service. Retrieved December 11, 2024.

- What Is Schedule H: Household Employment Taxes. Intuit TurboTax, Income Tax Preparation Service. Retrieved December 11, 2024.

- Calculate household employer taxes with Schedule H. Jackson Hewitt, Income Tax Preparation Service. Retrieved December 11, 2024.

- Schedule H - Household Employment Taxes. TaxAct, Online Tax Preparation. Retrieved December 11, 2024.

- Schedule H (Form 1040): Household Employment Taxes. Fincent, IRS Tax Forms. Retrieved December 11, 2024.

- Schedule H for Household Employers: What Is It & How To Fill It Out Step-By-Step. NannyFiles, Jillian Plank, CPA. Retrieved December 11, 2024.