2024 Schedule J Form and Instructions

Income Averaging for Farmers and Fishermen

What Is Form 1040 Schedule J?

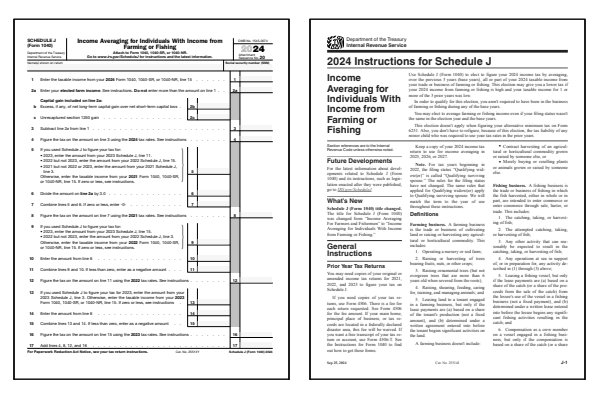

Page two of IRS Form 1040 requires that you attach Schedule J if you had income from farming or fishing, and, choose to calculate your tax due amount using the income averaging method. You can not file Schedule J with one of the shorter IRS forms such as Form 1040A or Form 1040EZ.

Schedule J can help farmers and fishermen lower their income tax due by averaging income over the last three years, smoothing out boom and bust years, for example.

Who Must File Form 1040 Schedule J?

- Income from wages as a crew member on a fishing vessel.

- Income from wages as a farm worker.

- Own or operate a farming business.

- Own or operate a fishing business.

- Boom and bust like income each year.

- One time or recurring litigation income.

Click any of the IRS Schedule J Form and Instructions links below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable Schedule J Forms

Printable Schedule J Instructions

When to File Schedule J

Schedule J is filed with your Form 1040, 1040-SR or 1040-NR if you are a farmer or fisherman and want to use income averaging to reduce your tax liability. Income averaging allows you to spread your current year's income over the previous three years, which may reduce your overall tax if your income fluctuates significantly from year to year. You must file form Schedule J if you are eligible and want to take advantage of income averaging for your farm or fishing business.

For more details, refer to the IRS instructions for Schedule J. The Schedule J instructions provide guidance on calculating your average income over the applicable years and reducing your tax liability accordingly.

Where to Mail Schedule J

If you're filing electronically, form Schedule J will be submitted along with your federal tax return. For paper filing, attach Schedule J to your Form 1040 or Form 1040-SR and mail it to the IRS address listed in the instructions for Form 1040. Notice the Attachment Sequence No. 20 text in the upper right-hand corner of the Schedule J form. Always verify the correct mailing address and use certified mail to ensure your return is tracked and delivered securely.

Common IRS Schedule J Mistakes to Avoid

If you make an error on Schedule J, you may need to file Form 1040X (Amended U.S. Individual Income Tax Return) to correct it. Mistakes on Schedule J can result in inaccurate calculations of your average income and may cause you to miss out on tax savings from income averaging.

Common Mistakes to Avoid:

- Failing to report all farm or fishing income when calculating your average income over the three-year period.

- Incorrectly calculating income from prior years, which can lead to inaccurate averaging and incorrect tax liability.

- Overlooking capital gains or other taxable events that should be included in your income averaging calculation.

- Forgetting to attach Schedule J when claiming income averaging for your farm or fishing business.

Review the Schedule J instructions carefully to ensure you report your income accurately and apply the correct averaging method to reduce your tax liability.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about Schedule J. These FAQs help clarify how income averaging works for farmers and fishermen.

What is income averaging?

Income averaging allows farmers and fishermen to spread their current year's income over the previous three years for tax purposes. This can help reduce your overall tax liability if your income fluctuates significantly from year to year. For example, a high-income year might push you into a higher tax bracket, resulting in a larger tax bill. In a following year, if your income drops significantly or you experience a loss, you may owe little to no tax. By using income averaging with Schedule J, you can potentially reduce your tax burden in boom years by averaging it with lower-income years. Check the Schedule J instructions for eligibility and calculation details.

Can I file Schedule J electronically?

Yes, Schedule J can be filed electronically along with your federal tax return. For paper filers, attach Schedule J in sequence with your Form 1040 or Form 1040-SR and mail it to the correct IRS address.

How do I calculate my average income on Schedule J?

To calculate your average income on Schedule J, you first enter your current year's income and allocate it over the prior three years. The form includes specific instructions based on whether you've used Schedule J in any of the previous three years. You will transfer amounts from previous years' Schedule J forms or Form 1040 to complete the income averaging calculations. The IRS instructions for Schedule J provide detailed worksheets to help you through this process and determine how income averaging affects your tax liability for the current year.

Can income averaging be used every year?

No, income averaging can only be used in years where you meet the eligibility requirements, and it may not be beneficial in years when your income does not fluctuate significantly. Review the Schedule J instructions to see if income averaging is appropriate for your situation each tax year.

Last updated: November 27, 2024

References:

- About Schedule J (Form 1040), Income Averaging for Farmers and Fishermen. U.S. Department of the Treasury, Internal Revenue Service. Retrieved November 27, 2024.

- Instructions for Schedule J (Form 1040), Income Averaging for Farmers and Fishermen. U.S. Department of the Treasury, Internal Revenue Service. Retrieved November 27, 2024.

- Taxes for Farmers and Ranchers. U.S. Department of Agriculture. Retrieved November 27, 2024.

- Schedule J (1040) - Income Averaging for Farmers and Fisherman. Utah State University, Rural Tax Education. Retrieved November 27, 2024.

- Farm Answers. The University of Minnesota, USDA-NIFA Beginning Farmer and Rancher (BFRDP). Retrieved November 27, 2024.

- What Is Schedule J: Income Averaging for Farmers and Fishermen. Intuit TurboTax, Income Tax Preparation Service. Retrieved November 27, 2024.

- Schedule J (Form 1040): Income Averaging for Farmers and Fishermen. Fincent, IRS Tax Forms. Retrieved November 27, 2024.