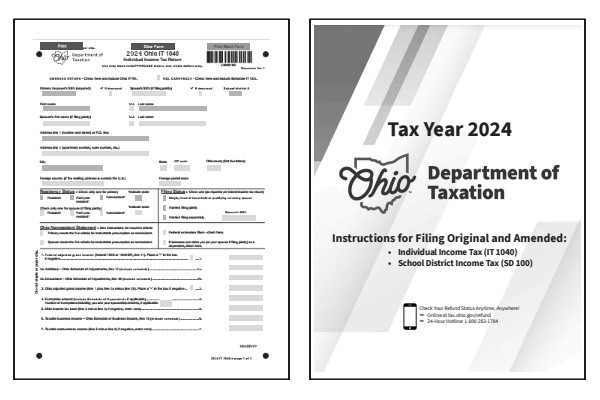

2024 Ohio Form 1040

Printable OH IT-1040 Tax Forms and Instructions

What Is Ohio Form IT-1040?

Ohio IT-1040 is the form used by full-year residents to file their state income tax return. The purpose of Form IT-1040 is to determine your tax liability for the state of Ohio. Part-year resident and nonresident filers will also complete Ohio Form IT-1040. Part-year residents must attach Ohio Form IT RC if claiming a credit for taxes paid to another state. Nonresidents must attach Ohio Form IT NRC to claim the nonresident credit for income not subject to Ohio tax.

Read the What Is my Ohio Residency Status

section of the IT-1040 instructions book to help determine

if you should file as a resident, part-year resident, or nonresident for tax year 2024.

Who Must File Ohio Form IT-1040?

In Ohio, all residents, part-year residents, and nonresidents with Ohio-sourced income are generally required to file an individual income tax return using Form IT-1040. Ohio-sourced income includes wages earned in Ohio, lottery or casino winnings, income from Ohio property, and income from businesses operating in the state. Full-year nonresidents living in reciprocal states (Indiana, Kentucky, West Virginia, Michigan, or Pennsylvania) are exempt from filing if their only Ohio-sourced income is wages.

Certain exceptions exist where individuals may not need to file an Ohio income tax return. You are exempt if your Ohio adjusted gross income is less than or equal to $0, your exemption amount equals or exceeds your Ohio adjusted gross income, or your applicable credits (such as the senior citizen credit) equal or surpass your income tax liability. Despite these exceptions, if you have a school district income tax liability, you are still required to file the Ohio IT 1040.

Read the Who Must File

section of the Ohio IT-1040 instructions booklet to help determine if you need to file a state income tax return for tax year 2024.

Printable Ohio State Tax Forms

Printable Ohio IT-1040 Instructions

How To Check The Status Of My Ohio Tax Return?

To check the status of your Ohio IT-1040 income tax return online, visit the Ohio Department of Taxation website and use their Check My Refund Status service. Ohio Department of Taxation asks that you wait three weeks before checking the status of an electronically filed return and 12 weeks for a mailed-in paper return.

To check the status of your Ohio income tax return for 2024, you will need the following information:

- Social Security Number

- Date of Birth

- Type of Tax Return

The requested information must match what was submitted on your 2024 Ohio Form IT-1040. To check prior year returns, you will need to contact the Ohio Department of Taxation service center by phone, email, or mail.

To contact the Ohio Department of Taxation service center by phone or email, use the check your refund status link above. Alternatively, read or print the 2024 Ohio Form IT-1040 instructions to obtain the proper phone number and mailing address.

Last updated: January 10, 2025

References:

- Individual Income Tax Forms. State of Ohio, Ohio Department of Taxation. Retrieved January 10, 2025.

- Filing Season Central. State of Ohio, Ohio Department of Taxation. Retrieved January 10, 2025.