2024 Schedule A-NR Form and Instructions

Itemized Deductions for Nonresidents

What Is Schedule A-NR?

Schedule A-NR is a tax form used by nonresident aliens to itemize deductions on their US Nonresident Income Tax Return. It allows eligible taxpayers to deduct certain expenses from their gross income, potentially reducing their taxable income. This Schedule A-NR is distinct from the Schedule A used with Form 1040 for US residents. Nonresident aliens should only use the Schedule A-NR specifically designed for Form 1040-NR tax returns.

Who Must File Schedule A-NR

Nonresident aliens should complete and attach Schedule A-NR to Form 1040-NR if they choose to itemize deductions. Common deductions include:

- State and Local Income Taxes: Taxes paid to state and local governments.

- Charitable Contributions: Donations to qualified charitable organizations.

- Casualty and Theft Losses: Losses from federally declared disasters.

- Other Itemized Deductions: Certain miscellaneous deductions allowed under US tax law.

These deductions must be directly connected to income effectively connected with a US trade or business. Deductions related to income not effectively connected with a US trade or business are generally not allowed.

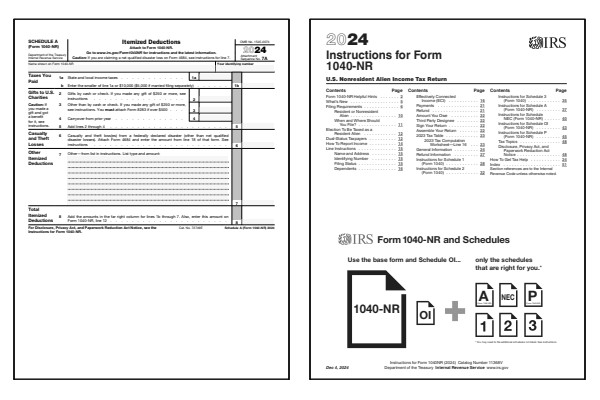

Click any of the IRS Schedule A-NR form and instructions below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable Schedule A-NR Forms

Printable Schedule A-NR Instructions

When to File Schedule A-NR

Schedule A-NR should be completed and submitted with Form 1040-NR by the tax filing deadline, which is typically April 15 if you earned wages subject to withholding. For nonresident aliens without wage income, the filing deadline extends to June 15. Refer to the Form 1040-NR instructions for specific guidance on when to file Schedule A-NR.

Where to Mail Schedule A-NR

Mail your completed Form 1040-NR, along with Schedule A-NR and any other required attachments, to the appropriate IRS address as specified in the Form 1040-NR instructions. Notice the Attachment Sequence No. 7A in the upper right corner of Schedule A-NR form. The mailing address depends on whether you are enclosing a payment and your filer type (individual, estate, or trust). Refer to the Where To File section in the Form 1040-NR instructions for the correct address.

Common IRS Schedule A-NR Mistakes to Avoid

- Using the Incorrect Schedule: Ensure you are using the schedule designed for nonresident aliens (Schedule A-NR), not the schedule used by US residents (Schedule A).

- Claiming Ineligible Deductions: Only deductions connected to income effectively connected with a US trade or business are allowable.

- Incorrectly Calculating Deductions: Accurately calculate and substantiate each deduction with proper documentation.

- Omitting Required Attachments: Include all necessary forms and schedules to support your itemized deductions.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about Schedule A-NR. These FAQ help clarify when it's better to for nonresident alien individuals to itemize deductions.

Do nonresidents and residents file the same Schedule A?

No, nonresident aliens must use Schedule A-NR which is specifically designed for Form 1040-NR. US resident will file Schedule A and attach it to Form 1040 or Form 1040-SR.

Who needs to file Schedule A-NR?

Nonresident aliens who choose to itemize deductions on their Form 1040-NR US Nonresident Alien Income Tax Return will need to file Schedule A-NR. There is a limited standard deduction available for certain nonresident filers. For all other nonresident filers, you may be limited to the deductions available on Schedule A-NR.

What deductions can I claim on Schedule A-NR?

You can claim deductions such as state and local income taxes, charitable contributions, casualty and theft losses, and other itemized deductions. Such deductions must generally be connected to income that is effectively connected to a US trade or business.

Are there any deductions I cannot claim on Schedule A-NR?

Deductions related to income not effectively connected with a US trade or business are generally not allowable on Schedule A-NR.

Last updated: January 26, 2025

References:

- About Form 1040-NR, US Nonresident Alien Income Tax Return. US Department of the Treasury, Internal Revenue Service. Retrieved January 26, 2025.

- Instructions for Form 1040NR. US Department of the Treasury, Internal Revenue Service. Retrieved January 26, 2025.

- About Publication 519, US Tax Guide for Aliens. US Department of the Treasury, Internal Revenue Service. Retrieved January 26, 2025.