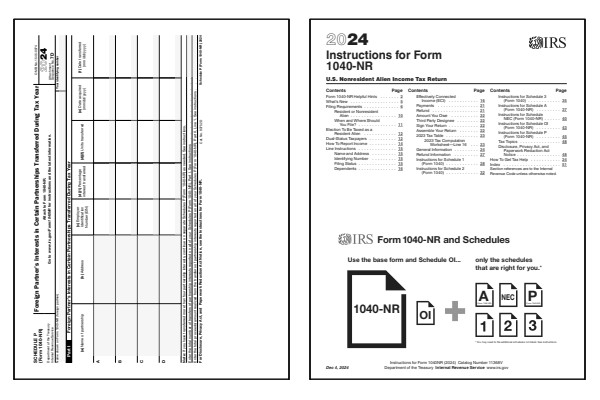

2024 Schedule P Form and Instructions

Foreign Partner's Interests in Certain Partnerships Transferred During Tax Year

What Is Schedule P?

Schedule P is used by nonresident aliens to report gains or losses from the sale or transfer of certain partnership interests. Its purpose is to record these gains or losses so that applicable capital gains tax can be added to your US nonresident tax return. Schedule P is attached to Form 1040-NR, the US Nonresident Alien Income Tax Return.

Who Must File Schedule P

Schedule P is required for nonresident aliens who transfer a partnership interest connected to US business activities or real property interests. If you did not have any such transactions during the tax year, you do not need to file Schedule P. For specific requirements and examples, refer to the Schedule P line items and the Form 1040-NR instructions.

Click any of the IRS Schedule P form and instructions below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher. Schedule P is a new form, first published for the 2023 tax year.

Printable Schedule P Forms

Printable Schedule P Instructions

When to File Schedule P

Attach Schedule P to your Form 1040-NR if, during the tax year, you transferred an interest in a partnership engaged in a US trade or business or holding US real property interests. Schedule P should be submitted with Form 1040-NR by the tax filing deadline, which is typically April 15 if you earned wages subject to withholding. For nonresident aliens without wage income, the filing deadline extends to June 15. Refer to the Form 1040-NR instructions for specific guidance on when to file Schedule P.

Where to Mail Schedule P

Mail your completed Form 1040-NR, along with Schedule P and any other required attachments, to the appropriate IRS address listed in the Form 1040-NR instructions. Notice the Attachment Sequence No. 7D in the upper right corner of Schedule P form. The mailing address depends on whether you are enclosing a payment and your filer type (individual, estate, or trust). Refer to the Where To File section in the Form 1040-NR instructions for the correct address.

Common IRS Schedule P Mistakes to Avoid

- Incomplete Information: Ensure all parts of Schedule P are fully completed, including details about the partnership and the transaction.

- Incorrect Calculations: Accurately calculate the gain or loss from the transfer of the partnership interest to avoid discrepancies.

- Missing Attachments: Attach all necessary forms and schedules to your Form 1040-NR to provide complete information to the IRS.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about Schedule P for nonresidents.

Where can I find Schedule P for prior years?

Schedule P was introduced for the 2023 tax year, so it is not available for prior years. Nonresident aliens only need to file Schedule P for applicable partnership transfers beginning in 2023.

Who needs to file Schedule P?

Nonresident aliens who have transferred an interest in a partnership engaged in a US trade or business, or holding US real property interests, during the tax year are required to file Schedule P.

What information is required on Schedule P?

Schedule P asks for information about the partnership, including its name, address, and Employer Identification Number (EIN), as well as information about the transfer, such as the date acquired, date transferred, and the percentage interest transferred.

Where can I find the instructions for Schedule P?

Instructions for Schedule P are included in the Instructions for Form 1040-NR.

Can I file Schedule P electronically?

Yes, Schedule P can be filed electronically along with your US nonresident tax return. For paper filers, include Schedule P with your Form 1040-NR and mail it to the address specified in the instructions.

Last updated: January 26, 2025

References:

- About Form 1040-NR, US Nonresident Alien Income Tax Return. US Department of the Treasury, Internal Revenue Service. Retrieved January 26, 2025.

- Instructions for Form 1040NR. US Department of the Treasury, Internal Revenue Service. Retrieved January 26, 2025.

- About Publication 519, US Tax Guide for Aliens. US Department of the Treasury, Internal Revenue Service. Retrieved January 26, 2025.