2024 Schedule 8812 Form and Instructions

Credits for Qualifying Children and Other Dependents

What Is Form 1040 Schedule 8812?

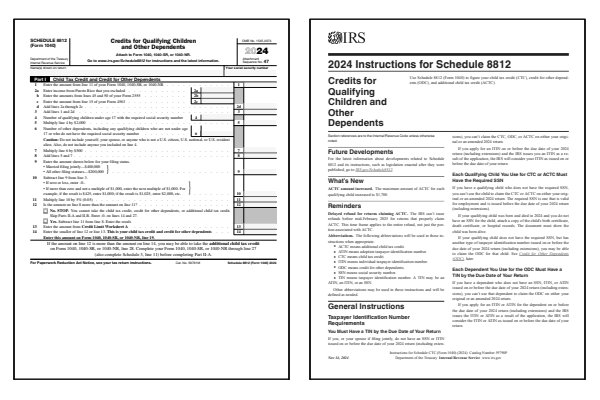

Schedule 8812, formerly titled the Additional Child Tax Credit, is used to claim the refundable portion of the standard Child Tax Credit. Currently, the maximum refundable amount is $1,700 per qualifying child. The Enhanced Child Tax Credit, which temporarily provided higher amounts, has expired. For all qualifying children under age 17 with a valid Social Security number, the Child Tax Credit begins with a nonrefundable base amount of $2,000. From this, you will adjust downwards based on your income and filing status.

On page two of the IRS Form 1040, line 19 and line 28, the taxpayer is asked to add the amounts from Schedule 8812. Form 1040 Schedule 8812, Credits for Qualifying Children and Other Dependents, can be used with the redesigned Form 1040. You can also file IRS Schedule 8812 with the other 1040 series forms such as Form 1040SR and Form 1040NR.

Schedule 8812, Credits for Qualifying Children and Other Dependents, asks that you first complete the Child Tax Credit and Credit for Other Dependents Worksheet. See the instructions for Form 1040, line 19, or the instructions for Form 1040NR, line 19. The 2024 Schedule 8812 Instructions are published as a separate booklet which you can find below. You may also need to read the Schedule 8812 line item instructions found within the general Form 1040 instructions booklet.

Who Must File Form 1040 Schedule 8812?

- Calculate your Child Tax Credit.

- Calculate your Additional Child Tax Credit.

- Report advance child tax credit payments you received.

- Have at least one qualifying child.

- Child must have a SSN number.

- Child must be under age 18.

- Not filing Form 2555.

Click any of the IRS Schedule 8812 Form and Instructions links below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable Schedule 8812 Forms

Printable Schedule 8812 Instructions

When to File Schedule 8812

Schedule 8812 is filed with your Form 1040, Form 1040-SR, or Form 1040-NR when you are claiming the child tax credit (CTC) or the additional child tax credit (ACTC) for qualifying children and other dependents. This form helps calculate the refundable and nonrefundable portions of the credit, ensuring you receive the correct amount. Schedule 8812 should be filed by April 15th, unless you have filed for an extension, which may extend the deadline to October 15th.

For more details on how to prepare this form, consult the instructions for Schedule 8812. The Schedule 8812 instructions provide guidance on who qualifies for the credit and how to calculate your refund or tax reduction accurately.

Where to Mail Schedule 8812

If you're filing electronically, Schedule 8812 will be submitted with your federal income tax return. For paper filing, attach Schedule 8812 to your Form 1040, Form 1040-SR, or Form 1040-NR and mail it to the IRS address listed in the general instructions. Notice the Attachment Sequence No. 47 text in the upper right-hand corner of the Schedule 8812 form. Always verify the correct mailing address and, if possible, use certified mail to track your return and ensure it's delivered on time.

Common IRS Schedule 8812 Mistakes to Avoid

If you make an error on Schedule 8812, you may need to file Form 1040X (Amended U.S. Individual Income Tax Return) to correct it. Errors on Schedule 8812 can result in missing out on beneficial credits for qualifying children or other dependents, or receiving the wrong amount of the credit.

Common Mistakes to Avoid:

- Incorrectly calculating the number of qualifying children for the child tax credit or additional child tax credit.

- Failing to account for changes in the number of dependents or their eligibility during the tax year.

- Forgetting to complete and attach form Schedule 8812 when claiming the child tax credit or additional child tax credit.

- Misreporting income or additional taxes, which could affect the refundable portion of the credit.

- Not properly calculating or applying the phase-out limits for higher incomes.

In cases of intentional fraud or reckless disregard of the rules, the IRS can ban you from claiming certain credits for up to 10 years. Always ensure your information is accurate to avoid penalties or being barred from future credits. Review the Schedule 8812 instructions carefully to ensure you qualify for the credit and calculate it correctly.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about Schedule 8812. These FAQs cover key points to help you file accurately when claiming credits for qualifying children and other dependents.

Does my child need a Social Security Number to qualify for the child tax credit?

Yes, a qualifying child must have a Social Security Number (SSN) issued by the Social Security Administration before the due date of your tax return, including any extensions. Without a valid SSN, you cannot claim the child tax credit or the additional child tax credit for that child.

What are the maximum amounts for the Child Tax Credit and Additional Child Tax Credit?

For the 2024 tax year, the maximum amount of the Child Tax Credit (CTC) per qualifying child is $2,000. The refundable portion of this credit, known as the Additional Child Tax Credit (ACTC), is worth up to $1,700 for each qualifying child.

What is Schedule 8812 used for?

Schedule 8812 is used to calculate the child tax credit (CTC) and the additional child tax credit (ACTC). It helps determine both the nonrefundable and refundable portions of the credit for qualifying children and other dependents.

Can I file Schedule 8812 electronically?

Yes, Schedule 8812 can be filed electronically as part of your federal tax return. For paper filers, attach Schedule 8812 in sequence with your Form 1040, Form 1040-SR, or Form 1040-NR and mail it to the correct IRS address.

How do I know if my child qualifies for the child tax credit?

A qualifying child for the child tax credit must meet certain age, relationship, residency, and support requirements. Check the Schedule 8812 instructions to ensure that your child or dependent meets the qualifications to claim the credit.

What is the additional child tax credit (ACTC)?

The additional child tax credit (ACTC) is the refundable portion of the child tax credit. If you don't receive the full amount of the child tax credit due to insufficient tax liability, the ACTC allows you to receive a refund of the remaining credit.

Last updated: December 11, 2024

References:

- About Schedule 8812 (Form 1040), Child Tax Credit. U.S. Department of the Treasury, Internal Revenue Service. Retrieved December 11, 2024.

- Instructions for Schedule 8812 (Form 1040), Child Tax Credit. U.S. Department of the Treasury, Internal Revenue Service. Retrieved December 11, 2024.

- Child Tax Credit: How it works & How to claim it. H&R Block, Income Tax Preparation Service. Retrieved December 11, 2024.

- IRS Schedule 8812: Claim The Additional Child Tax Credit for each Qualifying Child. Taxfyle, Tax and Bookkeeping Services. Retrieved December 11, 2024.

- What is Schedule 8812?. Thomson Reuters, Tax & Accounting. Retrieved December 11, 2024.

- What is the IRS Form 8812?. Intuit TurboTax, Income Tax Preparation Service. Retrieved December 11, 2024.

- What is Form 8812?. Community Tax, Income Tax Services. Retrieved December 11, 2024.