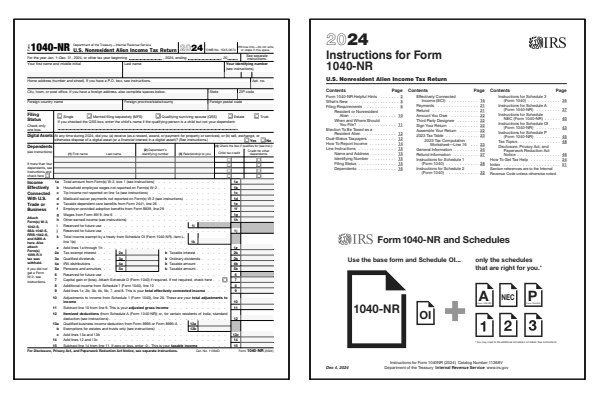

2024 1040-NR Form and Instructions

US Nonresident Income Tax Return

Nonresident individual taxpayers will file Form 1040-NR. Read the Form 1040-NR instructions, page 10, to determine if you are a resident alien or a nonresident alien for tax purposes. If you have a green card or where present in the United States at any time during calendar year 2024, pay close attention to those instructions.

Read the first few pages of the Form 1040 Instructions booklet If you think you might need to file as a resident instead.

Below on this page you will find the free printable 1040-NR form and 1040-NR instructions booklet PDF files. These are the official IRS forms along with any supporting schedules, worksheets, and tax tables for the 2025 income tax season.

For the 2024 tax year, federal tax form 1040-NR, US Nonresident Income Tax Return, must be postmarked by April 15, 2025. Federal income taxes due are based on the calendar year January 1, 2024 through December 31, 2024.

Prior year federal tax forms, instructions, and schedules are also available, and should be mailed as soon as possible if late.

Who Must File Form 1040-NR?

Nonresident individuals in general must file Form 1040-NR if any of the following applied during the 2024 calendar year:

- Received income from a US source.

- Capital gain or loss income.

- Engage in business in the United States.

- Scholarship, fellowship, grant (1042-S).

- Owe alternative minimum tax.

- Owe household employment tax.

- Were paid excess advanced credits.

Several exceptions exist.

Read the Who Must File Form 1040-NR

section of the instructions booklet to find out more.

Click any of the IRS 1040-NR form and instructions below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable Form 1040-NR Files

Printable Form 1040-NR Instructions

The following schedules are included inside the Form 1040-NR PDF file:

- Schedule A NR - Itemized Deductions for Nonresidents

- Schedule NEC - Tax on Income Not Effectively Connected With a US Trade or Business

- Schedule OI - Other Information for Nonresidents

- Schedule P - Foreign Partner's Interests in Certain Partnerships Transferred During Tax Year

The Form 1040-NR tax table can be found inside the instructions booklet. See also Form 1040-ES NR for nonresidents if you are required to make quarterly estimated tax payments.

When to File Form 1040-NR

Form 1040-NR is used by nonresident aliens to report US income, including wages, salaries, and other taxable income earned in the United States. It is required for individuals who are not US citizens or residents but who earned US income, whether through employment, business, or other taxable sources. The filing deadline is typically April 15 for those who earned wages subject to withholding, though it extends to June 15 for other nonresident aliens. The IRS instructions for Form 1040-NR provide detailed guidance on completing the form based on income type and filing status.

Where to Mail Form 1040-NR

If you are filing Form 1040-NR by mail, submit it to the IRS address provided in the form's instructions, which varies based on your US income source and any applicable tax treaties. Electronic filing may also be available for certain nonresident aliens, but many still file by mail due to specific filing requirements. Be sure to check the latest IRS instructions for the correct mailing address or available e-file options for nonresident tax returns.

Common IRS Form 1040-NR Mistakes to Avoid

Completing Form 1040-NR accurately is essential to ensure that income is properly reported and eligible deductions or tax treaties are applied. Errors on Form 1040-NR can lead to overpayment or underpayment of taxes or disallowance of certain treaty benefits.

Common Mistakes to Avoid:

- Failing to report all US income or accurately list the sources of income.

- Incorrectly claiming deductions that apply only to resident aliens, such as the standard deduction.

- Misapplying tax treaty benefits, which vary by country and income type.

- Omitting required statements or schedules, such as Schedule NEC for reporting income not effectively connected with a US trade or business.

Consult the IRS instructions for Form 1040-NR for guidance on tax treaties and correct reporting of US income and deductions.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about Form 1040-NR.

What does Nonresident Alien mean?

A Nonresident Alien is an individual who is not a US citizen and does not meet the IRS requirements for tax residency in the United States. Nonresident aliens are generally only required to pay tax on income they earn from US sources. They file Form 1040-NR to report US sourced income, such as wages from a US employer or rental income from US property. The IRS determines residency status based on the substantial presence test and visa classification, which help establish whether an individual is classified as a resident or nonresident alien for tax purposes. Refer to the Form 1040-NR instructions for details on the requirements for each status.

Can nonresident aliens claim the standard deduction on Form 1040-NR?

No, nonresident aliens cannot claim the standard deduction on Form 1040-NR. However, they may be eligible for certain itemized deductions and may apply tax treaty benefits based on their country of residence, which can reduce taxable income.

If I have a green card and live in the US, do I file Form 1040-NR?

No, if you hold a green card and live in the US, you are considered a resident for tax purposes and should file Form 1040, not Form 1040-NR. Green card holders who reside in the US generally report worldwide income, similar to US citizens, by using Form 1040.

If I have a green card and live outside the US, do I file Form 1040-NR?

No, even if you live outside the US, holding a green card typically means you are considered a US resident for tax purposes, so you would file Form 1040 instead of Form 1040-NR. As a US tax resident, you are required to report worldwide income, regardless of your country of residence. Refer to the Form 1040-NR instructions for details on the requirements for green card holders.

Do I file Form 1040-NR if I am a US citizen living abroad?

No, US citizens do not file Form 1040-NR, even if they live abroad. Form 1040-NR is specifically for nonresident aliens, individuals who are not US citizens or residents for tax purposes but who earn income from US sources. If you are a US citizen, you are required to report your worldwide income using Form 1040, regardless of where you live. For US citizens abroad, additional credits or exclusions, such as the Foreign Earned Income Exclusion, may help reduce tax liabilities.

Last updated: January 26, 2025

References:

- About Form 1040-NR, US Nonresident Alien Income Tax Return. US Department of the Treasury, Internal Revenue Service. Retrieved January 26, 2025.

- Instructions for Form 1040NR. US Department of the Treasury, Internal Revenue Service. Retrieved January 26, 2025.

- Form 1040-NR: A comprehensive guide for nonresident aliens. Ines Zemelman EA, Taxes for Expats. Retrieved January 26, 2025.

- Form 1040-NR - Should I File?. TaxAct, Help Center. Retrieved January 26, 2025.

- How to File Form 1040-NR. eFile, Online Tax Preparation. Retrieved January 26, 2025.