2024 Schedule 5 Form and Instructions

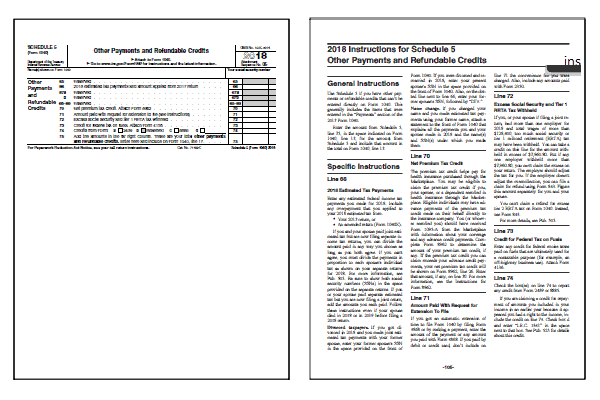

Other Payments and Refundable Credits

Schedule 5 has been discontinued by the IRS beginning with the 2019 income tax year. The information entered previously on Schedule 5 has been added to Schedule 3. Prior year Schedule 5 tax form and instructions can still be printed using the links below on this page.

What Is Form 1040 Schedule 5?

On page two of IRS Form 1040, line 17, the taxpayer is asked to add the amount from Schedule 5, line 75. Form 1040 Schedule 5, Other Payments and Refundable Credits, was created as part of the Form 1040 redesign implemented for the 2018 tax year. You do not file IRS Schedule 5 with the older 1040 series forms such as Form 1040A or Form 1040EZ.

Form 1040 Schedule 5, Other Payments and Refundable Credits, asks that you report any other payments or refundable credits that can't be entered directly onto Form 1040. The 2024 Schedule 5 Instructions are not published as a separate booklet. Instead, you will need to read the Schedule 5 line item instructions found within the general Form 1040 instructions booklet.

Who Must File Form 1040 Schedule 5?

- Estimated tax payments from Form 1040ES.

- Amount paid with extension to file request.

- Credit for federal tax on fuels.

- Excess social security tax withheld.

- Net premium tax credit.

Click any of the IRS Schedule 5 Form and Instructions links below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable Schedule 5 Forms

Schedule 5 Form 2024

Other Payments and Refundable Credits

Discontinued

Schedule 5 Form 2023

Other Payments and Refundable Credits

Discontinued

Schedule 5 Form 2022

Other Payments and Refundable Credits

Discontinued

Printable Schedule 5 Instructions

Schedule 5 Instructions 2024

Included inside the 1040 and 1040-SR instructions book.

Discontinued

Schedule 5 Instructions 2023

Included inside the 1040 and 1040-SR instructions book.

Discontinued

Schedule 5 Instructions 2022

Included inside the 1040 and 1040-SR instructions book.

Discontinued

When to File Schedule 5

Schedule 5 was previously filed with Form 1040 to report certain payments and refundable credits, including estimated tax payments, excess Social Security tax withheld, and premium tax credits. Since Schedule 5 was discontinued, these payments and credits have been incorporated into other parts of Form 1040, primarily on Schedule 3. For any tax years prior to the discontinuation, check archived IRS instructions for Schedule 5 to ensure accurate filing if you need to reference it.

Where to Mail Schedule 5

If you filed Schedule 5 prior to its discontinuation, it would have been attached to your Form 1040 and mailed to the appropriate IRS address based on your state, as listed in the instructions for that year. For current filings, the payments and credits previously reported on Schedule 5 are now reported on Schedule 3 and other parts of Form 1040, following IRS updates to streamline reporting. For past filings, always verify the IRS mailing address based on the specific instructions for that tax year.

Common IRS Schedule 5 Mistakes to Avoid

If referencing Schedule 5 for past filings, review the archived IRS instructions for the year in question. Common issues on Schedule 5 included errors in reporting estimated tax payments and other credits that applied to prior tax years.

Common Mistakes to Avoid:

- Miscalculating estimated tax payments or credits.

- Forgetting to report the amount applied from a prior year's return.

- Failing to attach Schedule 5 when it was required to report certain payments.

Archived IRS instructions for Schedule 5 provide details to help ensure accurate reporting for past tax years when this form was in use.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about Schedule 5 prior to its discontinuation.

Do I file Schedule 5 this year?

No, Schedule 5 has been discontinued. Any payments or credits previously reported on this form are now reported on Schedule 3 and other sections of Form 1040, as part of IRS updates to streamline tax reporting.

Last updated: November 17, 2024

References:

- About Form 1040, U.S. Individual Income Tax Return. U.S. Department of the Treasury, Internal Revenue Service. Retrieved November 17, 2024.

- Line Instructions for Form 1040. U.S. Department of the Treasury, Internal Revenue Service. Retrieved November 17, 2024.

- IRS Discontinues Schedule C-EZ and Other Forms for 2019. Thomson Reuters, Tax & Accounting. Retrieved November 17, 2024.

- The new Form 1040 comes with 6 schedules. CBS News, MoneyWatch. Retrieved November 17, 2024.

- What is IRS Form 1040 Schedule 5?. Intuit TurboTax, Income Tax Preparation Service. Retrieved November 17, 2024.