2024 1040-V Form and Instructions

Payment Voucher

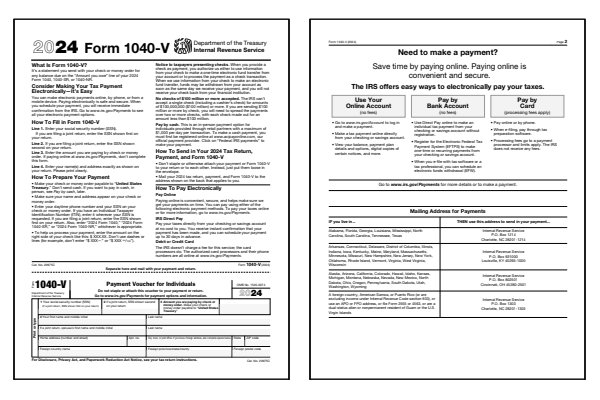

What Is Form 1040-V?

Form 1040-V is the payment voucher you detach and mail with your annual Form 1040, Form 1040-SR, or Form 1040-NR income tax return.

Use IRS Form 1040-V when you are paying by check or money order and make your check or money order payable to United States Treasury

.

Form 1040-V includes enough instructions on the form to complete the payment voucher. If you need additional instructions, see also the Form 1040 instructions booklet. Both explain how to make an income tax payment by check or money order, and where to mail your federal income tax payment voucher.

Who Must File Form 1040-V?

- Paying a balance due by check.

- Paying a balance due by money order.

Click any of the IRS 1040-V Form and Instructions links below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable 1040-V Forms and Instructions

When to File Form 1040-V

Form 1040-V is filed whenever you are making a payment by check or money order to the IRS for taxes owed on your Form 1040, Form 1040-SR, or Form 1040-NR. The payment voucher provides essential information to ensure that your payment is correctly applied to your tax account. While e-payments are available, Form 1040-V is useful for those who prefer or are required to file and pay by mail. The IRS instructions for Form 1040-V offer specific guidelines on completing and including this voucher with your payment.

Where to Mail Form 1040-V

If you are using Form 1040-V to mail a payment, mail the voucher with your check or money order to the IRS address for your location, as listed in the instructions for Form 1040-V.

The address varies based on the type of Form 1040 filed and your state.

Ensure that your check or money order is made payable to the United States Treasury

and include your name, address, phone number, and Social Security number on the payment.

Common IRS Form 1040-V Mistakes to Avoid

To avoid payment issues, ensure that you complete Form 1040-V accurately and follow all IRS instructions. Errors on Form 1040-V can lead to processing delays or incorrect application of your payment.

Common Mistakes to Avoid:

- Forgetting to include Form 1040-V when mailing a check or money order for your tax payment.

- Not completing all required fields on the form, such as the Social Security number, which ensures the payment is applied correctly.

- Sending the payment to the wrong IRS address based on your state or filing form type.

- Failing to make the check or money order payable to the United States Treasury or omitting important identification information on the payment.

The IRS instructions for Form 1040-V provide a full checklist to help avoid these errors when mailing your payment.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about Form 1040-V.

Do I have to file Form 1040-V if I pay my taxes electronically?

No, Form 1040-V is only required if you are making a payment by check or money order. If you pay electronically through IRS Direct Pay or another electronic method, you do not need to submit this payment voucher.

How do I make sure my payment is applied correctly with Form 1040-V?

To ensure proper application, include your name, address, Social Security number, and the tax year on both Form 1040-V and your check or money order. Mail the form and payment to the IRS address specified for your location, and make your payment to the United States Treasury.

Should I attach my payment to Form 1040-V?

No, you should not staple, clip, or otherwise attach your payment or Form 1040-V to your return or to each other. Instead, place both the payment and Form 1040-V loose in the envelope with your tax return. You should see this guideline written in the Form 1040-V instructions.

Can I pay the IRS online?

Yes, the IRS offers secure online payment options. You can use IRS Direct Pay to pay directly from a checking or savings account at no charge, with instant confirmation and the option to schedule payments up to 30 days in advance. Alternatively, you can pay by debit or credit card. The IRS does not charge a fee for this, however, processing fees may apply from the card service provider. For more information and to access these options, visit IRS.gov/Payments.

Last updated: November 27, 2024

References:

- About Form 1040-V, Payment Voucher. U.S. Department of the Treasury, Internal Revenue Service. Retrieved November 27, 2024.

- Line Instructions for Form 1040. U.S. Department of the Treasury, Internal Revenue Service. Retrieved November 27, 2024.

- What is the IRS Form 1040-V?. Levy and Associates, Tax Consultants. Retrieved November 27, 2024.

- Tips On Filling Out 1040-V. H&R Block, Income Tax Preparation Service. Retrieved November 27, 2024.

- What is Form 1040-V?. Intuit TurboTax, Income Tax Preparation Service. Retrieved November 27, 2024.