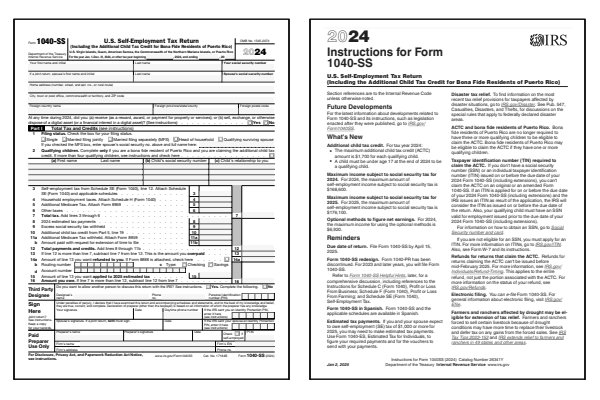

2024 1040-SS Form and Instructions

US Self-Employment Tax Return

What Is Form 1040-SS?

Form 1040-SS is for residents of the US Virgin Islands (USVI), Guam, American Samoa, the Commonwealth of the Northern Mariana Islands (CNMI), and the Commonwealth of Puerto Rico (PR) who are not required to file a United States (US) Form 1040, Form 1040-SR, or Form 1040-NR income tax return.

Form 1040-SS is generally used to report and pay self-employment income tax to the US. Furthermore, the Social Security Administration (SSA) will use this information to calculate any future benefits available to you under the US social security program. The 1040-SS form and instructions booklet are in English.

Who Must File Form 1040-SS?

- You or spouse had self-employment income of $400 or more.

- You are not required to file Form 1040 or Form 1040-NR.

- You are a resident of the US Virgin Islands, Guam, American Samoa, Northern Mariana Islands, or Puerto Rico.

Read the 2024 1040-SS instructions booklet to determine if you need to file. Take care not to confuse Form 1040-SS with similarly titled forms such as Estimated Tax for Individuals (1040-ES), Self-Employment Tax (Schedule SE), or Profit or Loss from Business (Schedule C), all three of which are commonly filed by Self-Employed taxpayers residing within the United States.

Click any of the IRS 1040-SS Form and Instructions links below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable Form 1040-SS Files

Printable Form 1040-SS Instructions

When to File Form 1040-SS

Form 1040-SS is used by individuals in US territories, such as Puerto Rico, Guam, the US Virgin Islands, and American Samoa, to report self-employment income and calculate Social Security and Medicare taxes. It serves as an alternative to Schedule SE (Self-Employment Tax) for taxpayers who do not need to file a full Form 1040. The form is typically due by April 15 for the previous tax year, although extensions may be available if requested. The IRS instructions for Form 1040-SS provide guidance on calculating self-employment tax and completing the form accurately.

Where to Mail Form 1040-SS

If you are required to file Form 1040-SS, mail it to the IRS address listed in the form's instructions based on your territory of residence. Be sure to include any supporting documentation for your self-employment income and deductions. The mailing address may vary by US territory, so confirm the correct address in the IRS instructions to ensure timely processing.

Common IRS Form 1040-SS Mistakes to Avoid

Completing Form 1040-SS accurately is essential to ensure proper reporting of self-employment income and calculation of Social Security and Medicare taxes. Common errors on Form 1040-SS include calculation mistakes and misunderstandings about eligible deductions.

Common Mistakes to Avoid:

- Miscalculating self-employment income, which can lead to underpayment of Social Security and Medicare taxes.

- Forgetting to include deductions specific to self-employed individuals, such as health insurance premiums and retirement contributions.

- Not filing by the due date, which can result in penalties and interest on any taxes owed.

- Failing to meet the form's requirements for individuals who reside in US territories and have self-employment income.

The IRS instructions for Form 1040-SS include worksheets and detailed guidelines to help reduce errors in reporting income and deductions.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about Form 1040-SS.

Who should file Form 1040-SS?

Form 1040-SS is intended for self-employed individuals residing in US territories, such as Puerto Rico, Guam, American Samoa, and the US Virgin Islands. If you are self-employed and don't need to file a full Form 1040, Form 1040-SS enables you to report income and calculate Social Security and Medicare taxes directly, fulfilling your tax obligations as a resident of a US territory.

Why should I file Form 1040-SS?

Filing Form 1040-SS is important for self-employed individuals in US territories because paying Social Security and Medicare taxes qualifies you for benefits under these programs. These contributions help ensure eligibility for financial support and healthcare during retirement or in the event of a disability, providing security for the future.

Can I claim deductions on Form 1040-SS?

Yes, Form 1040-SS allows you to claim deductions relevant to self-employed individuals, including health insurance premiums, retirement contributions, and other business expenses that reduce your taxable self-employment income. The IRS instructions for Form 1040-SS provide details on eligible deductions and reporting requirements.

Last updated: January 10, 2025

References:

- About Form 1040-SS, US Self-Employment Tax Return. US Department of the Treasury, Internal Revenue Service. Retrieved January 10, 2025.

- Instructions for Form 1040-SS. US Department of the Treasury, Internal Revenue Service. Retrieved January 10, 2025.

- Individual Income Tax. Departamento De Hacienda, Gobierno De Puerto Rico. Retrieved January 10, 2025.

- Who in Puerto Rico should file a US tax return?. H&R Block, Income Tax Preparation Service. Retrieved January 10, 2025.

- Puerto Rico - How to report this income. TaxAct, Online Tax Preparation. Retrieved January 10, 2025.