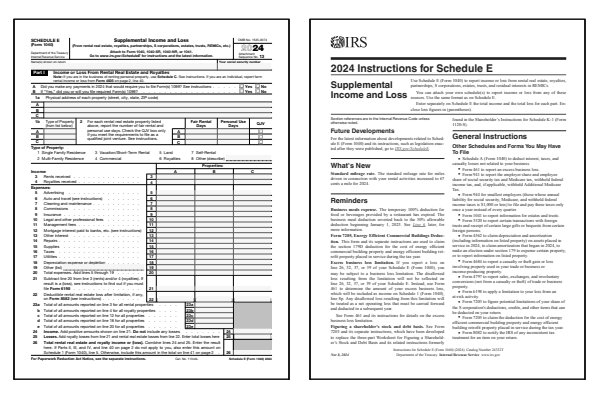

2024 Schedule E Form and Instructions

Supplemental Income and Loss

What Is Form 1040 Schedule E?

Page one of IRS Form 1040 and Form 1040NR requests that you attach Schedule E to report any income from rental real estate, royalties, partnerships, S corporations, trusts, estates, and residual interests in real estate mortgage investment conduits. You can not file Schedule E with one of the shorter IRS forms such as Form 1040A or Form 1040EZ.

Part 1 of form Schedule E is used to calculate your net income or loss from rental real estate and royalties. Parts 2, 3, and 4 are used to list and calculate your income or loss from partnerships, S corporations, estates, trusts, and real estate mortgage investment conduits. Part 5 on the second page of Schedule E summarizes the various parts of the tax form, and transfers the total income or loss amount onto Form 1040.

Who Must File Form 1040 Schedule E?

- Income or loss from a rental property.

- Income or loss from royalties.

- Income or loss from partnerships and S corporations.

- Income or loss from estates and trusts.

- Income or loss from a Real Estate Mortgage Investment Conduit (REMIC).

Click any of the IRS Schedule E Form and Instructions links below to download, save, view and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable Schedule E Forms

Printable Schedule E Instructions

When to File Schedule E

Schedule E is filed with your Form 1040, 1040-SR, or 1040-NR to report income or loss from supplemental sources such as rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in Real Estate Mortgage Investment Conduits (REMICs). You must file form Schedule E if you earned income or incurred losses from any of these sources during the tax year.

For more details, refer to the IRS instructions for Schedule E. The Schedule E instructions provide guidance on reporting supplemental income and calculating any associated gains or losses.

Where to Mail Schedule E

If you're filing electronically, form Schedule E will be submitted along with your tax return. For paper filing, attach Schedule E to your Form 1040 or Form 1040-SR and mail it to the IRS address listed in the instructions for Form 1040. Notice the Attachment Sequence No. 13 text in the upper right-hand corner of the Schedule E form. Always verify the correct mailing address and use certified mail to ensure your return is tracked and delivered securely.

Common IRS Schedule E Mistakes to Avoid

If you make an error on Schedule E, you may need to file Form 1040X (Amended U.S. Individual Income Tax Return) to correct it. Mistakes on Schedule E can lead to misreporting rental income or losses, or partnership and S corporation income, resulting in additional taxes or missed deductions.

Common Mistakes to Avoid:

- Failing to report all rental income, including income from short-term rentals or vacation properties.

- Incorrectly calculating depreciation on rental properties, which can result in overstated or understated expenses.

- Misreporting income from partnerships, S corporations, or trusts, especially if you received multiple Schedule K-1s.

- Overlooking deductible expenses related to rental properties, such as repairs, maintenance, or property management fees.

- Forgetting to report income or losses from royalties or residual interests in REMICs.

- Failing to file Form 1099 if you made payments to contractors or service providers that require it.

Review the Schedule E instructions carefully to ensure all supplemental income and losses are reported accurately, and retain any supporting documentation for your records.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about Schedule E. These FAQs help clarify how to report income and losses from rental real estate, partnerships, and other supplemental sources.

What types of income are reported on Schedule E?

Schedule E is used to report income or losses from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. If you received any of these types of income during the year, you must report them on Schedule E. Check the Schedule E instructions for a full list of reportable income sources.

Can I file Schedule E electronically?

Yes, Schedule E can be filed electronically along with your federal tax return. For paper filers, attach Schedule E in sequence with your Form 1040 or Form 1040-SR and mail it to the correct IRS address.

How do I report rental income on Schedule E?

Rental income from residential or commercial properties is reported on Schedule E, along with any expenses related to the rental property. Common expenses include repairs, maintenance, property taxes, insurance, and depreciation. Be sure to keep detailed records of all rental income and expenses throughout the year to ensure accurate reporting.

What is a Schedule K-1, and how does it affect Schedule E?

A Schedule K-1 is a tax document issued by partnerships, S corporations, estates, and trusts to report your share of income, deductions, and credits from those entities. You will use the information on the Schedule K-1 to complete Schedule E, where you report your share of the entity's income or loss. Always review the K-1 form carefully and include all relevant information on Schedule E.

How do I report income from rental services like Airbnb on Schedule E?

Income from short-term rental services like Airbnb and Vrbo (Vacation Rentals by Owner) are generally reported on Schedule E if you're renting out property as part of a rental business. If you rent your property for more than 14 days in a year, the income must be reported. Airbnb, Vrbo, and other short-term rental platforms often issue Form 1099-K to hosts who receive payments through third-party processors, but you may also receive a Form 1099-MISC if applicable. Be sure to report all rental income, including amounts not reported on a 1099, and deduct any allowable expenses related to the rental property, such as repairs, maintenance, and property management fees.

If you're providing substantial services (like daily cleaning or meals), the income may need to be reported as business income on Schedule C instead of Schedule E. For more information on reporting rental income, see IRS Publication 527, Residential Rental Property.

Last updated: November 27, 2024

References:

- About Schedule E (Form 1040), Supplemental Income and Loss. U.S. Department of the Treasury, Internal Revenue Service. Retrieved November 27, 2024.

- Instructions for Schedule E (Form 1040), Supplemental Income and Loss. U.S. Department of the Treasury, Internal Revenue Service. Retrieved November 27, 2024.

- IRS Form 1040 & Schedule E Tax Form: Reporting Rental Income on Schedule E and Supplemental Income and Loss for Rental Properties Income Tax. Taxfyle, Tax and Bookkeeping Services. Retrieved November 27, 2024.

- Tax on rental income: Tax guide for Airbnb, VRBO, and other short-term rental hosts. H&R Block, Income Tax Preparation Service. Retrieved November 27, 2024.

- What Is a Schedule E IRS Form?. Intuit TurboTax, Income Tax Preparation Service. Retrieved November 27, 2024.

- A Breakdown of your Schedule E Expense Categories. LandlordStudio, Property Owner Services. Retrieved November 27, 2024.

- IRS Schedule E: The Ultimate Guide for Real Estate Investors. Hall CPA, IRS Guides. Retrieved November 27, 2024.

- Short Term Rental – Schedule E or Schedule C?. The Daily CPA, Jeremias Ramos, CPA. Retrieved November 27, 2024.

- Home Sharing Taxes: Schedule E vs Schedule C. Let's Ledger, Tax and Bookkeeping Services. Retrieved November 27, 2024.