2024 Schedule NEC Form and Instructions

Tax on Income Not Effectively Connected With a US Trade or Business

What Is Schedule NEC?

Schedule NEC is used by nonresident aliens to report income from US sources that is not effectively connected with a US trade or business. This includes passive income such as dividends, interest, royalties, and certain capital gains. Income reported on Schedule NEC is typically subject to a flat withholding tax rate, often 30%, unless a tax treaty between the US and the taxpayer's country of residence specifies a lower rate.

Who Must File Schedule NEC?

Nonresident aliens filing Form 1040-NR must file Schedule NEC if they have US source income that is not effectively connected with a US trade or business. This typically includes income subject to withholding tax at a flat rate, such as:

- Dividends: Income from US corporations.

- Interest: Certain types of interest income, excluding portfolio interest which may be exempt.

- Royalties: Payments for the use of intellectual property, patents, trademarks, etc.

- Gambling Winnings: Income from gambling activities in the US

- Other Fixed or Determinable Annual or Periodical (FDAP) Income: Such as pensions, annuities, or alimony payments.

If any of these types of income apply to you, Schedule NEC must be completed and filed with Form 1040-NR. See the 1040-NR instructions for Schedule NEC for additional examples and more information.

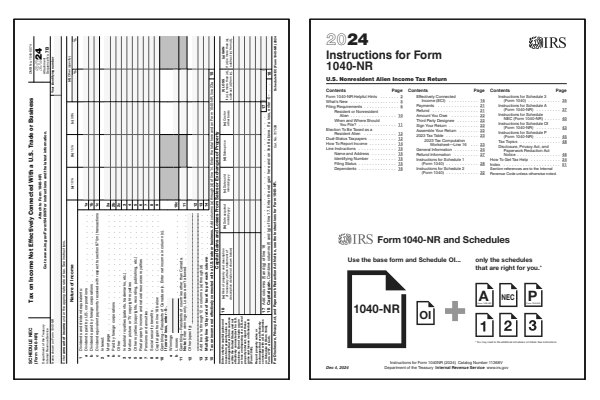

Click any of the IRS Schedule NEC form and instructions below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable Schedule NEC Forms

Printable Schedule NEC Instructions

When to File Schedule NEC

Schedule NEC should be submitted with Form 1040-NR by the tax filing deadline, which is typically April 15 if you earned wages subject to withholding. For nonresident aliens without wage income, the filing deadline extends to June 15. Refer to the Form 1040-NR instructions for specific guidance on when to file Schedule NEC.

Where to Mail Schedule NEC

Mail your completed Form 1040-NR, along with Schedule NEC and any other required attachments, to the appropriate IRS address as specified in the Form 1040-NR instructions. Notice the Attachment Sequence No. 7B in the upper right corner of Schedule A-NR form. The mailing address depends on whether you are enclosing a payment and your filer type (individual, estate, or trust). Refer to the Where To File section in the Form 1040-NR instructions for the correct address.

Common IRS Schedule NEC Mistakes to Avoid

- Incorrect Tax Rates: Applying the wrong withholding tax rate.

- Omitting Income: Failing to report all US source income not effectively connected with a US trade or business.

- Misclassification of Income: Incorrectly classifying income as effectively connected when it is not, or vice versa.

- Not Claiming Treaty Benefits: Overlooking applicable tax treaty benefits that could reduce withholding rates.

Frequently Asked Questions (FAQ)

Below are answers to some of the most common questions asked about Schedule NEC for nonresident tax returns.

What does Not Effectively Connected mean?

Not Effectively Connected income refers to US income that isn't tied to work you do in a US business or trade. For example, this might include passive income like dividends, certain interest, royalties, or gambling winnings. For nonresidents, this type of income is usually subject to a flat tax rate, typically withheld at the source, instead of being taxed at graduated rates like wages or business income.

Who needs to file Schedule NEC?

Nonresident aliens with US source income that is not effectively connected with a US trade or business must file Schedule NEC with their Form 1040-NR.

What types of income are reported on Schedule NEC?

Income such as dividends, interest, royalties, gambling winnings, and other FDAP income from US sources are reported on Schedule NEC.

What is the tax rate on Schedule NEC?

The tax is generally a flat rate, typically 30%, applied to the gross income amount, unless a lower rate is specified by an applicable tax treaty.

Can I claim deductions against income reported on Schedule NEC?

No, deductions are not allowed against income reported on Schedule NEC. This type of tax is calculated on the gross income amount.

Last updated: January 26, 2025

References:

- Effectively connected income (ECI). US Department of the Treasury, Internal Revenue Service. Retrieved January 26, 2025.

- About Form 1040-NR, US Nonresident Alien Income Tax Return. US Department of the Treasury, Internal Revenue Service. Retrieved January 26, 2025.

- Instructions for Form 1040NR. US Department of the Treasury, Internal Revenue Service. Retrieved January 26, 2025.

- About Publication 519, US Tax Guide for Aliens. US Department of the Treasury, Internal Revenue Service. Retrieved January 26, 2025.