2024 1040-ES (NR) Form and Instructions

US Estimated Tax for Nonresident Alien Individuals

What Is Form 1040-ES (NR)?

Form 1040-ES (NR) is used by Nonresident (NR) alien individuals to calculate and mail-in estimated tax payments prior to filing a 1040-NR income tax return. If you are a nonresident alien individual and earn US source income, you might be required to submit quarterly estimated tax payments to the federal government.

Self-employed nonresident alien individuals who file Schedule C, Schedule F, and Schedule SE are most often required to file quarterly estimated tax payments. Nonresident estimated tax, however, is not limited to the self-employed, farming, and fishing. US sourced income from interest and dividends, rental real estate, royalties, alimony, and other types of income may also be subject to quarterly estimated tax payment.

Who Must Make Nonresident Estimated Tax Payments?

Nonresident alien individuals in general must make estimated tax payments if both of the following apply for the 2024 calendar year:

- You expect to owe at least $1,000 in US federal income tax.

- You expect your withholding and credits to total less than the smaller of:

- 100% of the tax reported on your 2023 US tax return,

- 90% of the tax you will report on your 2024 US tax return.

The withholding and tax credits wording as stated by the IRS can be confusing. If you expect to owe at least $1,000 in federal income taxes, assume that you need to make estimated tax payments. Then, complete the 2024 Estimated Tax Worksheet For Nonresident Alien Individuals found on page 7 to determine if you indeed are required to make quarterly estimated payments.

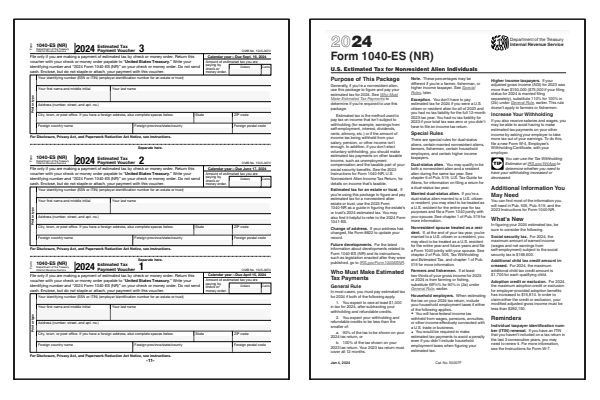

Printable Form 1040-ES (NR), Instructions, Vouchers

The following tables and worksheets are included inside each of the Form 1040-ES (NR) PDF files listed above:

- Form 1040-ES (NR)

- Form 1040-ES (NR) Instructions

- Payment Voucher 1, 2, 3, and 4

- Mailing Address

- Estimated Tax Worksheet

- Record of Estimated Tax Payments

- Self-Employment Tax and Deduction Worksheet

- Tax Rate Schedules

Form 1040-ES (NR) is generally published in February of each year by the IRS. Prior year forms are included above for historical reference. You will not use the older versions of the form after the annual nonresident tax return due date has passed.

When Are 2024 Nonresident Estimated Tax Payments Due?

Nonresident estimated tax payments follow the same schedule as US resident payments. The first estimated tax payment is due on April 15, 2024. Roughly each quarter you will mail an estimated tax payment voucher with a check to the IRS. Here are the nonresident quarterly due dates for the 2024 tax year:

- April 15, 2024

- June 17, 2024

- September 16, 2024

- January 15, 2025

Each quarterly estimated tax payment for nonresident alien individuals should be postmarked on or before the quarterly due date. Please read the 2024 Form 1040-ES (NR) instructions to confirm your due dates and to obtain the correct mailing address.

What Happens If You Pay Nonresident Estimated Taxes Late?

If you keep missing the nonresident estimated tax payment deadlines, the IRS may decide to apply a penalty when you file your annual US income tax return. The 2024 Form 1040-ES (NR) instructions discuss when a penalty is applied and how to amend estimated tax payments.

Use the 2024 Estimated Tax Worksheet for Nonresident Alien Individuals in conjunction with your annual revenue forecast to adjust payments downward or upward throughout the year. Keep such calculations with your US income tax records so that you can request the removal of penalties in writing if needed.

Where to Mail Form 1040-ES (NR)

If you are mailing Form 1040-ES (NR) with a check or money order, send it to the IRS address provided in the form instructions. Currently the mailing address is: Internal Revenue Service, PO Box 1303, Charlotte, NC 28201-1303 USA. Each quarterly payment should be mailed by the specified due dates (typically April, June, September, and January of the following year). If you prefer, payments can be made online through the IRS Direct Pay service or other electronic payment options listed in the Form 1040-ES (NR) instructions.

Last updated: November 18, 2024

References:

- About Form 1040-ES (NR), US Estimated Tax for Nonresident Alien Individuals. U.S. Department of the Treasury, Internal Revenue Service. Retrieved November 18, 2024.

- Publication 519, US Tax Guide for Aliens. U.S. Department of the Treasury, Internal Revenue Service. Retrieved November 18, 2024.