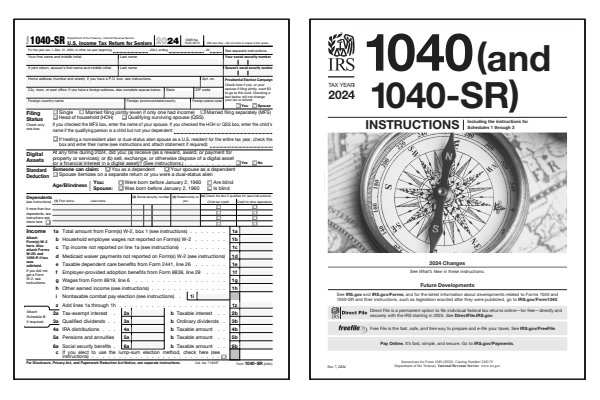

2024 1040-SR Form and Instructions

US Tax Return for Seniors

What Is Form 1040-SR?

Form 1040-SR is a relatively new form created in 2019 specifically for use by taxpayers age 65 and older. The form was required by the Bipartisan Budget Act of 2018. The text of the law specifies that such a form should be as similar as practical to Form 1040EZ, with modifications beneficial to seniors.

The 2023 Form 1040-SR mirrors Form 1040. The color, font size, layout, and page count might differ, however, the line numbers and information collected are the same. Line number references in the instructions apply to either form. Qualifying seniors can file either Form 1040 or 1040-SR the choice is yours.

Who Can File Form 1040-SR?

US citizens and resident aliens born before January 2, 1960, have the option to file Form 1040-SR. If your filing status is married filing jointly, only one spouse needs to be 65 years of age or older.

- You or your spouse were born before January 2, 1960.

Read the 2024 1040-SR instructions below to determine if you need to file. Click any of the IRS 1040-SR Form and Instructions below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable Form 1040-SR Files

Printable Form 1040-SR Instructions

When to File Form 1040-SR

Form 1040-SR is designed for taxpayers aged 65 and older as a simplified alternative to the standard Form 1040. It includes larger text and a more readable layout, catering to seniors who may have income from sources like Social Security, pensions, investments, and retirement distributions. Form 1040-SR follows the same filing deadlines as Form 1040, with the usual due date of April 15 each year. Extensions are available if requested by filing Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

Where to Mail Form 1040-SR

Form 1040-SR can be mailed to the IRS address specified in the instructions based on your state of residence. Taxpayers can also e-file Form 1040-SR if preferred, as the IRS accepts electronically filed returns from taxpayers of all ages. Check the IRS mailing address in the Form 1040-SR instructions to ensure accurate delivery if filing by mail.

Common IRS Form 1040-SR Mistakes to Avoid

Completing Form 1040-SR accurately is essential to avoid issues like missed deductions or incorrect additional taxes calculation. Errors can occur when reporting retirement income, claiming credits, or calculating taxable Social Security benefits.

Common Mistakes to Avoid:

- Misreporting Social Security income or other retirement distributions, leading to inaccurate taxable income.

- Overlooking the standard deduction increase for seniors, which may reduce taxable income.

- Failing to claim the Credit for the Elderly or Disabled if eligible, which can reduce overall tax liability.

- Incorrectly applying medical expense deductions if they exceed 7.5% of adjusted gross income.

The IRS instructions for Form 1040-SR provide guidance on reporting income and claiming deductions specific to seniors, helping to reduce errors.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about Form 1040-SR.

What is the difference between Form 1040 and Form 1040-SR?

Form 1040 and Form 1040-SR are similar in content and function, but Form 1040-SR is designed specifically for taxpayers aged 65 and older. Form 1040-SR features a larger font, clearer layouts, and higher-contrast design elements, making it easier to read for seniors. Both forms allow you to report the same types of income, deductions, and credits, including the standard deduction and additional credits for seniors and the blind. Taxpayers age 65 and older can choose either form based on preference, as both provide the same tax reporting capabilities.

Who can use Form 1040-SR?

Form 1040-SR is available for taxpayers aged 65 and older. It features larger text and a more accessible format but otherwise includes the same sections, filing options, and instructions as Form 1040. If you are 65 or older, you can choose to file either Form 1040 or Form 1040-SR based on your preference.

Can I file Form 1040-SR for free?

Yes, eligible taxpayers can file Form 1040-SR for free through IRS Free File, which is available to individuals with adjusted gross income below a specified threshold, usually around $73,000. Additionally, seniors can use free filing options through the IRS Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) programs, which offer in-person assistance for qualified taxpayers. If you meet these qualifications, you can access free resources to file Form 1040-SR and avoid paid tax preparation fees.

Where can seniors get free help filing their taxes?

Seniors can get free, in-person tax assistance through the IRS Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. These programs offer free help with tax preparation for qualifying individuals, especially those aged 60 and older, at local community centers, libraries, and senior centers. Appointments are often limited, so it's best to visit early in the tax season to ensure availability.

Last updated: December 27, 2024

References:

- About Form 1040-SR, U.S. Tax Return for Seniors. U.S. Department of the Treasury, Internal Revenue Service. Retrieved December 27, 2024.

- Instructions for Forms 1040 and 1040-SR. U.S. Department of the Treasury, Internal Revenue Service. Retrieved December 27, 2024.

- H.R.1892 - Bipartisan Budget Act of 2018. 115th Congress Public Law 123, U.S. Government Publishing Office. November 30, 2023.

- 10 Tax Deductions for Seniors & Retirees. Freshbooks, Accounting and Tax Services. Retrieved December 27, 2024.

- Everything to Know About the 1040-SR Form for Filing Seniors. Intuit TurboTax, Income Tax Preparation Service. Retrieved December 27, 2024.

- Form 1040-SR: Everything Seniors Need to Know for their Tax Return. Taxfyle, Tax and Bookkeeping Services. Retrieved December 27, 2024.

- Form 1040-SR U.S. Tax Return for Seniors: Definition and Filing. Investopedia, Income Tax Forms. Retrieved December 27, 2024.

- 7 Tax Breaks for Retirees. AARP, Money. Retrieved December 27, 2024.