2024 Schedule EIC Form and Instructions

Earned Income Credit

What Is Form 1040 Schedule EIC?

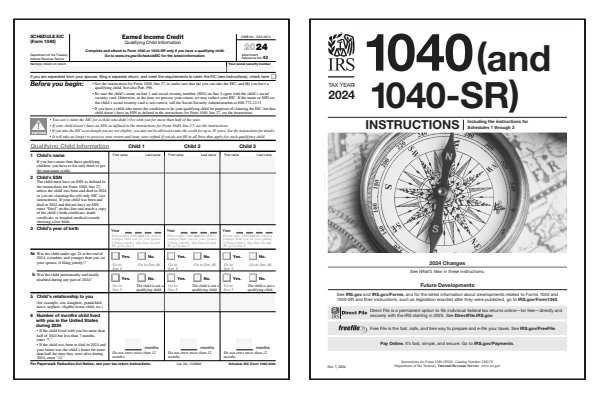

Page two of IRS Form 1040 requests that you attach Schedule EIC if you have a qualifying child and wish to claim the Earned Income Credit (EIC). Schedule EIC can only be attached to Form 1040 and Form 1040-SR.

The first page of form Schedule EIC asks that you list the name of one to three qualifying children, their SSN, year of birth, and the number of months the child lived with you during the tax year. The second page of Schedule EIC contains the general instructions for the form, however, you will also need the line item instructions and worksheets found within the corresponding Form 1040 or 1040A instructions booklet.

Who Must File Schedule EIC?

- You have a qualifying child: son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister, half brother, half sister, or a descendant of any of them (grandchild, niece, or nephew).

- Qualifying child is under age 19 at the end of the tax year, and younger than either you or your spouse if filing jointly.

- Qualifying child is under age 24 at the end of the tax year, is a student, and younger than either you or your spouse if filing jointly.

- Qualifying child lived with you in the United States for more than half of the tax year.

Click any of the IRS Schedule EIC Form and Instructions links below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable Schedule EIC Forms

Printable Schedule EIC Instructions

When to File Schedule EIC

Schedule EIC is filed with your Form 1040 or Form 1040-SR if you are claiming the Earned Income Credit (EIC) and have qualifying children. The Earned Income Credit is a refundable tax credit designed to help low to moderate income workers and families reduce their tax liability. You must file form Schedule EIC to claim the credit, as it provides the IRS with detailed information about the qualifying children, including their name, Social Security Number (SSN), and year of birth.

For more details on filing, refer to the IRS instructions for Schedule EIC. The Schedule EIC instructions will guide you through reporting the necessary information about your qualifying children.

Where to Mail Schedule EIC

If you're filing electronically, form Schedule EIC will be submitted along with your federal income tax return. For paper filing, attach Schedule EIC to your Form 1040 or Form 1040-SR and mail it to the IRS address listed in the instructions for Form 1040. Notice the Attachment Sequence No. 43 text in the upper right-hand corner of the Schedule EIC form. Always verify the correct mailing address and use certified mail to ensure your return is tracked and delivered securely.

Common IRS Schedule EIC Mistakes to Avoid

If you make an error on Schedule EIC, you may need to file Form 1040X (Amended U.S. Individual Income Tax Return) to correct it. Mistakes on Schedule EIC can result in incorrect reporting of qualifying children, which could reduce the Earned Income Credit or delay your refund.

Common Mistakes to Avoid:

- Failing to report all qualifying children, or incorrectly reporting children who do not meet the eligibility criteria.

- Misreporting your earned income, which affects the amount of your credit.

- Not ensuring that your children meet the residency, relationship, and age requirements for the Earned Income Credit.

- Claiming the Earned Income Credit for a child who is already claimed by someone else.

- Forgetting to attach Schedule EIC when claiming the Earned Income Credit for qualifying children.

Review the Schedule EIC instructions carefully to ensure all information about your qualifying children is accurate, and confirm that you meet the requirements for the Earned Income Credit.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about Schedule EIC. These FAQs help clarify how to claim the Earned Income Credit for qualifying children.

What is the Earned Income Credit (EIC)?

The Earned Income Credit (EIC) is a refundable tax credit designed to assist low to moderate income workers by reducing their tax liability. If you qualify, you can receive a refund even if you owe no taxes. The amount of the credit depends on your earned income, filing status, and the number of qualifying children you claim.

How do I know if my child qualifies for the Earned Income Credit?

To qualify for the Earned Income Credit, a child must meet certain residency, relationship, and age requirements. The child must live with you for more than half the year, be your dependent, and be under 19 years old (or 24 if a full-time student) or permanently disabled. Complete the Qualifying Child Information worksheet on Schedule EIC and read the Qualifying Child section of the instructions for more details.

Can I file Schedule EIC electronically?

Yes, Schedule EIC can be filed electronically along with your federal tax return. For paper filers, attach Schedule EIC in sequence with your Form 1040 or Form 1040-SR and mail it to the correct IRS address.

Can I claim the Earned Income Credit if I don't have any qualifying children?

Yes, you may still qualify for the Earned Income Credit without children, but the credit amount will be lower. In this case, you do not need to file Schedule EIC; the credit can be claimed directly on Form 1040 or Form 1040-SR if you meet the income and filing requirements. Refer to the Form 1040 Instructions, Line 27, for details on claiming the Earned Income Credit without qualifying children.

What happens if I claim the Earned Income Credit when I'm not eligible?

If you claim the Earned Income Credit (EIC) when you are not eligible, you may face penalties. If it's determined that your mistake was due to reckless or intentional disregard of the EIC rules, you could be banned from claiming the credit for 2 years, even if you're otherwise eligible. If the claim is fraudulent, the ban could extend to 10 years. Additionally, you may have to pay penalties and return any amount of the EIC that was improperly claimed.

Last updated: December 27, 2024

References:

- About Schedule EIC (Form 1040), Earned Income Credit. U.S. Department of the Treasury, Internal Revenue Service. Retrieved December 27, 2024.

- Instructions for Form 1040, U.S. Individual Income Tax Return. U.S. Department of the Treasury, Internal Revenue Service. Retrieved December 27, 2024.

- When to Use Schedule EIC: Earned Income Credit. Intuit TurboTax, Income Tax Preparation Service. Retrieved December 27, 2024.

- Filing Tax Form 8862: Information to Claim Earned Income Credit after Disallowance. Intuit TurboTax, Income Tax Preparation Service. Retrieved December 27, 2024.

- Schedule EIC Instructions. Teach Me Personal Finance, Tax Planning. Retrieved December 27, 2024.