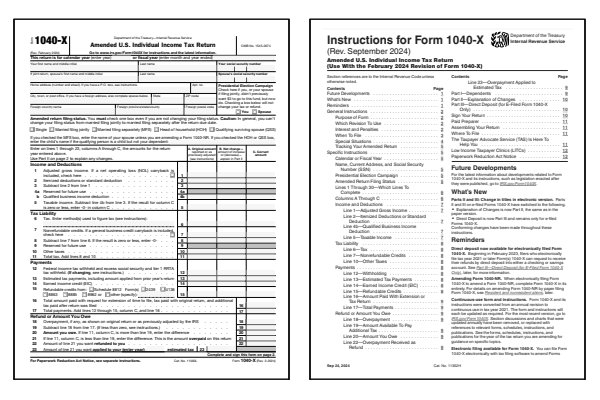

2024 1040X Form and Instructions

Amended US Individual Income Tax Return

What Is Form 1040X?

Form 1040X is used to amend or correct IRS Form 1040, Form 1040-SR, and Form 1040-NR tax returns. To obtain a credit or refund based upon your correction, Form 1040X generally must be filed within three years of the return due date, April 15 for example. See the Form 1040X instructions booklet below for exceptions to this rule and more details on when and where to file.

Who Must File Form 1040X?

- Missed a credit or deduction which reduces your tax due.

- Found a shoe box full of receipts after you filed your return.

- Correct an error on Form 1040, Form 1040-SR, or Form 1040-NR.

- Change return amounts which were adjusted by the IRS.

- Claim a carry back due to a loss or unused credit.

Click any of the IRS 1040X Form and Instructions links below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher. Form 1040X is a multi-year form which can be used for income tax years 2024, 2023, and 2022.

Printable Form 1040X Files

Printable Form 1040X Instructions

When to File Form 1040-X

Form 1040-X is used to correct errors on a previously filed Form 1040, Form 1040-SR, or Form 1040-NR. You should file Form 1040-X if you need to change your filing status, adjust income or deductions, or claim additional credits. The form allows you to correct mistakes in your return up to three years after the original filing date or within two years after paying the tax, whichever is later. The IRS instructions for Form 1040-X provide guidelines on making amendments and ensuring accurate reporting.

Where to Mail Form 1040-X

Form 1040-X can be mailed to the IRS address specified in the form's instructions for your location. However, if you initially filed your return electronically, you may be able to submit Form 1040-X electronically as well. If filing by mail, include any supporting documents, such as new or corrected schedules and forms, to support the changes made. Always confirm the correct mailing address in the instructions, as it may vary based on your filing state and whether you are due a refund or owe additional taxes.

Common IRS Form 1040-X Mistakes to Avoid

Filing Form 1040-X requires careful attention to detail to ensure accurate corrections. Common issues with Form 1040-X involve incomplete or unsupported amendments, which can delay processing.

Common Mistakes to Avoid:

- Failing to include all necessary forms and schedules impacted by the amendment, such as a revised Schedule A for itemized deductions.

- Not clearly explaining each change on Part II of Form 1040-X, where the IRS requires a description of adjustments.

- Incorrectly calculating additional taxes owed or refunds due based on the changes.

- Forgetting to sign and date Form 1040-X before mailing.

The IRS instructions for Form 1040-X include detailed steps for completing each section accurately, reducing the risk of errors and delays.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about Form 1040-X.

How long does it take for the IRS to process Form 1040-X?

The IRS typically takes 16 weeks or more to process a Form 1040-X, depending on filing volume and whether you filed electronically or by mail. You can check the status of your amended return using the IRS's Where's My Amended Return? tool.

Can I file Form 1040-X electronically?

Yes, if you originally filed Form 1040 electronically, you may be eligible to submit Form 1040-X electronically as well. Contact your tax software provider for more information.

Do I amend my return if I filed the wrong form?

Yes, Form 1040-X can be used if you realize you should have filed Form 1040 instead of Form 1040-NR, or vice versa.

To amend your return, complete the appropriate form (Form 1040, 1040-SR, or 1040-NR) and label it Amended

across the top, and attach it to Form 1040-X.

Enter only your name, address, and identification number on Form 1040-X, and explain your reason for filing in Part II.

See the Form 1040X instructions for more details.

Last updated: January 26, 2025

References:

- About Form 1040-X, Amended U.S. Individual Income Tax Return. U.S. Department of the Treasury, Internal Revenue Service. Retrieved January 26, 2025.

- Instructions for Form 1040X. U.S. Department of the Treasury, Internal Revenue Service. Retrieved January 26, 2025.

- Filing an amended tax return with Form 1040X. H&R Block, Income Tax Preparation Service. Retrieved January 26, 2025.

- What is the IRS 1040-X Form?. Intuit TurboTax, Income Tax Preparation Service. Retrieved January 26, 2025.

- What do I need to send in with my Amended Return?. TaxSlayer, Income Tax Preparation Service. Retrieved January 26, 2025.

- 11 Tips on How and When to File an Amended Tax Return. Kiplinger Personal Finance, Taxes. Retrieved January 26, 2025.

- How to File an Amended Tax Return with Form 1040-X. Nerdwallet, Taxes. Retrieved January 26, 2025.