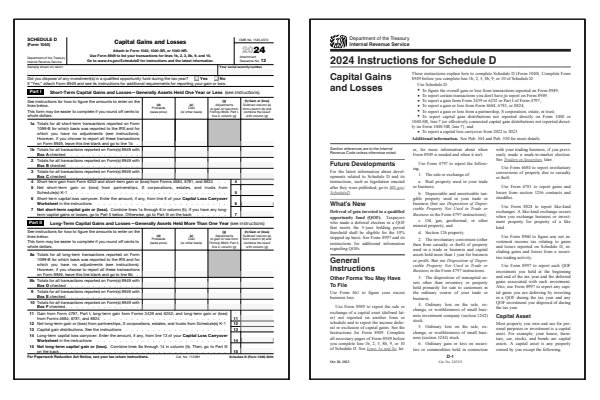

2024 Schedule D Form and Instructions

Capital Gains and Losses

What Is Form 1040 Schedule D?

Page one of IRS Form 1040 and Form 1040NR requests that you attach Schedule D to report a capital gain or loss of income if required. You can not file Schedule D with one of the shorter IRS forms such as Form 1040A or Form 1040EZ.

Part 1 of form Schedule D is used to calculate your net short-term capital gain or loss for assets held one year or less. Part 2 is used to calculate your net long-term capital gain or loss for assets held more than one year. Part 3 on the second page of Schedule D directs you to various worksheets found within the instructions booklet, and how to transfer those amounts onto Form 1040.

Who Must File Schedule D?

- Short-term gain or loss on stocks, bonds, ETF, etc.

- Long-term gain or loss on stocks, bonds, ETF, etc.

- Gain or loss from a partnership, S corporation, estate or trust.

- Like-kind exchanges of real or personal property.

- Gain or loss from casualty or theft or property.

- Capital gain distributions not reported directly on Form 1040.

- Capital loss carryover from a prior year.

Click any of the IRS Schedule D Form and Instructions links below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable Schedule D Forms

Printable Schedule D Instructions

If the IRS has not published the Schedule D instructions for 2024, try using their HTML version of the Schedule D instructions until the PDF file is published.

When to File Schedule D

Schedule D is filed with your Form 1040, Form 1040-SR, or Form 1040-NR when you need to report capital gains or losses from the sale of investments, real estate, or other capital assets. You must file form Schedule D if you sold or exchanged assets during the year and need to report gains or losses for tax purposes. Additionally, Schedule D is used to report capital gain distributions from mutual funds or other investments.

For more information on filing, refer to the IRS instructions for Schedule D. The Schedule D instructions guide you through calculating and reporting your capital gains and losses accurately.

Where to Mail Schedule D

If you're filing electronically, form Schedule D will be submitted along with your federal tax return. For paper filing, attach Schedule D to your Form 1040 or Form 1040-SR and mail it to the IRS address listed in the instructions for Form 1040. Notice the Attachment Sequence No. 12 text in the upper right-hand corner of the Schedule D form. Always verify the correct mailing address and use certified mail to ensure your return is tracked and delivered securely.

Common IRS Schedule D Mistakes to Avoid

If you make an error on Schedule D, you may need to file Form 1040X (Amended U.S. Individual Income Tax Return) to correct it. Mistakes on Schedule D can result in incorrect reporting of capital gains or losses, which can lead to additional taxes, penalties, or missed deductions.

Common Mistakes to Avoid:

- Failing to report all capital asset sales, including the sale of stocks, bonds, or real estate.

- Incorrectly calculating the cost basis of assets, especially when factoring in reinvested dividends or stock splits.

- Forgetting to report capital gains distributions from mutual funds or exchange-traded funds (ETF).

- Not applying the correct holding period to determine if a gain or loss is long-term or short-term.

- Failing to offset capital gains with allowable capital losses to reduce tax liability.

Review the Schedule D instructions carefully to ensure you report all capital transactions accurately and apply the correct tax treatment.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about Schedule D. These FAQs help clarify how to report capital gains and losses and how they affect your taxes.

What types of transactions are reported on Schedule D?

Schedule D is used to report capital gains and losses from the sale of stocks, bonds, real estate, cryptocurrency (such as Bitcoin), and other capital assets. It also includes capital gain distributions from mutual funds or ETF and any other transactions involving capital assets. Check the Schedule D instructions for a full list of reportable transactions, including cryptocurrency sales or exchanges.

Can I file Schedule D electronically?

Yes, Schedule D can be filed electronically along with your federal tax return. For paper filers, attach Schedule D in sequence with your Form 1040 or Form 1040-SR and mail it to the correct IRS address.

What is a capital gain or loss?

A capital gain occurs when you sell a capital asset for more than its original cost (basis), while a capital loss occurs when you sell it for less than its basis. Capital gains and losses are reported on Schedule D, and their tax treatment depends on whether they are short-term (held for less than a year) or long-term (held for more than a year).

Can I offset capital gains with capital losses?

Yes, you can offset capital gains with capital losses on Schedule D. If your losses exceed your gains, you can deduct up to $3,000 ($1,500 if married filing separately) of the excess loss against other income, and any remaining losses can be carried forward to future tax years.

Do I need to report cryptocurrency transactions on Schedule D?

Yes, cryptocurrency such as Bitcoin (BTC) and Ethereum (ETH) are considered capital assets by the IRS. If you sell, exchange, or otherwise dispose of cryptocurrency, you must report the transaction on Schedule D. This includes transactions where you traded cryptocurrency for other assets, sold it for cash, or used it to purchase goods or services. Make sure to calculate your capital gain or loss by comparing the sale price to your original cost basis.

Last updated: January 16, 2025

References:

- About Schedule D (Form 1040), Capital Gains and Losses. U.S. Department of the Treasury, Internal Revenue Service. Retrieved January 16, 2025.

- Instructions for Schedule D (Form 1040), Capital Gains and Losses. U.S. Department of the Treasury, Internal Revenue Service. Retrieved January 16, 2025.

- Your Crypto Tax Guide. Intuit TurboTax, Income Tax Preparation Service. Retrieved January 16, 2025.

- Schedule D (Form 1040): Track Your Capital Gains and Losses. Fincent, IRS Tax Forms. Retrieved January 16, 2025.

- Reporting capital gains and losses on Schedule D. Jackson Hewitt, Income Tax Preparation Service. Retrieved January 16, 2025.

- 2024 IRS Tax Form 1040 Schedule D Capital Gains and Losses: Your Guide to Form 1040 and Schedule D Tax Forms. Taxfyle, Tax and Bookkeeping Services. Retrieved January 16, 2025.

- Schedule D: How to report your capital gains (or losses) to the IRS. Bankrate, Investing. Retrieved January 16, 2025.