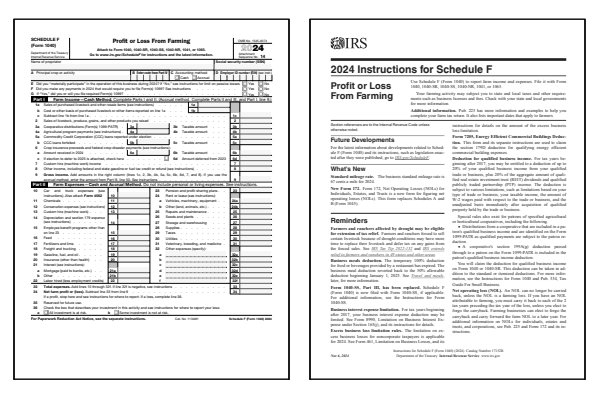

2024 Schedule F Form and Instructions

Profit or Loss from Farming

What Is Form 1040 Schedule F?

Schedule 1 of IRS Form 1040 requires that you attach Schedule F to report a farm income or loss. Schedule F is a two page tax form which lists the major sources of farm income and farming related expense. The end result is the net farm profit or loss amount which you will transfer to Schedule 1.

Who Must File Form 1040 Schedule F?

- You own or operate a farm: livestock, produce, grains, greenhouse, nursery, floriculture, dairy, aquaculture, etc.

- Operate as a sole proprietor or one owner LLC.

- Receive distributions from a cooperative.

- Buy and resell livestock.

- Received a crop insurance or disaster payment.

- Receive agricultural program payments.

Click any of the IRS Schedule F Form and Instructions links below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable Schedule F Forms

Printable Schedule F Instructions

When to File Schedule F

Schedule F is filed with your Form 1040, 1040-SR, 1040-SS, or 1040-NR if you are reporting income or loss from farming activities. Form Schedule F is used by farmers to report income from the sale of livestock, produce, grains, or other products raised or grown on a farm. You must file form Schedule F if you operate a farm as a sole proprietor or if you're involved in any farming business that produces income.

For more details on filing, refer to the IRS instructions for Schedule F. The Schedule F instructions guide you through reporting all farm income, allowable expenses, and calculating your farm's profit or loss.

Where to Mail Schedule F

If you're filing electronically, form Schedule F will be submitted along with your federal tax return. For paper filing, attach Schedule F to your Form 1040 or Form 1040-SR and mail it to the IRS address listed in the instructions for Form 1040. Notice the Attachment Sequence No. 14 text in the upper right-hand corner of the Schedule F form. Always verify the correct IRS address and use certified mail to ensure your return is tracked and delivered securely.

Common IRS Schedule F Mistakes to Avoid

If you make an error on Schedule F, you may need to file Form 1040X (Amended U.S. Individual Income Tax Return) to correct it. Mistakes on Schedule F can result in misreporting farm income or expenses, leading to additional taxes, penalties, or missed deductions.

Common Mistakes to Avoid:

- Failing to report all farm income, including proceeds from livestock, produce, grains, or other farm-related products.

- Incorrectly calculating the cost of feed, seed, and fertilizer expenses, which can lead to inaccurate profit or loss figures.

- Overlooking depreciation deductions for farm equipment or structures used in farming operations.

- Misreporting farm-related vehicle expenses or not keeping proper mileage logs.

- Forgetting to report government agricultural program payments or disaster assistance payments.

Review the Schedule F instructions carefully to ensure you accurately report all farm income and expenses, and retain all necessary documentation in case of an audit.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about Schedule F. These FAQs help clarify how to report income and expenses from farming activities.

What types of income are reported on Schedule F?

Schedule F is used to report income from farming activities, including income from the sale of livestock, produce, grains, and other products raised or grown on a farm. It also includes income from government agricultural program payments and other farm-related income. Check the Schedule F instructions for a full list of reportable income types.

Can I file Schedule F electronically?

Yes, Schedule F can be filed electronically along with your federal tax return. For paper filers, attach Schedule F in sequence with your Form 1040 or Form 1040-SR and mail it to the correct IRS address.

What expenses can I deduct on Schedule F?

You can deduct any ordinary and necessary expenses related to farming operations on Schedule F, including costs for feed, seed, fertilizer, chemicals, labor, repairs, maintenance, and depreciation for farm equipment. Be sure to keep detailed records of all farm-related expenses for accurate reporting.

Do I need to file Schedule F if my farm didn't make a profit?

Yes, you must still file Schedule F even if your farm didn't make a profit. The form allows you to report both income and losses, and losses from farming can sometimes offset other income on your tax return. Review the Schedule F instructions for details on how losses are handled.

Which accounting method Cash or Accrual for farming?

Your accounting method determines when you report farming income and expenses on your income tax return. If you use the cash method, you report farming income when you receive it and deduct farming expenses when you pay them. With the accrual method, you report farming income when it's earned and deduct farming expenses when they are incurred, even if the money hasn't changed hands yet. For more information on this topic, see the Schedule F instructions and IRS Publication 225, Farmer's Tax Guide.

Did you materially participate in the operation of this farm?

To materially participate in a farm means that you were actively involved in its operations on a regular, continuous, and substantial basis. In simple terms, if you managed the farm, made day-to-day decisions, and worked regularly in the farming activities, you materially participated. If you were mostly hands-off and only collected profits, you may not meet the criteria. For more detailed rules on determining material participation, see the Schedule F instructions or IRS Publication 225, Farmer's Tax Guide.

Last updated: November 27, 2024

References:

- About Schedule F (Form 1040), Profit or Loss From Farming. U.S. Department of the Treasury, Internal Revenue Service. Retrieved November 27, 2024.

- Instructions for Schedule F (Form 1040), Profit or Loss From Farming. U.S. Department of the Treasury, Internal Revenue Service. Retrieved November 27, 2024.

- Taxes for Farmers and Ranchers. U.S. Department of Agriculture. Retrieved November 27, 2024.

- Rural Tax Education. Utah State University, National Farm Income Tax Extension Committee. Retrieved November 27, 2024.

- Farm Answers. The University of Minnesota, USDA-NIFA Beginning Farmer and Rancher (BFRDP). Retrieved November 27, 2024.

- What is Schedule F: Profit or Loss from Farming. Intuit TurboTax, Income Tax Preparation Service. Retrieved November 27, 2024.

- Cracking the Code: Simplified IRS Schedule F Instructions Line by Line. FarmRaise, Accounting Software for Farmers. Retrieved November 27, 2024.