2024 4868 Form and Instructions

Application for Automatic Extension of Time To File

Form 4868 Is Used For What Purpose?

Form 4868 is used for the purpose of avoiding the late filing penalty. For example, your Form 1040 is almost complete but you are missing an important piece of information. You can file without that information and later amend your tax return which can get complicated. You do not have to explain to the IRS why you are asking for the extension of time to file your income tax return. You should keep in mind, however, that the IRS can reject your request for an extension of time to file.

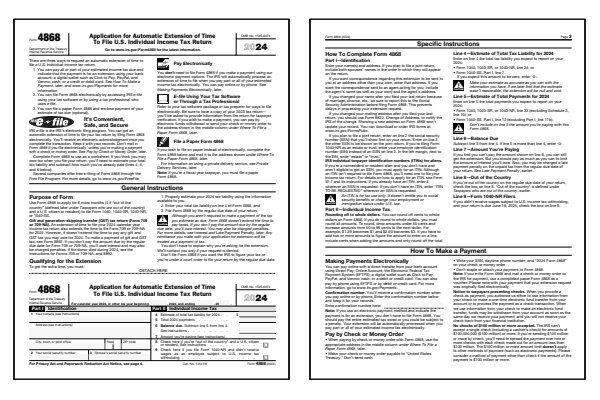

Form 4868, Instructions, Payment Voucher

Below is the PDF file link which you can download, print, and save. This printable PDF file contains the IRS 4868 tax form, instructions and payment voucher. You are applying for an extension of time to file which must be made by the regular due date of your tax return to avoid the late filing fee. You do not have to submit a payment, however, interest will accumulate on any amount due to the IRS. The IRS can also impose a late payment penalty, see Form 4868 for more information.

Use This To Extend Which Income Tax Forms?

You can use Form 4868 to request an extension of time to file your Form 1040, Form 1040-SR, Form 1040-NR, or Form 1040-SS income tax return.

How Long Is The Extension?

Form 4868 is an application for an extension of time to file for 6 more months.

The phrase 6 more months

is used to reconcile the fact that US citizens and resident aliens abroad are often given an automatic 2 months extension.

If you are out of the country, for example, and submit Form 4868, you may be applying for an additional 4 months.

Using the normal tax due date of April 15, the total time allowed to file your income tax return would be October 15.

Should I File Form 4868 Or Use The Automatic 2 Month Extension?

As you read through the Form 4868 instructions, you may realize that it is easier to print, fill out, write a check, and mail in Form 4868 versus trying to figure out if you meet the automatic 2 month extension test. Furthermore there are two penalties involved here:

- Late payment penalty.

- Late filing penalty.

If you know that you owe money to the IRS and can reasonably estimate how much you owe, you can avoid both the late payment penalty and late filing penalty by submitting Form 4868 and include a payment. Then, you can file your federal income tax forms at any time prior to the end of the 6 month extension. Just watch your mail to ensure that the IRS has accepted your application.

Last updated: January 26, 2025

References:

- About Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. Internal Revenue Service, U.S. Department of the Treasury. Retrieved January 26, 2025.

- Extension of Time To File Your Tax Return. Internal Revenue Service, U.S. Department of the Treasury. Retrieved January 26, 2025.