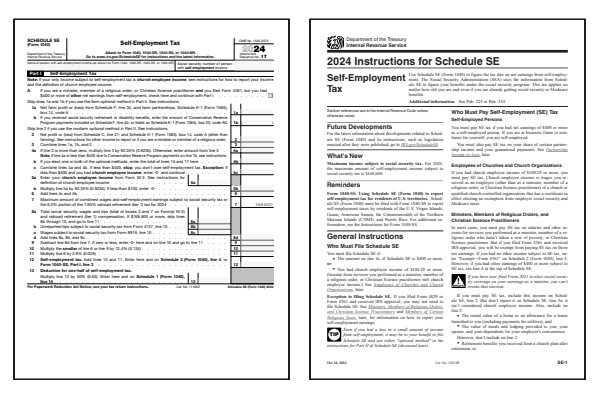

2024 Schedule SE Form and Instructions

Self-Employment Tax

What is Form 1040 Schedule SE?

Schedule SE is used to calculate both your self-employment tax due, and your one-half self-employment tax deduction on IRS Form 1040 and Form 1040NR. Schedule SE is generally required if you file Schedule C, Schedule F, or Schedule K-1 (Form 1065). You can not file Schedule SE with one of the shorter IRS forms such as Form 1040A or Form 1040EZ.

Who Must File Form 1040 Schedule SE?

- Practice a profession: freelance, instructor, agent, etc.

- Own a business as a sole proprietor or one owner LLC.

- Own a farm: livestock, produce, grains, greenhouse, nursery, floriculture, dairy, aquaculture, etc.

- General or limited partner in a partnership.

- Filing form Schedule C, Schedule F, or Schedule K-1.

- Active traders who report trading income as business income.

Click any of the IRS Schedule SE form and instructions below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

Printable Schedule SE Forms

Printable Schedule SE Instructions

When to File Schedule SE

Schedule SE is filed along with your Form 1040, Form 1040-SR, Form 1040-SS, or Form 1040-NR. The deadline for filing is typically April 15th, unless you file for an extension. Extensions may give you until October 15th, but interest on any unpaid taxes will still accrue. See the PDF instructions for Schedule SE above for more information on when to file.

If you expect to owe $1,000 or more in self-employment tax, you may also be required to make quarterly estimated tax payments using Form 1040-ES. Failing to do so could result in penalties when you file your return. If you have missed one or more quarterly estimated payments, it's important to start making them as soon as possible to reduce any penalties and interest charges.

Where to Mail Schedule SE

If filing electronically, Schedule SE is submitted as part of your e-filed federal tax return. For paper filing, Schedule SE should be mailed along with Form 1040 to the correct IRS address for your state. You can find the correct mailing address inside the printable instructions for Schedule SE above on this page. Some forms, such as 1040-ES for quarterly estimated tax payments, may need to be mailed separately or at different times during the year. Always follow the specific instructions provided with each income tax form to ensure your forms are filed on time.

Common IRS Schedule SE Mistakes to Avoid

If you've made an error on Schedule SE, you may need to file Form 1040X (Amended U.S. Individual Income Tax Return) to correct it. Be sure to include all forms, even those without changes, and update any forms impacted, such as Schedule SE or Schedule C.

Common Mistakes to Avoid:

- Failing to report all sources of self-employment income.

- Miscalculating deductions, leading to incorrect net earnings.

- Overlooking the Social Security tax cap on earnings.

- Omitting self-employment deductions like health insurance premiums or retirement plan contributions.

- Misreporting income from partnerships or multiple businesses.

Calculating net earnings from multiple income sources can be tricky. Ensure you calculate Social Security tax correctly when you have both wages and self-employment income, and be cautious about which types of income are subject to Social Security and Medicare taxes.

Frequently Asked Questions (FAQ)

Below are answers to some of the most common questions about Schedule SE and self-employment taxes. Whether you're filing as a sole proprietor, freelancer, or have multiple businesses, these FAQ can help clarify important points about how to calculate and file your self-employment taxes accurately.

What is the self-employment tax rate?

The self-employment tax rate is 15.3%, which consists of 12.4% for Social Security and 2.9% for Medicare.

How is the self-employment tax calculated?

Self-employment tax is calculated based on your net earnings from self-employment. The tax rate is 15.3%, which consists of 12.4% for Social Security and 2.9% for Medicare. You only pay Social Security tax on earnings up to a certain limit, which changes each year.

Can I deduct half of my self-employment tax?

Yes, you can deduct half of your self-employment tax when calculating your adjusted gross income (AGI) on Form 1040. This deduction does not affect your net earnings from self-employment but reduces your overall taxable income, helping to lower your income tax liability.

How much of the self-employment tax is deductible?

You can deduct 50% of your self-employment tax when calculating your adjusted gross income (AGI) on Form 1040. This deduction is an adjustment to income and helps reduce your total income tax, though it does not reduce your self-employment tax itself.

Do I need to file Schedule SE if I have a regular job and a side gig?

Yes, if your side gig results in $400 or more in net earnings, you must file Schedule SE, even if you have a regular salaried job.

If I have two businesses, do I need two Schedule SE forms?

No, you do not need to file separate Schedule SE forms for each business. You will combine the net earnings from both businesses to calculate your total self-employment tax on a single Schedule SE form. However, for Schedule C, you are required to file a separate Schedule C form for each business to report their individual income and expenses.

If my spouse and I each have separate businesses, do we need two Schedule SE forms?

If you and your spouse file jointly and each have separate businesses, you will each need to file a separate Schedule SE form to calculate your individual self-employment tax. This is because self-employment tax is calculated individually, even when filing jointly. Additionally, each of you will also need to file a separate Schedule C (or Schedule F) for your individual businesses to report income and expenses.

If I am a US citizen who freelances overseas, do I still need to file Schedule SE?

Yes, as a US citizen, you are required to file Schedule SE if your net earnings from self-employment are $400 or more, even if you work overseas. You may also qualify for the Foreign Earned Income Exclusion or other credits, but the self-employment tax must still be calculated.

Should I use Schedule C or Schedule SE?

You need both. Schedule C is used to report income and expenses from your business, while Schedule SE calculates your self-employment tax based on the net earnings reported on Schedule C. If you're self-employed, both forms are typically required.

Last updated: November 27, 2024

References:

- About Schedule SE (Form 1040), Self-Employment Tax. U.S. Department of the Treasury, Internal Revenue Service. Retrieved November 27, 2024.

- Instructions for Schedule SE (Form 1040). U.S. Department of the Treasury, Internal Revenue Service. Retrieved November 27, 2024.

- Federal Quarterly Estimated Tax Payments. Yale University, Tax Compliance and Planning. Retrieved November 27, 2024.

- Filing taxes as an independent contractor. H&R Block. Retrieved November 27, 2024.

- Are You Self-Employed? Here's How to Tell. TaxSlayer. Retrieved November 27, 2024.

- Self-Employment Tax vs. Income Tax - What's the Difference?. TurboTax, Intuit. Retrieved November 27, 2024.

- Self-employment tax: what it is, how it works. Ernst & Young. Retrieved November 27, 2024.

- Social Security Contributions. PricewaterhouseCoopers (PwC). Retrieved November 27, 2024.