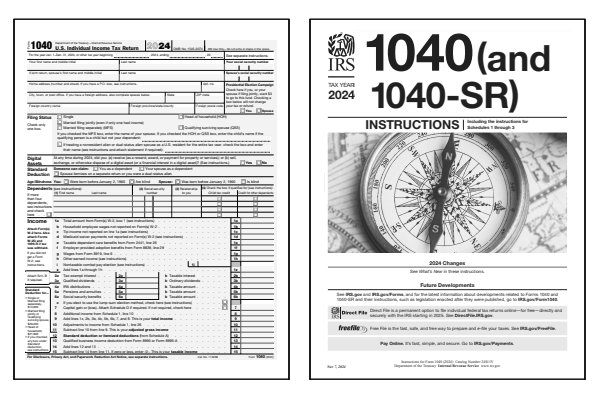

2024 1040 Form and Instructions

US Individual Income Tax Return

Most US resident individual taxpayers will file Form 1040 this year, including those who previously filed Form 1040EZ and Form 1040A. Read the Form 1040 instructions, page 8, to determine if you are a resident or a nonresident for tax purposes.

If you think you might need to file a nonresident income tax return instead, read the first few pages of the Form 1040NR Instructions booklet.

Below on this page you will find the free printable 1040 form and 1040 instructions booklet PDF files. These are the official IRS forms along with any supporting schedules, worksheets, and tax tables for the 2025 income tax season.

For the 2024 tax year, federal tax form 1040, US Individual Income Tax Return, must be postmarked by April 15, 2025. Federal income taxes due are based on the calendar year January 1, 2024 through December 31, 2024.

Prior year federal tax forms, instructions, and schedules are also available, and should be mailed as soon as possible if late.

Who Must File Form 1040?

US citizens and resident aliens in general will file Form 1040. Most people must file a federal income tax return if any of the following applied during the 2024 calendar year:

- Status is Married Filing Separately.

- Gross income exceeds $14,600 (Single).

- Gross income exceeds $29,200 (Married).

- Unreported income subject to Social Security and Medicare tax.

- Unearned income exceeds $1,300 (varies by status).

- Business income or loss, self-employed, LLC, etc.

- Capital gain or loss, other gains or losses.

- Fisherman or Farming income or loss.

- Rental, royalty, partnership, S corporation, or trust income.

- Received alimony income or paid alimony.

- Owe household employment taxes.

- Recapture taxes and advance payments.

- Foreign taxes and credits to claim.

Read the Filing Requirements

section of the Form 1040 instructions booklet, page 8, to determine if you have to file.

Click any of the IRS 1040 Form and Instructions links below to download, save, view, and print the file for the corresponding year.

These free PDF files are unaltered and are sourced directly from the publisher.

Printable Form 1040 Files

Printable Form 1040 Instructions

The following tables and worksheets are included inside the Form 1040 Instructions PDF file:

- 2024 Earned Income Credit (EIC) Table

- 2024 Form 1040 Tax Table

- 2024 Tax Computation Worksheet

- Alternative Minimum Tax Worksheet

- Child Tax Credit Worksheet

- Earned Income Credit (EIC) Worksheet

- Foreign Earned Income Tax Worksheet

- IRA Deduction Worksheet

- Qualified Dividends and Capital Gain Tax Worksheet

- Self-Employed Health Insurance Deduction Worksheet

- Simplified Method Worksheet

- Social Security Benefits Worksheet

- Standard Deduction Worksheet for Dependents

- State and Local Income Tax Refund Worksheet

- Student Loan Interest Deduction Worksheet

The Form 1040 tax table can be found inside the instructions booklet.

When to File Form 1040

Form 1040 is the main US federal income tax return used by individuals to report income, claim deductions and credits, and calculate taxes owed or refunds. It must be filed by April 15 for most taxpayers, though extensions are available by filing Form 4868, Application for Automatic Extension of Time to File US Individual Income Tax Return. Form 1040 also allows taxpayers to include additional forms and schedules to report specific types of income, deductions, and credits. The IRS instructions for Form 1040 provide detailed guidelines on completing each section based on individual tax situations.

Where to Mail Form 1040

If filing Form 1040 by mail, send it to the IRS address specified in the form instructions, which varies based on your location and whether you owe taxes or expect a refund. While electronic filing is widely available and encouraged, paper filing is an option for those who prefer or require it. The IRS instructions for Form 1040 provide the correct mailing address based on filing status and payment or refund status. Electronic payment and Direct Deposit options are also explained in the instructions booklet.

Common IRS Form 1040 Mistakes to Avoid

Completing Form 1040 accurately is essential to avoid delays or additional tax liabilities. Errors often involve incorrect reporting of income, missed deductions, or calculation errors on tax credits, which can impact refunds or result in penalties.

Common Mistakes to Avoid:

- Leaving out income from sources like interest, dividends, or rental income.

- Failing to report self-employment income, including work as an independent contractor, freelancer, or gig worker.

- Not reporting capital gains on the sale or exchange of cryptocurrency or other digital assets.

- Incorrectly claiming tax credits, like the Earned Income Credit (EIC), without meeting eligibility requirements.

- Miscalculating or overlooking eligible deductions, such as education, medical expenses, or retirement contributions.

- Omitting Social Security numbers for dependents or other necessary identifying information.

- Leaving out your spouse's SSN when filing as Married Filing Separately.

The IRS instructions for Form 1040 include detailed guidance on avoiding these errors and ensuring accurate reporting.

Frequently Asked Questions (FAQ)

Here are answers to some of the most commonly asked questions about Form 1040.

Who needs to file Form 1040?

Most US citizens and residents with taxable income or certain credits or deductions must file Form 1040. This includes individuals with wages, salaries, interest, dividends, business income, or other income types specified in the form instructions.

Which schedules do I include with Form 1040?

Form 1040 may require additional schedules to report specific information. Some examples include Schedule 1 for additional income and adjustments to income, Schedule 2 for additional taxes, and Schedule 3 for additional credits and payments. As you complete the 1040 form, you will see notices to attach additional forms if required.

Is a 1040 the same as a W-2?

No, Form 1040 and Form W-2 are different forms with unique purposes. Form 1040 is an individual income tax return used to report total income, deductions, and credits to calculate taxes owed or refunds due. In contrast, Form W-2 is a wage and tax statement provided by an employer, showing the income and taxes withheld for an employee throughout the year. You use Form W-2 information to help complete your Form 1040 when filing your taxes.

What does a 1040 stand for?

Form 1040 does not really stand for anything specific, but it's the standard US individual income tax return form. The form's number was assigned as part of the IRS numbering system in the early 1900s. Today, Form 1040 is the primary document most taxpayers use to file their federal income tax return each year.

What happens if you don't file a 1040?

If you don't file Form 1040 when required, you may face late filing penalties and interest charges on any unpaid taxes. If taxes are owed, failure to file can lead to further actions, including liens, garnishments, or other collection activities. For those owed a refund, filing late generally means forfeiting the refund after a set period (typically three years from the filing deadline).

What is the difference between Form 1040 and a tax return?

Form 1040 is one type of tax return form, specifically for individual income tax.

A tax return

broadly refers to the entire document filed with the IRS to report income, claim deductions and credits, and determine taxes owed or refunds due.

The Form 1040, along with any schedules and additional forms, comprises a full individual income tax return.

Last updated: December 27, 2024

References:

- About Form 1040, US Individual Income Tax Return. US Department of the Treasury, Internal Revenue Service. Retrieved December 27, 2024.

- Instructions for Form 1040. US Department of the Treasury, Internal Revenue Service. Retrieved December 27, 2024.

- What is IRS Form 1040: US Individual Income Tax Return?. H&R Block, Income Tax Preparation Service. Retrieved December 27, 2024.

- What Is an IRS 1040 Form?. Intuit TurboTax, Income Tax Preparation Service. Retrieved December 27, 2024.

- What Is a 1040 Tax Form and How Does It Work?. US New, Money. Retrieved December 27, 2024.