2024 Form 2290 And Instructions

Heavy Highway Vehicle Use Tax Return

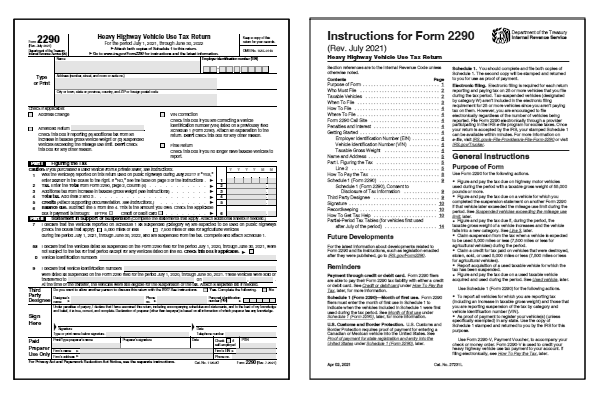

What Is Form 2290?

Form 2290, Heavy Highway Vehicle Use Tax Return, is generally used by those who own or operate a highway motor vehicle with a taxable gross weight of 55,000 pounds or more. A highway motor vehicle for use tax purposes is defined inside the instructions booklet.

Self-propelled vehicles designed to carry a load over public highways including but not limited to trucks and buses. Vans, pickup trucks, panel trucks, and similar smaller trucks generally are lower in weight and therefore not subject to this tax.

Who Must File Form 2290?

Any individual, limited liability company (LLC), corporation, partnership, or any other type of organization with a taxable heavy vehicle registered in your name must file Form 2290 Heavy Highway Vehicle Use Tax Return.

Inside the Form 2290 PDF file you will find:

- Form 2290 Heavy Highway Vehicle Use Tax Return.

- Tax Computation Worksheet.

- Schedule of Heavy Highway Vehicles (Schedule 1).

- Form 2290-V Payment Voucher.

- Heavy Highway Vehicle Use Tax Table.

- When to file your form and the payment due date.

- See the form instruction book for examples and help.

When Is Form 2290 Use Tax Payment Due?

The due date for filing IRS Form 2290 Heavy Highway Vehicle Use Tax Return is confusing to those new to the tax. Remember, the form and payment due date is different for a heavy highway vehicle the first year for which you file, versus a previously filed heavy highway vehicle.

For previously filed heavy highway vehicles, the regular due date is August 31, 2025. Federal heavy highway vehicle use tax payments due are based on the tax period July 1, 2024 through June 30, 2025. Prior year 2290 heavy highway vehicle use tax forms should be mailed as soon as possible if late.

For additional help, examples, and due date details please visit the IRS Trucking Tax Center.

Printable Form 2290

Click any of the IRS 2290 form links below to download, save, view, and print the file for the corresponding year. These free PDF files are unaltered and are sourced directly from the publisher.

- 2024 2290 Form

- 2024 2290 Instructions

- 2023 2290 Form

- 2023 2290 Instructions

- 2022 2290 Form

- 2022 2290 Instructions

Form 2290 and the instructions booklet are generally published in June of each year by the IRS. When published, the current year 2024 Form 2290 PDF file will download. The prior tax year 2023 Form 2290 PDF file will download if the IRS has not yet published the file.

Please report any broken 2290 form and instructions booklet links using our contact us page found at the bottom of this page.

Last updated: October 24, 2024

References:

- About Form 2290, Heavy Highway Vehicle Use Tax Return. U.S. Department of the Treasury, Internal Revenue Service. Retrieved October 24, 2024.

- Instructions for Form 2290. U.S. Department of the Treasury, Internal Revenue Service. Retrieved October 24, 2024.

- When Form 2290 Taxes are Due. U.S. Department of the Treasury, Internal Revenue Service. Retrieved October 24, 2024.