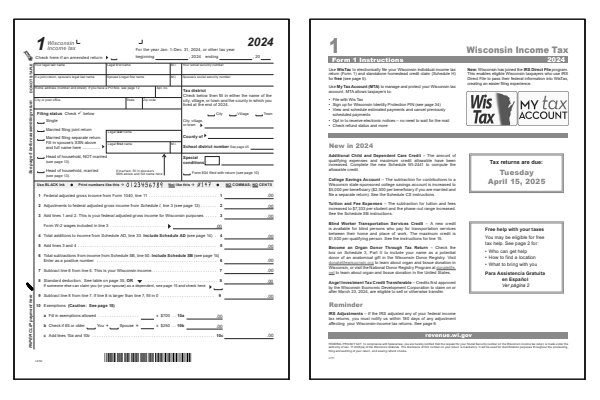

2024 Wisconsin Form 1

Printable WI Tax Forms and Instructions

What Is Wisconsin Form 1?

Wisconsin Form 1 is the state's individual income tax return form, used by residents to report their annual income and calculate the amount of tax owed or refund due. Individuals use this form to report various income sources, including wages, business earnings, retirement distributions, and other taxable income specific to Wisconsin. It incorporates state-specific deductions, credits, and adjustments to ensure accurate tax reporting under Wisconsin law.

Form 1 is required for full-year Wisconsin residents, and it allows taxpayers to claim credits like the Wisconsin Earned Income Credit or the Homestead Credit, if eligible. The form aligns closely with federal tax reporting requirements, so most information from the federal Form 1040 is transferred directly to Form 1. Taxpayers must complete their federal return before filing Form 1, as federal data is used to complete calculations on the state form.

Who Must File Wisconsin Form 1?

You must file a Wisconsin tax return if your gross income exceeds the minimum specified for your filing status. For tax year 2024, Single residents under the age of 65 must file if their gross income is $13,930 or more. Married residents under the age of 65 must file if their gross income is $25,890 or more.

Gross income means all income before deducting expenses that is reportable to the state of Wisconsin. Even if your gross income is below the amount specified for your filing status, you may still have to file a Wisconsin tax return. Other filing requirements include but are not limited to when:

- You have unearned income from interest, dividends, capital gain distributions, scholarships, fellowships, and grants.

- You have earned income from wages, tips, and self-employment income that were not reported on a W-2.

- You owe a penalty on an IRA, retirement plan, education savings account, or health savings account.

- You were a nonresident or part-year resident of Wisconsin for tax year 2024, and your gross income was $2,000 or more.

Read the Who Must File

section of the WI Form 1 instructions book to help determine if you should file a Wisconsin income tax return for tax year 2024.

Printable Wisconsin State Tax Forms

Printable Wisconsin Form 1 Instructions

When Is Wisconsin Form 1 Due?

Wisconsin state income tax Form 1 must be postmarked by April 15, 2025, in order to avoid penalties and late fees. Wisconsin state tax forms for the 2024 tax year will be based on income earned between January 1, 2024, through December 31, 2024. Ensure that your forms and instructions all have the correct year on them when preparing your income tax return.

Where Do I Mail My Wisconsin State Tax Return?

The mailing address for your Wisconsin income tax return depends on whether you are submitting a payment and claiming the homestead credit.

Payment enclosed:

Wisconsin Department of Revenue, PO Box 268, Madison, WI 53790-0001

Refund or no payment:

Wisconsin Department of Revenue, PO Box 59, Madison, WI 53785-0001

Claiming the Homestead Credit:

Wisconsin Department of Revenue, PO Box 34, Madison, WI 53786-0001

If you're using any company besides the US Postal Service, see Private Delivery Services in the WI Form 1 instructions booklet.

How To Check The Status Of My Wisconsin Tax Return?

To check the status of your WI Form 1 income tax refund online, visit the Wisconsin Department of Revenue website and use their Where's My Refund service.

The Wisconsin Department of Revenue states that you could receive your refund in as few as seven business days if you e-file compared to several weeks if filing on paper. Paper refund checks will usually be issued within two weeks.

To check the status of your Wisconsin income tax refund for 2024, you will need the following information:

- Tax Year

- Social Security Number

- Amount Of Refund

The requested information must match what was submitted on your 2024 Wisconsin Form 1. The Wisconsin Department of Revenue refund lookup service can be used to look at the income tax years 2024, 2023, and 2022.

To contact the Wisconsin Department of Revenue service center by phone or email, use that same check your refund status link. Alternatively, read or print the 2024 Wisconsin Form 1 instructions file to obtain the proper phone number and mailing address to send a letter.

Last updated: January 11, 2025

References:

- Individuals, Forms and Instructions. State of Wisconsin, Department of Revenue. Retrieved January 11, 2025.

- Individual Income Tax Filing Requirements. State of Wisconsin, Department of Revenue. Retrieved January 11, 2025.

- Returns of persons other than corporations. Wisconsin State Legislature, Administrative Tax Code. Retrieved January 11, 2025.

- Free Tax Preparation in Wisconsin. Richard Dilley Tax Center, University of Wisconsin - Madison. Retrieved January 11, 2025.

- Curbside Tax Form Pickup. ED Locke Public Library, McFarland, Wisconsin. Retrieved January 11, 2025.

- Wisconsin State Tax Filing. FreeTaxUSA, Income Tax Services. Retrieved January 11, 2025.