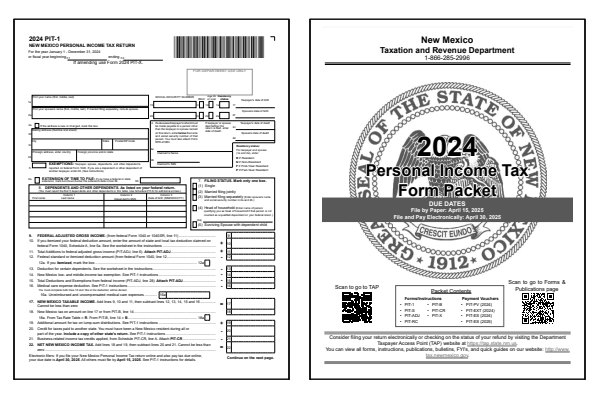

2024 New Mexico Form PIT-1

Printable NM State Tax Forms and Instructions

What Is New Mexico Form PIT-1?

New Mexico Form PIT-1 is the primary form used by full-year residents to file their state individual income tax returns.

The purpose of Form PIT-1 is to calculate how much New Mexico income tax you owe for the year.

Part-year and nonresidents generally file Form PIT-1 and attach Schedule PIT-B, which helps determine how much of your income is taxable in New Mexico.

New Mexico does not currently offer a short form for individuals.

Read the Which Form to File

section of the 2024 PIT-1 instructions to see if you must include any additional schedules based on your residency status.

Who Must File New Mexico Form PIT-1?

According to the 2024 PIT-1 Instructions, every person who has income from New Mexico sources and is required to file a federal return must also file a state return. New Mexico residents who are required to file a federal return must also file a state return regardless of their income source.

Even if you are not required to file, you must file NM Form PIT-1 to claim a New Mexico refund or tax credits. New Mexico offers several credits and rebates. The Working Families Tax Credit (WFTC), for example, is tied to eligibility for the Federal Earned Income Tax Credit (EITC). You may also qualify for the Low-Income Comprehensive Tax Rebate (LICTR), Child Income Tax Credit, and other state tax credits.

Read the Who Must File

section of the 2024 New Mexico PIT-1 instructions for a full explanation of whether you need to file an NM state income tax return this year.

Printable New Mexico State Tax Forms

Printable New Mexico PIT-1 Instructions

NM Form PIT-1 Instructions 2024

Instructions for PIT-1, New Mexico Income Tax

PDF file, about 1.7 MB

NM Form PIT-1 Instructions 2023

Instructions for PIT-1, New Mexico Income Tax

PDF file, about 1.7 MB

NM Form PIT-1 Instructions 2022

Instructions for PIT-1, New Mexico Income Tax

PDF file, about 2.6 MB

How do I check my New Mexico tax refund?

To check the status of your New Mexico PIT-1 income tax return online, visit the New Mexico Taxation and Revenue Department website and use their Where Is My Refund service. New Mexico Taxation and Revenue Department states that you could receive your refund within 2 to 4 weeks if you e-file compared to 6 to 8 weeks if filing on paper.

To check the status of your New Mexico income tax return for 2024, you will need the following information:

- Social Security Number or ITIN

- Amount of refund requested

The requested information must match what was submitted on your 2024 New Mexico Form PIT-1. The New Mexico Taxation and Revenue Department refund lookup service can only be used to query the current income tax year 2024. Contact the New Mexico Taxation and Revenue Department service center by phone or mail if you are having trouble using the service or need to discuss a prior year income tax return.

To contact the New Mexico Taxation and Revenue Department service center by phone or email, use the check your refund status link above. Alternatively, read or print the 2024 New Mexico Form PIT-1 instructions to obtain the proper phone number and mailing address.

Last updated: January 9, 2025

References:

- Forms and Publications. State of New Mexico, New Mexico Taxation and Revenue Department. Retrieved January 9, 2025.

- Who is required to file. State of New Mexico, New Mexico Taxation and Revenue Department. Retrieved January 9, 2025.