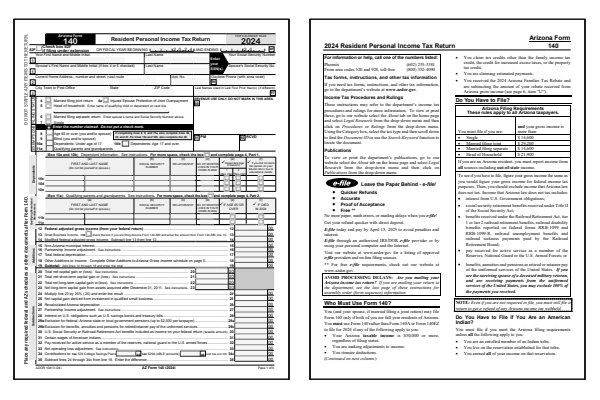

2024 Arizona Form 140

Printable AZ-140 Tax Forms and Instructions

What Is Arizona Form 140?

Arizona Form 140 is used by full-year residents to file their state income tax return. Nonresident and part-year resident filers will complete Arizona Form 140NR and Arizona Form 140PY instead. Arizona also provides two additional forms taxpayers can use to file state tax returns: Form 140EZ (Easy Form), and Form 140A (Short Form).

In general, any full year resident can file Long Form 140 rather than Easy Form 140EZ or Short Form 140A. You do not have to file the Easy Form or Short Form, for example. You must, however, use Arizona Form 140 if any of the following apply to you.

- Your Arizona taxable income is $50,000 or more.

- You received active duty, military, or reservist pay.

- You are making adjustments to income.

- You itemize deductions.

- You made estimated payments.

- You claim tax credits other than the family income tax credit, the property tax credit, or the credit for increased excise taxes.

Read the first page of any AZ Form 140 instructions book to help determine if you should file as a resident, part-year resident, or nonresident for tax year 2024. The first page of each instruction booklet will also discuss the criteria for choosing between the Easy, Short, and Long forms for tax year 2024.

Who Must File Arizona Form 140?

You must file an Arizona tax return if your gross income exceeds the minimum specified for your filing status. For tax year 2024, Single residents must file if their gross income is more than $14,600. Married residents likewise must file if their gross income is more than $29,200.

Gross income means all income before deducting expenses that is reportable to the state of Arizona. Even if your gross income is below the amount specified for your filing status, you may still have to file an Arizona tax return. Other filing requirements include but are not limited to when:

- You have unearned income from interest, dividends, capital gain distributions, scholarships, fellowships, and grants.

- You have earned income from wages, tips, and self-employment income that were not reported on a W-2.

- You owe a penalty on an IRA, retirement plan, education savings account, or health savings account.

- You must file a return to get a refund of any Arizona income tax withheld.

Read the Who Must File

section of the AZ 140 instructions book to help determine if you should file an Arizona income tax return for tax year 2024.

Printable Arizona State Tax Forms

Printable Arizona Form 140 Instructions

How To Check The Status Of My Arizona Tax Return?

To check the status of your Arizona Form 140 income tax refund online, visit the Arizona Department of Revenue website and use their Check Refund Status service. Arizona Department of Revenue states that an electronically filed return can be looked up once it enters their system, probably within a few days. Paper filed income tax returns may require 8-12 weeks to process, faster if you are early, later if closer to the due date.

To check the status of your Arizona income tax refund for 2024 you will need the following information:

- Social Security Number

- Filing Status

- Zip Code

- Tax Year

The requested information must match what was submitted on your 2024 Arizona Form 140. You can also look up prior year refunds if you have the requested information available. If not, you will need to contact the Arizona Department of Revenue service center by phone or mail.

To contact the Arizona Department of Revenue service center by phone or email, use the check your refund status link above. Alternatively, read or print the 2024 Arizona Form 140 instructions to obtain the proper phone number and mailing address.

Last updated: January 11, 2025

References:

- Individual Income Tax Forms. State of Arizona, Arizona Department of Revenue. Retrieved January 11, 2025.

- Income Tax Filing Requirements. State of Arizona, Arizona Department of Revenue. Retrieved January 11, 2025.

- FAQ During Tax Season. State of Arizona, Arizona Department of Revenue. Retrieved January 11, 2025.

- Phoenix Free Tax Preparation. City of Phoenix, Volunteer Income Tax Assistance (VITA). Retrieved January 11, 2025.

- Who pays Arizona income tax?. H&R Block, State Taxes. Retrieved January 11, 2025.

- Arizona Tax Guide: What You'll Pay in 2024. AARP, State Taxes. Retrieved January 11, 2025.