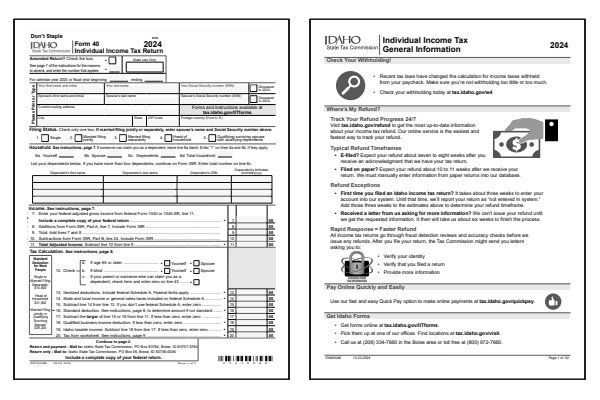

2024 Idaho Form 40

Printable ID State Tax Forms and Instructions

What Is Idaho Form 40?

Idaho Form 40 is used by full-year residents to file their state individual income tax return.

The purpose of Form 40 is to calculate how much Idaho income tax you owe or if you are due a refund for the year.

Part-year residents and nonresidents must file Idaho Form 43 instead of Form 40.

Idaho does not currently offer a separate short form for individuals.

Read the Which Form to File

section of the 2024 Idaho Form 40 instructions

to confirm whether you should file Form 40 or Form 43 based on your residency status.

Who Must File Idaho Form 40?

According to the Idaho Form 40 Instructions, residents must file a state tax return if gross income exceeds the minimum amount for their filing status. For 2024, single filers under age 65 must file if their gross income is $14,600 or more. Married filers under age 65 must file if their gross income is $29,200 or more. Nonresidents and part-year residents must file if their gross income exceeds $2,500. Gross income generally means all income before expenses and deductions other than income specifically exempt from state taxes.

Even below the threshold, you may still benefit from filing. For instance, if you had Idaho tax withheld on your W-2, you can claim a refund. Idaho provides certain credits, including a Child Tax Credit, Grocery Credit (often referred to as the Idaho Grocery Credit), and other credits that may increase your refund amount.

Read the Who Must File

section of the 2024 Idaho Form 40 instructions for full details on whether you need to file an Idaho state tax return this year.

Printable Idaho State Tax Forms

Printable Idaho 40 Instructions

How do I check my Idaho tax refund?

To check the status of your Idaho 40 income tax return online, visit the Idaho State Tax Commission website and use their Where's My Refund service. On its website, Idaho State Tax Commission states that electronically filed refunds process in about 7 weeks. Mailed-in paper refunds can take up to 10 weeks to complete processing.

To check the status of your Idaho income tax return for 2024, you will need the following information:

- Social Security Number or ITIN

- Refund Amount

The requested information must match what was submitted on your 2024 Idaho Form 40. To check prior year returns, you must contact the Idaho State Tax Commission service center by phone, email, or mail.

To contact the Idaho State Tax Commission service center by phone or email, use the check your refund status link above. Alternatively, read or print the 2024 Idaho Form 40 instructions to obtain the proper phone number and mailing address.

Last updated: January 9, 2025

References:

- Idaho Individual Income Tax Forms. State of Idaho, Idaho State Tax Commission. Retrieved January 9, 2025.

- Who needs to file. State of Idaho, Idaho State Tax Commission. Retrieved January 9, 2025.