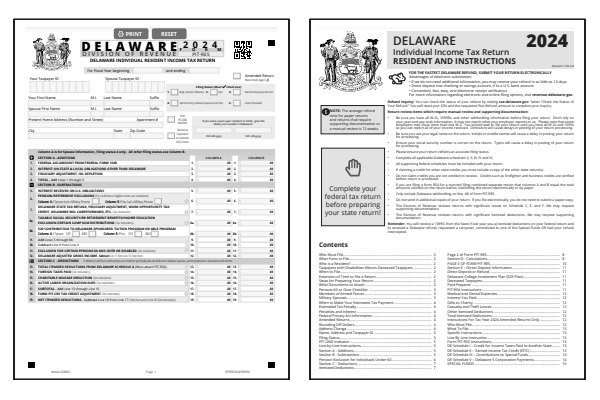

2024 Delaware Form PIT-RES

Printable DE State Tax Forms and Instructions

What Is Delaware Form PIT-RES?

Delaware Form PIT-RES is used by full-year residents to file their state individual income tax return.

The purpose of Form PIT-RES is to determine how much Delaware income tax you owe for the year.

If you are a non-resident with Delaware-source income, you must file Form PIT-NON instead of PIT-RES.

Part-year residents have the option to file either as a resident or non-resident, whichever is more advantageous.

Read the What Form to File

section of the 2024 Delaware PIT-RES instructions to confirm if you should file PIT-RES or PIT-NON.

Who Must File Delaware Form PIT-RES?

If you are a full-year Delaware resident and must file a federal income tax return, you typically have to file Form PIT-RES. Delaware does have its own gross income test, which you can find on page 2 of the PIT-RES instructions for 2024. Single, full-year residents under age 60 must file a tax return if their Delaware adjusted gross income exceeds $9,400. Married full-year residents under age 60 must file a tax return if their Delaware adjusted gross income exceeds $15,450. See the table provided in the instructions for a complete list of gross income thresholds by filing status and age.

Even if your income is below the gross income filing threshold, you might still benefit from filing. If you had Delaware tax withheld on your W-2, for example, you could get a refund. Delaware also offers certain credits, including a state Earned Income Tax Credit (EITC) that mirrors part of the Federal EITC. Review the credits section of the 2024 Delaware PIT-RES instructions to see if you qualify.

Read the Who Must File

section of the 2024 Delaware PIT-RES instructions for complete details on who must file a Delaware income tax return this year.

Printable Delaware State Tax Forms

Printable Delaware PIT-RES Instructions

How do I check my Delaware tax refund?

To check the status of your Delaware PIT-RES income tax return online, visit the Delaware Division of Revenue website and use their Refund Inquiry service. Delaware Division of Revenue states on its website that electronically filed income tax refunds are generally processed in 1 to 2 weeks. Mailed-in paper income tax forms are estimated to be processed in 30 to 90 days.

To check the status of your Delaware income tax return for 2024, you will need the following information:

- Social Security Number

- Refund Amount

The requested information must match what was submitted on your 2024 Delaware Form PIT-RES. To check prior year returns, you will need to contact the Delaware Division of Revenue service center by phone, email, or mail.

To contact the Delaware Division of Revenue service center by phone or email, use the check your refund status link above. Alternatively, read or print the 2024 Delaware Form PIT-RES instructions to obtain the proper phone number and mailing address.

Last updated: January 18, 2025

References:

- Delaware Individual Income Tax Forms. State of Delaware, Delaware Division of Revenue. Retrieved January 18, 2025.

- Delaware Personal Income Tax FAQs. State of Delaware, Delaware Division of Revenue. Retrieved January 18, 2025.