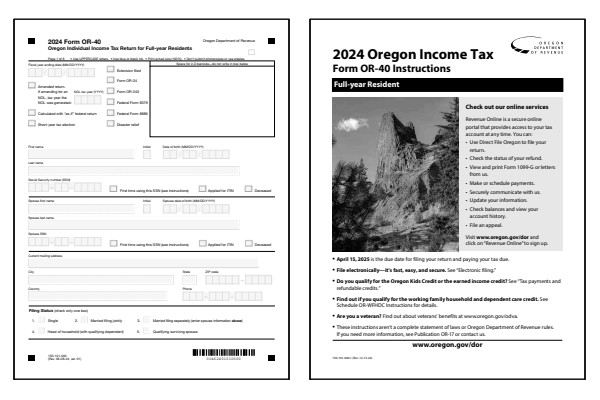

2024 Oregon Form 40

Printable OR-40 Tax Forms and Instructions

What Is Oregon Form 40?

Oregon Form 40 is used by full-year residents to file their state income tax return. The purpose of Form 40 is to determine your tax liability for the state of Oregon. Nonresident and part-year resident filers will complete Oregon Form OR-40-N or Form OR-40-P instead.

The State of Oregon does not have an OR-40 Easy Form (EZ) or OR-40 Short Form.

Read the Which Form To File

section of the OR-40 instructions book to help determine if you should file as a full-year resident, part-year resident, or nonresident for tax year 2024.

Who Must File Oregon Form 40?

You must file an Oregon tax return if you were required to file a federal income tax return. There is also a gross income test for those who were not required to file a federal income tax return. For tax year 2024, Single residents under the age of 65 must file if their gross income is more than $7,710. Married residents under the age of 65 must file if their gross income is more than $15,425.

Gross income means all income before deducting expenses that is reportable to the state of Oregon. Even if your gross income is below the amount specified for your filing status, you may still want to file an Oregon tax return. You may receive a refund for the state tax amount shown on your Oregon W-2, for example. You may also be eligible for any Oregon earned income credit or other low-income related credits.

Read the Filling Requirements

section of the Oregon Form 40 instructions book to help determine if you should file a state income tax return for tax year 2024.

Printable Oregon State Tax Forms

Printable Oregon Form 40 Instructions

How To Check The Status Of My Oregon Tax Return?

To check the status of your Oregon OR-40 income tax refund online, visit the Oregon Department of Revenue website and use their Where's My Refund service. Oregon Department of Revenue asks that you wait 5 to 10 days before checking the status of an electronically filed tax return and 6 to 8 weeks for a mailed in paper tax return.

To check the status of your Oregon income tax refund for 2024 you will need the following information:

- Social Security Number

- Filing Status (single, married filing jointly, etc)

- Refund Amount

The requested information must match what was submitted on your 2024 Oregon Form 40. To check prior year refunds, you will need to contact the Oregon Department of Revenue service center by phone, email, or mail.

To contact the Oregon Department of Revenue service center by phone or email, use the check your refund status link above. Alternatively, read or print the 2024 Oregon Form 40 instructions to obtain the proper phone number and mailing address.

Last updated: January 10, 2025

References:

- Individual Income Tax Forms. State of Oregon, Oregon Department of Revenue. Retrieved January 10, 2025.

- How to determine if you need to file an Oregon income tax return. State of Oregon, Oregon Department of Revenue. Retrieved January 10, 2025.

- Determining which form to use. State of Oregon, Oregon Department of Revenue. Retrieved January 10, 2025.

- What are Oregon's Filing Requirements. TaxSlayer Support, Oregon State Taxes. Retrieved January 10, 2025.

- Personal Income Tax Filing and Payment Information. City of Portland, Oregon. Retrieved January 10, 2025.

- Overview of Oregon. US News, Best States Rankings. Retrieved January 10, 2025.

- Free tax preparation services for families and individuals with qualifying household income. Oregon State University, Volunteer Income Tax Assistance (VITA). Retrieved January 10, 2025.