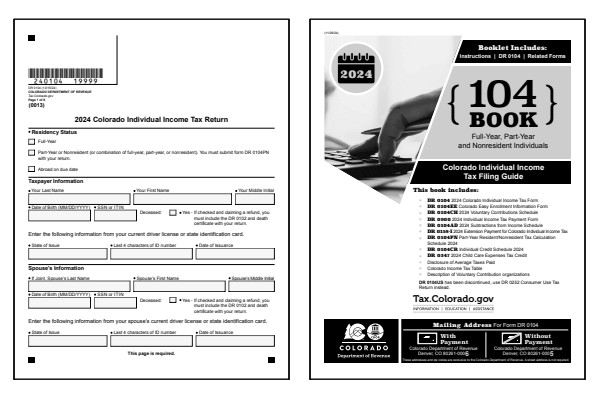

2024 Colorado Form 104

Printable CO 104 Tax Forms and Instructions

What Is Colorado Form 104?

Colorado Form 104 is used by all individuals, including full-year, part-year, and nonresidents, to file their state income tax returns. The purpose of CO Form 104 is to calculate how much income tax you owe the state. There is no short form 104 filing option. Part-year and nonresident filers will complete Colorado Form 104 and attach Form 104PN.

Read the Part-Year Colorado Residents and Nonresidents

section of the CO Form 104 instructions book to help determine if you should file as a resident, part-year resident, or nonresident for tax year 2024.

The instructions booklet also highlights the available Colorado schedules and worksheets for tax year 2024.

What are Colorado's Filing Requirements?

If you are a resident and are required to file a federal income tax return, then you must file Colorado Form 104. Other filing requirements exist based on residency status and state tax liability. Complete the form to determine if you have a Colorado income tax liability for 2024.

You must file a Colorado income tax return if you were:

- A full-year resident of Colorado, or

- A part-year resident of Colorado with taxable income during that part of the year you were a resident, or

- A nonresident of Colorado with Colorado source income,

AND

- You are required to file a federal income tax return, or

- You have a Colorado income tax liability for the year.

According to the Colorado Department of Revenue, the state may create a filing for you if you do not submit a return.

Read the Who Must File This Tax Return

section of the CO Form 104 instructions book to help determine if you should file for tax year 2024.

Printable Colorado State Tax Forms

Printable Colorado Form 104 Instructions

Check The Status Of A Colorado Tax Return

To check the status of your Colorado 104 income tax return online, visit the Colorado Department of Revenue website and use their Check Refund Status service. Colorado Department of Revenue states that if you e-file and request your refund by direct deposit, you should receive your refund within 2-3 weeks. Furthermore, you will receive your refund 1-2 weeks faster than if you request to receive a refund check by mail. Allow 8 to 12 weeks if you mail in a paper Colorado state tax return.

To check the status of your Colorado income tax return for 2024, you will need the following information:

- Social Security Number

- Amount of your refund

The requested information must match what was submitted on your 2024 Colorado Form 104. You can also request a PIN/Letter ID to make managing your income tax information easier in the future. To check prior year returns, you will need to contact the Colorado Department of Revenue service center by phone, secure message, or mail.

To contact the Colorado Department of Revenue service center by phone or email, use the check your refund status link above. Alternatively, read or print the 2024 Colorado Form 104 instructions to obtain the proper phone number and mailing address.

Last updated: January 10, 2025

References:

- Income Tax Forms for Individuals and Families. State of Colorado, Colorado Department of Revenue. Retrieved January 10, 2025.

- Individual Income Tax Filing Requirements. State of Colorado, Colorado Department of Revenue. Retrieved January 10, 2025.