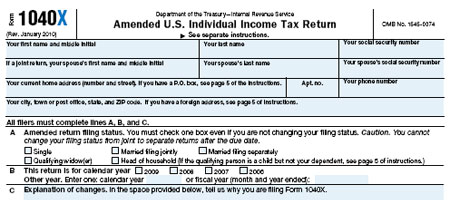

Form 1040X and 1040X Instructions

Form 1040X Amended US Individual Income Tax Return is the tax form you use to amend your 1040, 1040A, 1040EZ and related forms. While some exceptions do exist, you generally must file Form 1040X within 3 years after the date you filed your original income tax return. Use Form 1040X to correct your filing status, number of dependents, total income, deductions, and credits.

Form 1040X is used by taxpayers who rushed through their income tax forms at tax time and realize days, months, or even years later that they missed a credit that could put more money in their pockets. Form 1040X is also used when a tax adviser identifies a prior year mistakes or missed deductions and credits.

If you have concerns about the last 3 years of tax returns you filed or need help completing Form 1040X for a known issue, visit an H&R Block location near you for help. Many of the tax software products that we feature on our site also allow you to file Form 1040X, however, you will need to print and mail Form 1040X into the IRS because it can’t be filed electronically.

Click the Form 1040X image above to obtain a blank form direct from the IRS. The two links below can also be used to obtain printable Form 1040X and Form 1040X Instructions.

More printable income tax forms can be found on our site.