Indiana Income Tax Rate For 2023

Indiana has one individual income tax bracket with a flat rate of 3.15%. Below you will find 2023 Indiana tax brackets and tax rates for all four IN filing statuses. The Indiana tax rate and tax brackets tabulated below are based on income earned between January 1, 2023 through December 31, 2023. Individual taxpayers will submit both their federal tax forms and state tax forms by April 15, 2024.

The current year 2023 Indiana tax rate of 3.15% is lower than last year. Previously the Indiana tax rate was higher at 3.4% in 2015, 3.3% in 2016, and 3.23% from 2017 to 2022. Outlook for the 2024 Indiana income tax rate is to remain at 3.15%. Every two years the state of Indiana reviews and adjusts their individual income tax rate.

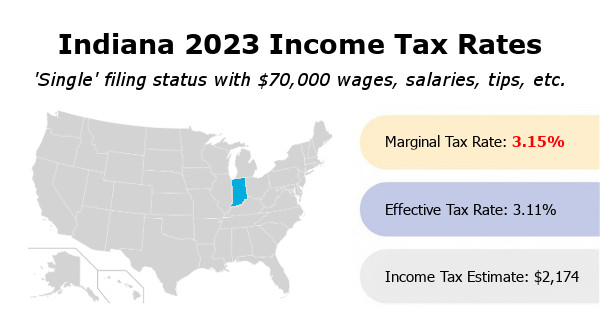

Indiana Income Tax Calculation For $70,000 In Wages

- Tax Year: 2023

- Filing Status: Single

- Indiana Tax Rate: 3.15%

- Indiana Personal Exemption: $1,000

- Indiana Income Tax Estimate: $2,174

- Indiana Effective Tax Rate: 3.11%

To simplify and standardize the calculation across states, we assume the taxpayer has only income from Wages, salaries, tips, etc Line 1 on federal Form 1040. Indiana Form IT-40 begins with federal adjusted gross income, 1040 Line 11. That means we must subtract the personal exemption amount of $1,000 from our 2023 wages. The result is our Indiana taxable income, which we can then multiply by the 2023 Indiana tax rate of 3.15%.

Indiana Income Tax = ( $70,000 - $1,000 ) × 3.15% = $2,174

To calculate the effective income tax rate for the state of Indiana, we simply divide the previously calculated income tax estimate by our initial $70,000 in wages.

Indiana Effective Tax Rate = $2,174 ÷ $70,000 = 3.11%

The actual amount of income tax you will pay in the state of Indiana will vary. Indiana, as with other states, often allow taxpayers to make additions and subtractions to their federal taxable income. Many states also offer credits for families with children, charitable contributions, and environmental initiatives, for example.

Indiana 2023 Income Tax Brackets by Filing Status

| Tax Bracket | Tax Rate |

|---|---|

| $0+ | 3.15% |

| Tax Bracket | Tax Rate |

|---|---|

| $0+ | 3.15% |

| Tax Bracket | Tax Rate |

|---|---|

| $0+ | 3.15% |

| Tax Bracket | Tax Rate |

|---|---|

| $0+ | 3.15% |

Please reference the Indiana tax forms and instructions booklet published by the Indiana Department of Revenue to determine if you owe state income tax or are due a state income tax refund. Indiana tax forms are generally published at the end of each calendar year, which will include any last minute 2023 - 2024 legislative changes to the IN tax rate or tax brackets. The Indiana tax brackets and tax rates calculated on this web page are to be used for illustration purposes only.

Frequently Asked Questions

Which Indiana tax bracket am I in?

In the state of Indiana there is just one personal income tax bracket. Every individual taxpayer is therefore in the same bracket regardless of filing status and amount.

What is the Indiana income tax rate for 2023?

Indiana's 2023 income tax rate is 3.15%.

What is Indiana's marginal tax rate?

The current flat tax rate for Indiana is 3.15%. The Indiana marginal tax rate used in our example calculation above on this page is 3.15%. That is the tax rate applied to each additional dollar of taxable income you earn. Since Indiana is a flat tax rate state, the nominal or official tax rate equals the marginal tax rate.

What is Indiana's effective tax rate?

Indiana's effective tax rate is 3.11%. Effective tax rate equals the total tax paid divided by total taxable income. Find our Indiana tax rate calculations above on this page for more information.

How much state income tax will I pay in Indiana?

The national average adjusted gross income (AGI) reported by the IRS each year is about $70,000. A single Indiana taxpayer with $70,000 in wages would pay approximately $2,174 to the Indiana Department of Revenue. Find our Indiana tax rate calculations above on this page for more information.

Does Indiana have a standard deduction?

No. Indiana does not have a standard deduction for 2023.

Does Indiana have a personal exemption?

Yes. Indiana does have a personal exemption of $1,000 for a single person and $2,000 for a married couple.

Does Indiana have a dependent exemption?

Yes. Indiana does have a dependent exemption of $1,000 per dependent for 2023.

Is Indiana a flat tax state?

Yes. Indiana's state income tax rate is a flat 3.15% of your taxable income. Regardless of your income level, you will pay the same rate. There are nine flat tax rate states in the United States: Colorado, Illinois, Indiana, Kentucky, Massachusetts, Michigan, North Carolina, Pennsylvania, and Utah

Last updated: November 3, 2023

References:

- Tax Rates, Fees & Penalties. Indiana Department of Revenue, State of Indiana. Retrieved November 3, 2023.

- Departmental Notice #1 (PDF). Indiana Department of Revenue, State of Indiana. Retrieved November 3, 2023.

- Individual Tax Rate Decrease (PDF). Indiana Department of Revenue, State of Indiana. Retrieved November 3, 2023.