Calculate Income Tax Rates

US Federal and State Tax Brackets for Individuals

Paying income taxes is a fundamental part of life in the United States. While it's common knowledge that we pay taxes at the federal and state levels, understanding how these taxes are calculated can be confusing. This guide explains the concepts of tax brackets and tax rates and their implications for individual taxpayers.

What Are Income Tax Brackets?

The US employs a progressive tax system, meaning those earning more money are taxed at higher rates.

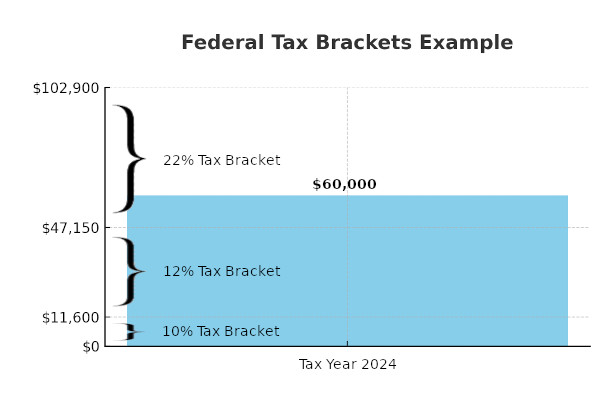

Income is divided into portions, or brackets

, with each portion taxed at a specific rate. For instance:

- 2024 Federal Tax Brackets for Single Filers

- 10% on the first $11,600 of taxable income.

- 12% on income from $11,601 to $47,150.

- 22% on income from $47,151 to $102,900.

- And higher…

If your taxable income is $60,000, only the income over $47,150 is taxed at 22%. The rest is taxed at the lower 10% and 12% rates. The bar chart above demonstrates that your entire income is not taxed at the highest tax bracket rate. Instead, the overall rate you pay is much lower. Let's talk about that next.

What Is the Marginal Tax Rate?

The marginal tax rate is the rate applied to your last dollar of taxable income. If you earn $60,000 as a single filer, your marginal rate is 22% because that's the rate applied to the top portion of your income. This is also commonly referred to as your tax bracket.

However, the effective tax rate - the average rate across all your income - is lower. The effective rate is calculated by dividing the total tax owed by your total income. This is a simplified formula you can use to calculate your effective tax rate:

Effective Tax Rate = Total Tax ÷ Total Income

What Are Federal Income Tax Rates?

Federal tax rates correspond to what taxpayers pay to the US Treasury Department. The Internal Revenue Service (IRS) publishes the percentage rates and brackets you'll pay on each portion of your taxable income. These federal rates range from 10% to 37% and apply differently depending on your filing status (single, married filing jointly, head of household, etc). See our federal tax rates page for more information and calculations.

How Do State Income Taxes Work?

State tax systems in the US can vary significantly from the federal model:

- Some states, like California and New York, have progressive tax brackets.

- Others, like Colorado and Illinois, use a flat tax rate, meaning all taxable income is taxed at the same rate.

- States like New Hampshire and Tennessee have unique tax systems.

- States like Florida and Texas don't levy individual income tax.

States with a progressive tax rate:

- Alabama

- Arkansas

- California

- Connecticut

- Delaware

- Hawaii

- Iowa

- Kansas

- Louisiana

- Maine

- Maryland

- Minnesota

- Missouri

- Montana

- Nebraska

- New Jersey

- New Mexico

- New York

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Rhode Island

- South Carolina

- Vermont

- Virginia

- Washington DC

- West Virginia

- Wisconsin

States with a single tax rate:

- Arizona

- Colorado

- Georgia

- Idaho

- Illinois

- Indiana

- Kentucky

- Massachusetts

- Michigan

- Mississippi

- North Carolina

- Pennsylvania

- Utah

States with no individual income tax:

States with unique tax situations:

Understanding your state's tax structure is essential for financial planning, as the combination of federal and state taxes determines your total liability. Some states have increased their rates over time, while others have decreased.

Adjustments to Tax Brackets and Inflation

Federal tax brackets are adjusted annually to account for inflation. These adjustments help prevent taxpayers from moving into higher brackets simply due to cost-of-living increases, a phenomenon known as bracket creep.

For example:

- In 2024, the 12% tax bracket for single filers ends at $47,150.

- In 2025, the upper limit may rise to $48,475 due to inflation adjustments, meaning more income is taxed at a lower rate.

This adjustment can lower your overall tax liability, even if your income remains steady.

Deductions, Credits, and Lowering Your Tax Bracket

Reducing your taxable income can lower your tax bracket and overall liability. Common strategies include:

Tax Deductions

- Deductions reduce the portion of your income subject to taxes.

- Examples: Contributions to retirement accounts, mortgage interest, and student loan interest.

Tax Credits

- Credits directly reduce the tax you owe, dollar-for-dollar.

- Examples: Child Tax Credit, Clean Energy Credit.

Unlike deductions, tax credits don't change your bracket but can significantly lower your final tax bill.

How Do Tax Brackets Impact Married vs Single Filers?

Married couples filing jointly benefit from wider brackets than single filers. For instance:

- The 12% federal tax bracket for joint filers extends to $89,450, compared to $47,150 for single filers.

The wider brackets reduce the likelihood of couples paying higher taxes on their combined incomes, often called the marriage tax penalty.

Planning for Taxes with Multiple Income Sources

Having multiple jobs or additional income sources (investments, rental properties) can increase your taxable income and unexpectedly push you into a higher tax bracket. This is where income tax brackets and rate calculations can be most helpful. If you are having an excellent year, plan for April 15th by setting aside some money to pay a higher tax bill.

Hopefully We Made Things Clearer

Understanding how federal and state tax brackets work can empower you to make smarter financial decisions. Tax brackets help ensure fairness in the system by taxing income progressively, while deductions and credits offer ways to reduce your liability. Whether you're filing as a single individual or jointly with a spouse, knowing how tax rates apply to your situation is key to effective tax planning.

Last updated: November 19, 2024

References:

- US Income Tax Rates. US Department of the Treasury. Retrieved November 19, 2024.

- California Tax Rates. State of California Franchise Tax Board. Retrieved November 19, 2024.

- Georgia Tax Rates. Georgia Department of Revenue. Retrieved November 19, 2024.

- New York Tax Rates. New York State Department of Taxation and Finance. Retrieved November 19, 2024.

- The State Flat Tax Revolution: Where Things Stand Today. Tax Foundation. Retrieved November 19, 2024.

- 2024 and 2025 Tax Brackets and Federal Income Tax Rates. NerdWallet, Taxes. Retrieved November 19, 2024.

- What is My Tax Bracket?. Intuit TurboTax. Retrieved November 19, 2024.