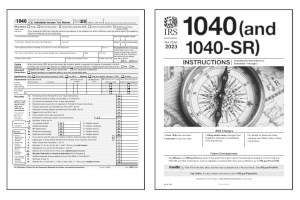

- 1040

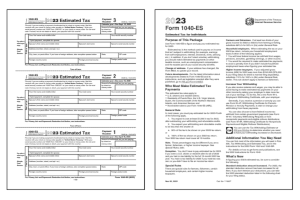

- 1040ES

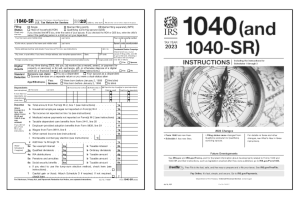

- 1040SR

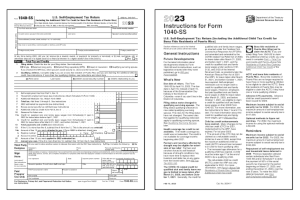

- 1040SS

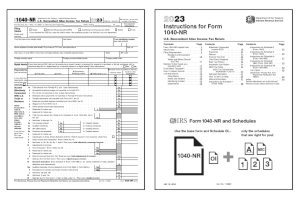

- 1040NR

Your guide to US income tax form preparation:

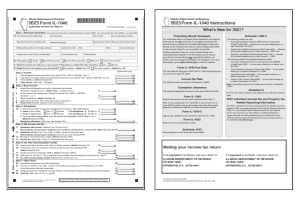

Federal Tax Forms

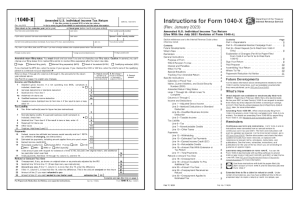

Printable federal tax forms to file your 1040, 1040-SR, 1040-SS, and 1040-NR tax return by mail. We have organized IRS forms, schedules, and instructions to make them easier to retrieve. Download, save, fill-in, print, assemble, and mail your federal income tax forms for free.

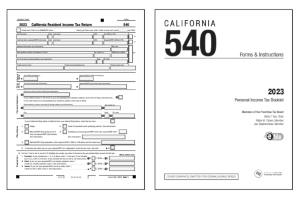

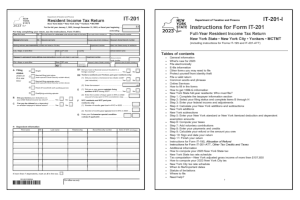

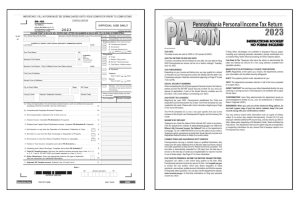

State Tax Forms

Printable state tax forms to file your single or multiple state tax return by mail. We have organized individual state income tax forms, schedules, and instruction PDF files to make them easier to retrieve. Download, save, fill-in, print, assemble, and mail your state income tax forms for free.

Income Tax Rates

Income tax brackets are a helpful way to visualize the amount of taxes you owe. You can use them to quickly estimate taxes due in future years. Moving to a different state, got a raise, a new job, or maybe thinking of taking time off. Tax brackets and rates help when planning for life changes.

Print Federal Tax Forms

Print State Tax Forms

How to Prepare Your Own Tax Return

Focus on your federal income tax return first. State income tax forms will request the amounts reported on your federal tax return. Most US citizens and resident aliens will file federal Form 1040. Seniors have the option to use Form 1040-SR to prepare their annual income tax return. Nonresident individuals will generally file Form 1040-NR to report income earned from US sources. Residents of commonwealth states will use Form 1040-SS to file a US self-employment tax return.

Gather the required schedules and instructions that you need to prepare your tax return. Over the years the instructions, numbers, and names of the required forms and schedules for individuals may change. Some forms might even get discontinued. We help point you in the right direction based on your tax filing status and any recent life changes. Use the sidebar navigation on the main Form 1040 pages to select and print the required schedules that you need to complete your tax return.

The most commonly required Form 1040 schedules include Schedule 1, Schedule 2, and Schedule 3. These schedules in turn may require that your file Schedule A, Schedule B, Schedule C, Schedule D, Schedule E, Schedule EIC, Schedule F, Schedule H, Schedule R, and Schedule SE depending upon your filing needs. Simply follow the instructions and include the schedules that are noted on Form 1040 to complete your federal income tax return.

To get started, download, save, print, fill-in, and assemble your federal tax forms and instructions worksheets. When finished, begin working on your state tax forms.